How do you react when you take a big loser on a high-conviction trade? How do you manage a position that goes instantly offside even when you believe it’s the right trade? But most importantly, how do you reset your mind and bounce back from the big loss so as to attack the next opportunity with even more size and aggression?

In this article, we will first explore how a trader manages a losing trade on the FOMC Rate announcement, but most importantly we will then see how he executes aggressively on a second high-conviction trade 30 minutes later in Powell’s FOMC Press conference.

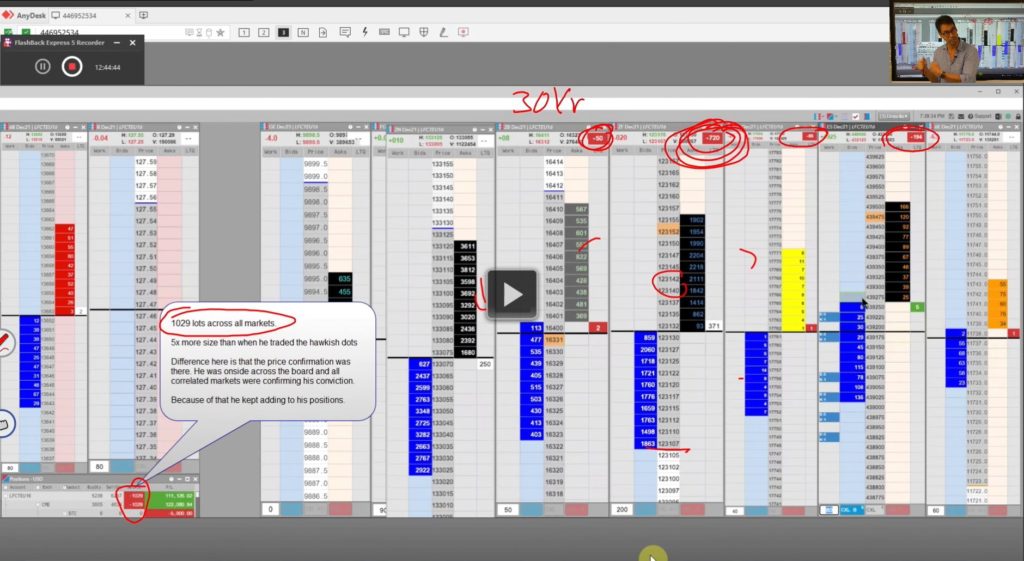

The key here is to observe and understand the big difference in trading execution between the two trades. In contrast to the first trade, where he was focusing on cutting his size quickly as the market moved against him, in the second trade he attacked much more aggressively with 5X the size of the first trade. This was because he received a positive price response immediately as he executed, whilst observing strong high-volume flows across correlated markets which were all reacting to the comments. Once the big position was built, he then focused on running the trade until the markets took big technical levels.

Watch the live trading execution

In the Youtube video below, Alex is going through the trading execution of AXIA Elite trader Demetris Mavrommatis, over the FOMC Rate Decision on 22 September 2021.

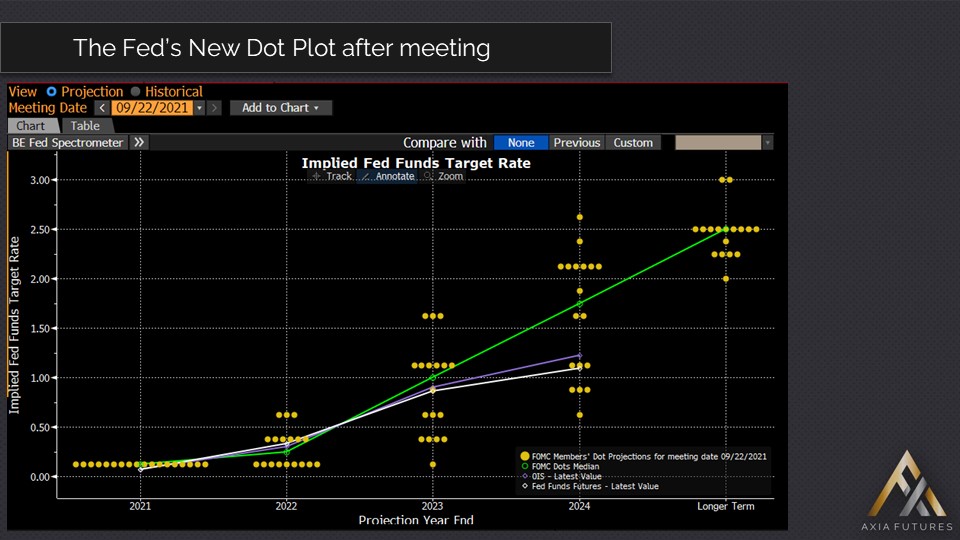

The FOMC event didn’t start well for Demetris as the trades he executed on the FED statement did not work. Although the Fed Dots (SEPs) were clearly hawkish indicating faster rate hikes, the market reaction was not what one would expect. After a brief blip down in US bonds/gold and equities on the hawkish statement, the markets retraced and rallied. Demetris was forced to exit his short positions for a loser.

