In the world of proprietary trading, when it comes to trading macro news or central bank rate decisions, sometimes the news can be huge outliers and deviate massively from market expectations in which case the market participants get taken by surprise. Examples of these are an unexpected FED rate cut, a huge unexpected beat/miss in the Non-Farm Payrolls, or as we saw recently an announcement of a massively effective Covid vaccine that beats even the most optimistic expectations.

Instances like these create very high probability trades and a trader can execute with very high conviction, being confident that the market will move aggressively to price in the new “unexpected” information.

However, on other occasions, a trader is faced with news that are not such big outliers and instead are open to interpretation, as they contain clues that are more subtle and nuanced. The market will probably not move immediately and aggressively on such news and there will rather be a two-way flow. In such situations, a top macro news trader will rely on full artillery of skill-sets, from deep understanding of the macro environment and what is driving market pricing, to his ability to deeply understand order-flow dynamics of individual markets and price action shifts. Moreover, he will rely on his skills of reading correlations between markets so that he can lean on the most-sensitive-to-the-news market to execute positions in other markets.

In this article, we will explore all the above, as our top macro trader has executed across 3 markets on the September 2020 Bank of England Rate Decision, and more specifically on comments regarding the potential adoption of negative rates.

Watch The Live Trading Recording:

Background: Recent Bank of England speeches

In the fight against the Pandemic, we have seen central banks around the world taking unprecedented measures to provide monetary support and stimulate their economies. Interest rate cuts and the launch of massive bond-buying programs (Quantitative Easing) have been the main monetary policy tools that have been used by central banks in this crisis in order to provide financial support.

Although the Federal Reserve has cut rates to 0%, FOMC officials decided NOT to go negative, whereas the ECB and the BOJ have been implementing negative policy rates for a while now.

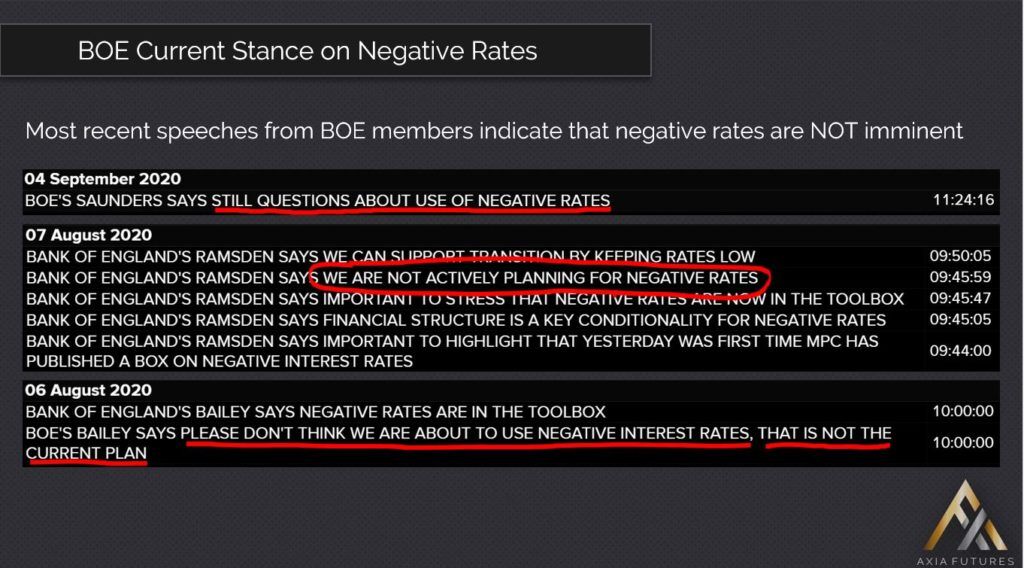

Bank of England’s policy rate is currently at 0.1%. In most recent times, the BOE has been in a dilemma with regards to the use of negative rates. Although some members have expressed their potential support for them, the majority of the MPC (Monetary Policy Committee) officials, including the BOE governor Bailey, have been communicating that although they are in BOE’s policy toolbox, this is not the right time to be implementing them.

As per recent BOE commentary, market participants had pushed back their expectations for negative rates. Pricing of future rates can be derived by looking at the Short-Sterling futures (UK short-term interest rates)

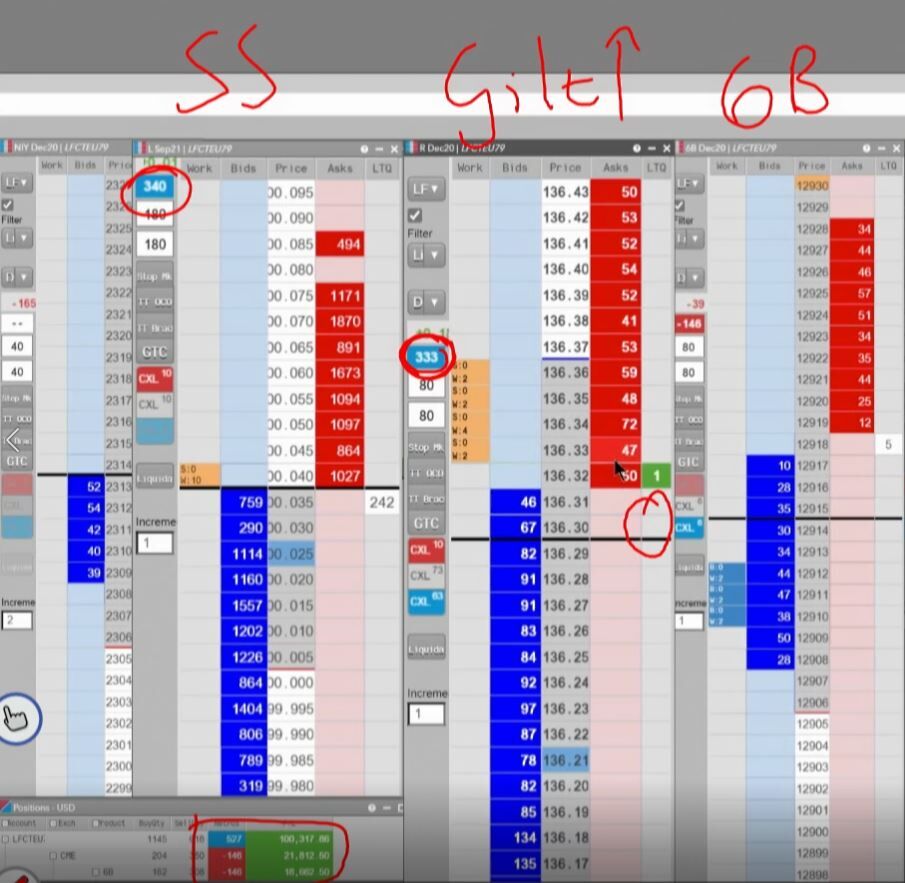

12pm Bank of England Rate Decision (Screendump)

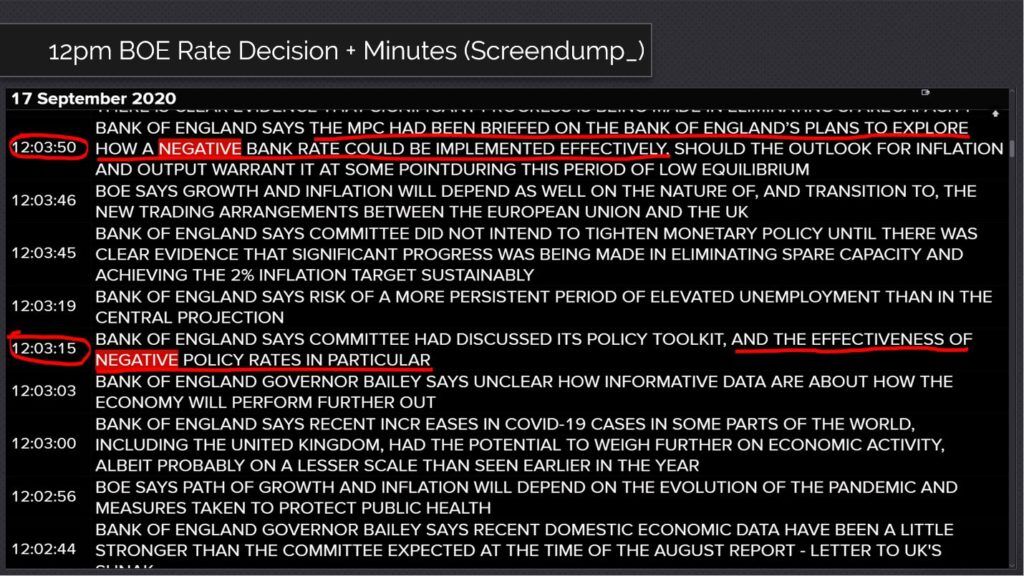

At midday UK time on 17 September 2020, the BOE released their latest Rate Decision. This was accompanied with BOE minutes, which show additional commentary on the deliberations of the MPC.