Nevertheless, 30 minutes later he executed very aggressively on the hawkish Powell remarks in the press conference regarding the timing/conclusion of tapering. As Powell announced that tapering of bond purchases might conclude by the middle of next year (i.e. faster than the market expectation), he built short positions in the US 5-year bonds, Gold and S&P. As the markets were caught off-guard by Powell’s remarks, they sold off to retrace the initial rally that happened on the FOMC statement. Demetris managed to hold the majority of his size in the US 5-year and Gold until the markets traded through the lows of the day and took key technical levels to the downside.

Deep Dive Analysis of the Trade

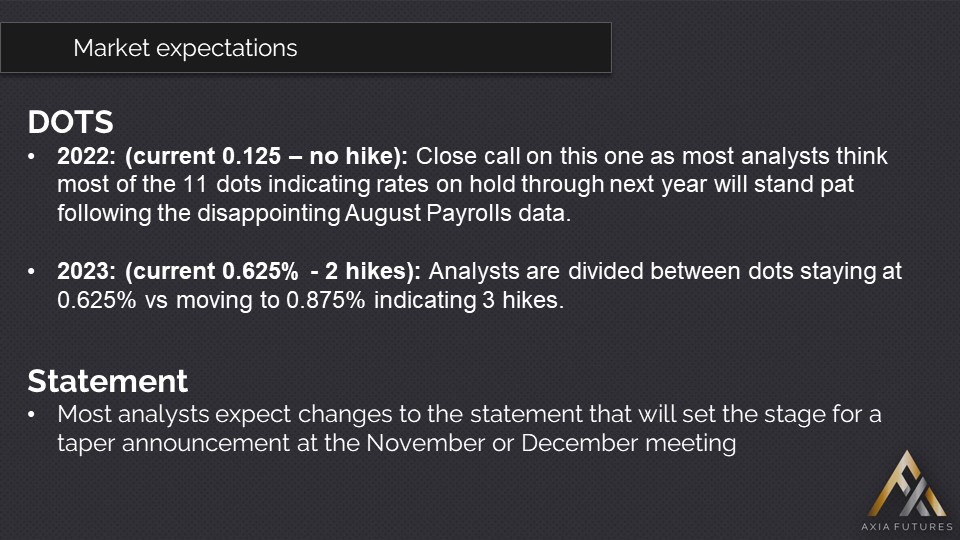

Market Expectations

The focus was on the FED’s dot plot. The median dots (SEPs) were at 0.125% indicating no hikes for 2022. Analysts were divided as to whether the FOMC members would move their dots up to indicate a hike for next year. Most believed that the very disappointing payrolls report would make most members stand pat on rates, while some others saw the median dot moving up to 0.375% (i.e. showing one rate hike by the end of next year). Furthermore, analysts expected changes to the FED statement that would set the stage for a taper announcement at the November or December meeting.