Not much was expected from BOE at this meeting and market participants viewed this meeting as a “non-event”. It was expected that rates and QE were going to be left unchanged and that commentary would be very similar to the previous meeting, as further action would be contingent on the evolution of the pandemic and potential Brexit developments.

The headlines from the Rate decision were hitting the wires in a piecemeal fashion (i.e one after the other) due recent changes in the release, unlike previous times where all headlines would hit at exactly 12.00pm.

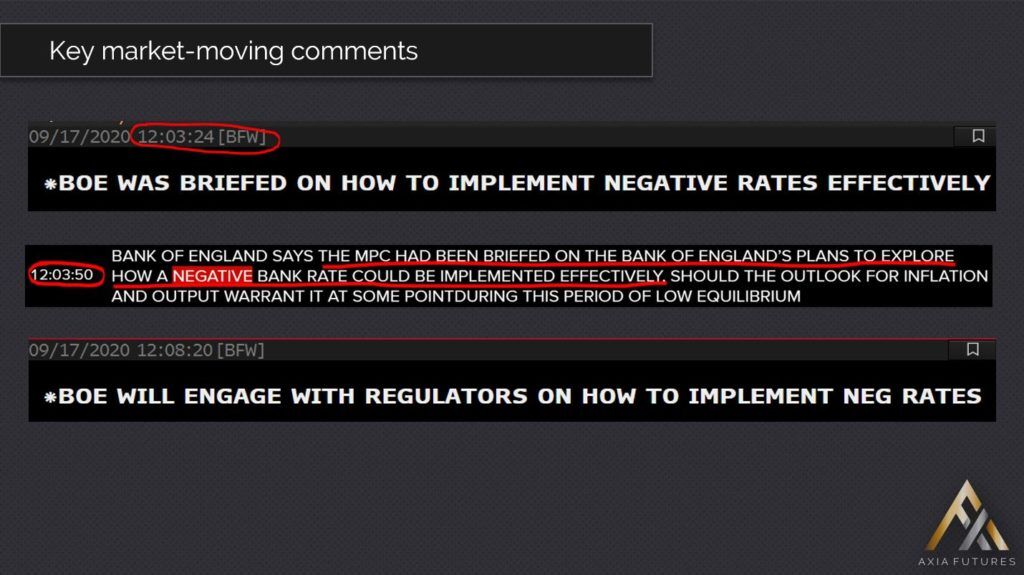

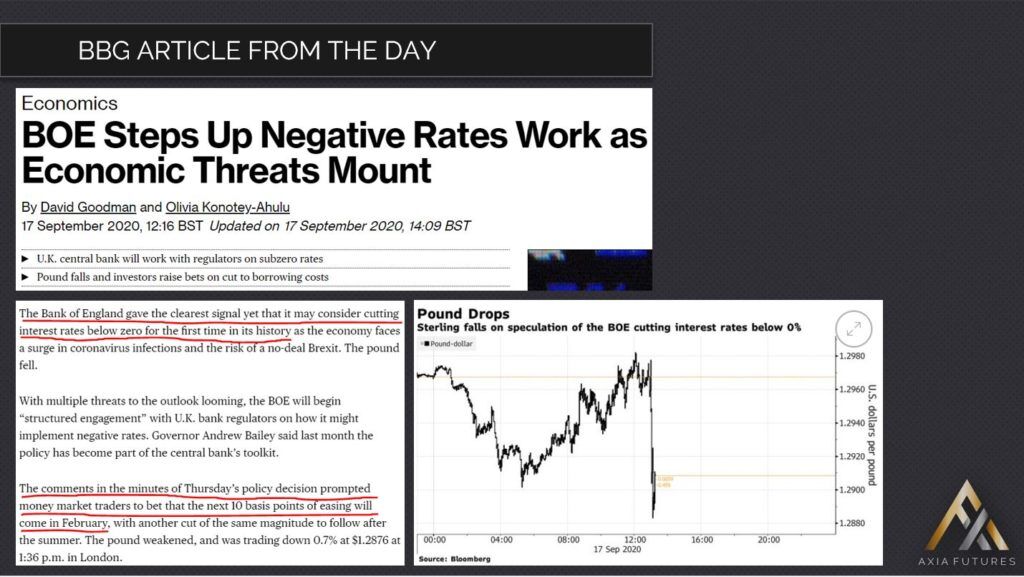

At around 12.03pm there were some comments on negative rates. More specifically the BOE said that the committee had “discussed the effectiveness of negative rates in particular” and also that the BOE was “briefed on how a negative bank rate could be implemented effectively, should the outlook for inflation and output warrant it”. A few minutes later it was also reported that the “BOE will engage with regulators on how to implement negative rates”.

Elite trader reaction to the news

Unlike other instances where we have seen our Elite trader smash big clips and enter the market aggressively with big size, in this case he started scaling in with smaller clips (10 lots) in the Gilts, and only when he saw the volume picking up and the order flow and price action changing significantly he attacked with bigger clips.

As he explained, the reason for this different reaction, was because he felt that comment itself was not a huge surprise, as the BOE had already mentioned before that they had been discussing negative rates. It was a comment that was open to interpretation, and he started trying to gauge from the price action how the market would take it.

The fact that they have been discussing them and they have been talking to regulators on how to implement them, on one hand could be interpreted as a technicality and that they just want to make sure that the processes are there in case the negative rates are ever needed. On the other hand, the market participants might interpret this statement as a signal, that the fact they have been briefed by regulators means that they are really close in implementing them. For more clarity, he kept looking at his newswires to see if additional headlines could paint a clearer picture on BOE’s intentions.

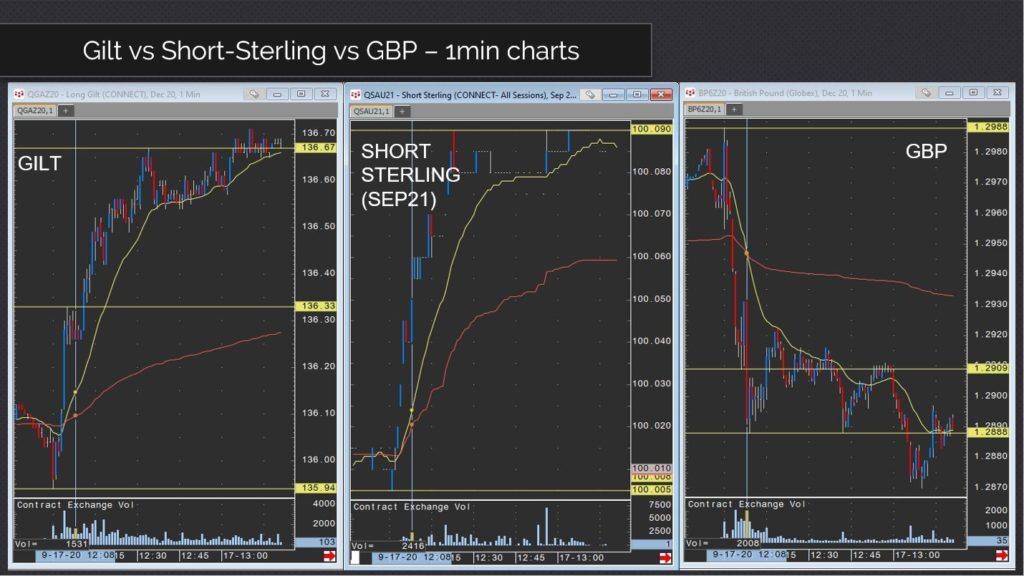

As these headlines are being picked up by other wires and start getting retweeted and rehashed, the market starts processing these as a potential signal that the BOE is getting ready and closer to implement them. The change in order flow dynamics and velocity of the market, and the volume spike across the three correlated markets he is looking at (GBP, Gilts and Short-Sterling), gives our trader confidence to attack more aggressively and build bigger positions in these markets.

He lifts over 300 Gilts while selling around 180 Cable (GBP). Although he doesn’t really trade short-end products like the Short-Sterling, and he would rather prefer to use them as a barometer to help him with execute in the Gilt and the Cable (GBP), in this case he does lift a couple of clips in the Short-Sterling, purely because the comment is specifically related to rates, which means Short Sterling should be the most sensitive market and the one that reacts the most in relative terms.