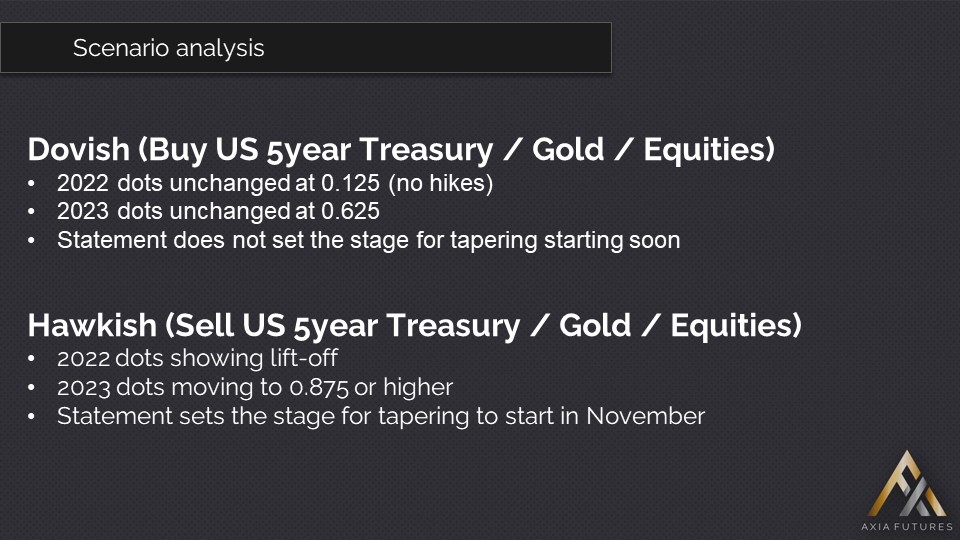

Scenario Analysis

Demetris was planning to execute in the 5-year Treasuries, the Gold, and potentially the S&P. His dovish scenario was if 2022 and 2023 dots were unchanged. In that case, he was planning to go long in all three markets. Conversely, the hawkish scenario would be if 2022 dots showed lift-off, 2023 dots moved higher and the statement was indicating bond tapering to start in November. In this scenario, he would be selling all three markets.

Trading execution over the FOMC Statement

The FOMC statement hits the wires at 7 pm UK time. Key headlines indicate that FED members now see lift-off in rates in 2022. Even more significantly, FED members now see the Fed Funds rate at 1.0% in 2023 vs 0.6% previously, signaling a steeper path of rate increases.

Demetris reacts by selling the US 5-year bond, however, he goes off-side instantly. He also sells Gold and S&P, but none of these markets seem to play ball with the hawkish headlines. Price confirmation is clearly not there, so he quickly reduces his exposure across the three markets. Nevertheless, as markets continue to rally, he takes a loser as he exits his positions.

Trading execution over Powell’s Hawkish Comments

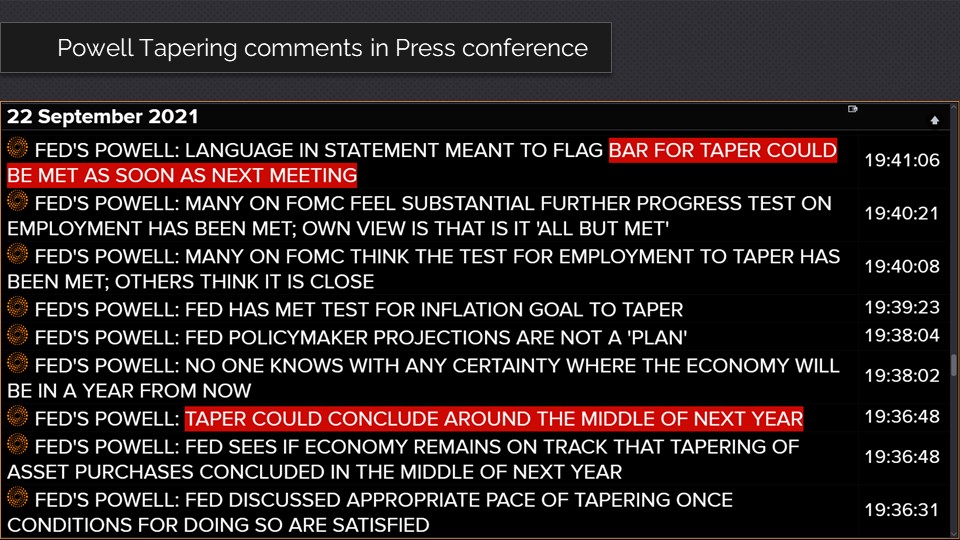

At 7.30 pm UK time, Powell begins his FOMC press conference where he is expected to offer further insight regarding the FED decision. Note that in the FOMC Statement there was no mention regarding the “pace of tapering” (i.e. how many billions of Treasuries per month to taper). Moreover, in the statement, there was no mention of when tapering is expected to conclude. Most analysts expected tapering to conclude towards the end of 2022.

Soon after his initial remarks, Powell states that “so long as the recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate”. He also states that “the language in the statement meant to flag that the bar for taper could be met as soon as the next meeting”.

These two hawkish quotes from the Fed chair are very significant, and something the market was not prepared for. He indicates that tapering will start and conclude sooner than what the analysts expected.

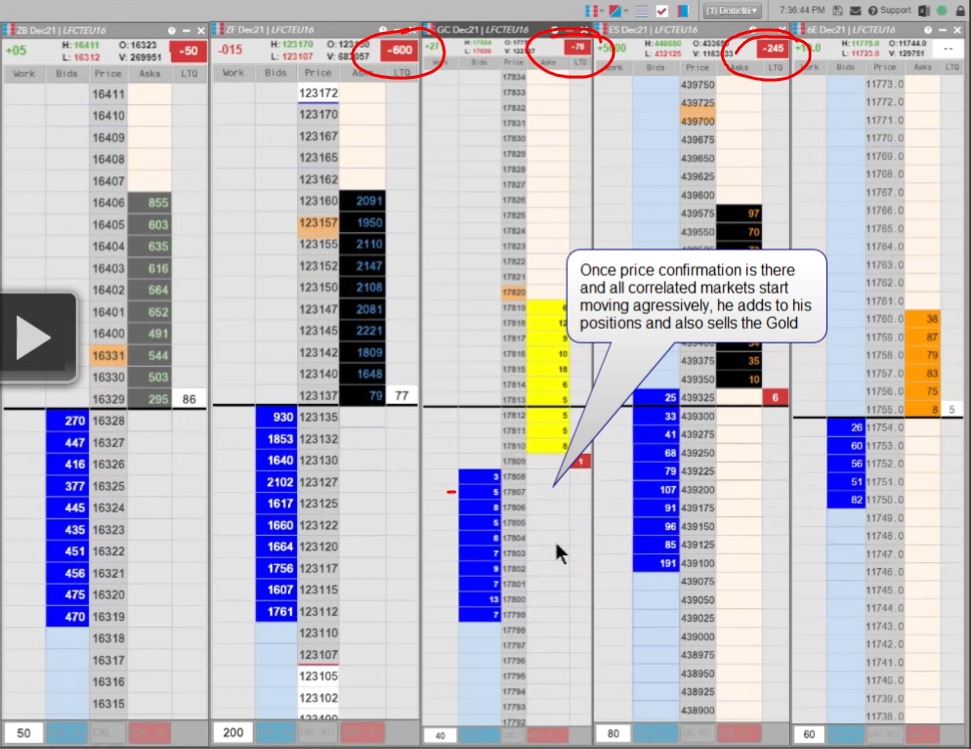

Demetris reacts by selling 600 lots (3 clips of 200 lots) in the US 5-year. A couple of seconds later and as soon as that trade goes onside, he instantly shifts his mouse to the S&P and sells 240 lots (3 clips of 80 lots). He also sells 80 lots in Gold and 50 lots in US 30-year bonds.

The key here is to note how quickly he built these big positions by observing the price action and the flows across markets that were strongly confirming his trade idea. He received a good positive price response seconds after his execution in the 5-year bonds, so immediately he shifted his focus on another market that he wanted to execute. In contrast to before where he entered a “defensive mode” of cutting the trade quickly as the market was moving against him, this time he did the opposite and built large positions across several markets in a matter of seconds.

Once the positions were built, then it was all about size management in order to maximise the potential reward of the trade. After the initial blip down on Powell’s remarks, the markets started trading sideways for a few minutes. Demetris was convinced that there was potential for a full retracement of the up-move on the FOMC Statement release. He felt that Powell was unusually hawkish and that the positioning of the up-move had to unwind and the markets fully retrace the original moves up.

As the moves accelerated through the “scene of the crime” (starting price), Demetris added to his positions and was now targeting the lows of the day in the Gold and furthermore some big technical levels to the downside in the US 5-year. Once those targets were reached he significantly cut his size and locked his profits.

Key takeaways

By analysing Demetris’ FOMC execution we can see firstly how a top trader reacts and manages a losing trade, but most importantly how he then shifts gears and maximises his profits on another opportunity that comes later in the session.

High conviction trades don’t always work the way a trader expects. Even with the best preparation and solid plan, things can go completely wrong. Instead of asking why while being blinded by our bias, we should focus on how to manage the trade. The clues on whether to add to the positions or cut them are in the price action and order flow. Deep observation of correlated markets as soon as the event hits is also critical so as to confirm our ideas and execution strategy.

At AXIA, these Elite trader execution videos are invaluable content for our junior and developing traders. We analyse many of these in our internal training, both on our Career Programme and on our Blueprint Coaching Programme. To register your interest in free training and see more of these, visit www.globalmacrodaytrader.com

Finally, to see more examples of our elite trader execution on other big fundamental events, such as geopolitical events and central bank policy meetings, visit the AXIA Elite Trader playlist on our YouTube channel.

FREE Webinar Sign Up: https://www.globalmacrodaytrader.com

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Twitter: https://twitter.com/AxiaFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Instagram: https://www.instagram.com/axiafutures/

Facebook: https://www.facebook.com/AXIAFutures/

Medium: https://medium.com/@axiafutures/

Contacts:

Demetris Mavrommatis — Co-Founder, Head of Trading

Alex Haywood — Co-Founder Head of Strategy