Trading the second leg of the move

As the markets react further to the news, he starts printing a decent PnL. Now we are 5 minutes in after the rates headlines hit and at this stage most of the other traders on the floor have reduced significantly their positions and most have even covered their positions completely as they managed to capitalise on this first leg of the move.

This is the point where his true skill-set comes in, in his ability to feel the market by observing the order flow and the correlations, and if he feels there is a valid reason to stick with the trade then he won’t cover it until it does what he expects it to do. And this is why he outperformed significantly on this event.

As the Short Sterling starts extending its highs again, and as GBP stays offered, he keeps feeding his Gilt position, feeling that there is a strong chance the Gilt will follow and have a second leg up. As he explains, these markets are normally very correlated during the first few minutes after a BOE rate decision, and as the flattening of the curve subsides after the strong reaction of the short-end, he expects the long-end (Gilts) to also go bid and catch up to this second leg in the Short Sterling. A few minutes later, the Gilt does catch a bid and extends its highs significantly, and our elite trader manages to double his daily PnL on this move.

Edge Spectrum on Macro News Events

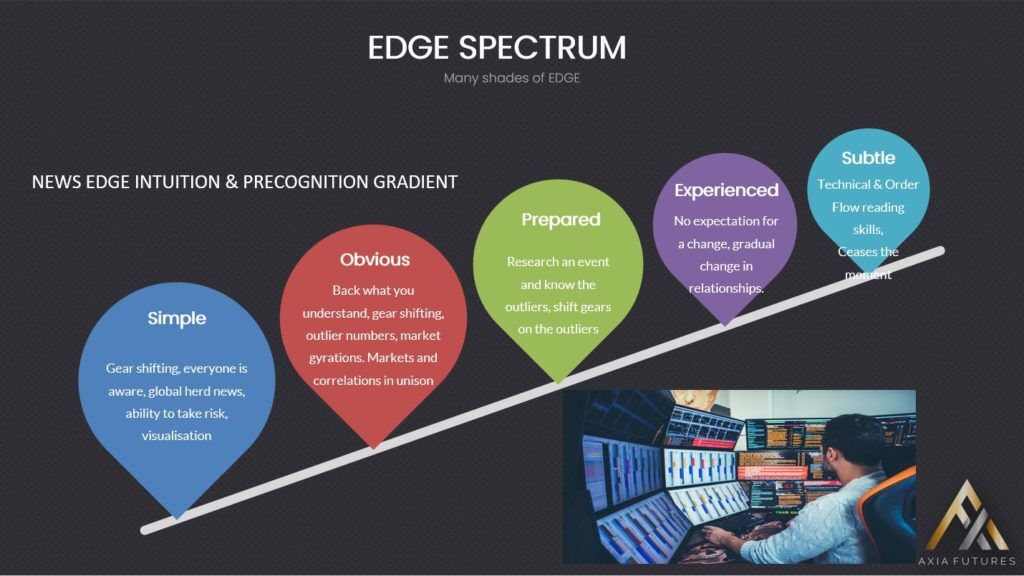

An edge is cultivated and refined over many years and a trader should always strive to keep improving his edge if he has the ambition to become a top performer. As Alex, our co-founder, explains at the end of the stream, when it comes to trading fundamental and global macro news events, a trader will be faced with many different kinds of news events that produce different market reactions.

On one end of this spectrum, you will have the really simple news, that most traders will make money on, as these are very simple to interpret and the market reacts in a very straightforward way, in the sense that it does what the trader expects it to do instantaneously. So an average trader with basic understanding, being in front of his desk and reacting relatively quickly should be able to profit out of them.

And on the other end of the spectrum, you have the very subtle, nuanced news that requires a much higher level of skill for a trader to be able to execute as efficiently as possible and profit out of them. In these instances, the market will make it a lot more difficult for a trader to make money. It will test him, it will squeeze him, it will make him doubt his conviction and trading idea.

In these situations, it won’t be enough for a trader to just understand the macro landscape and the news environment and what drives market pricing. A top trader will have to search for clues in the price action, in the order flow dynamics, in the key correlations between other markets. In other words, it will be a much harder process to profit in these scenarios, and a trader who wishes to maximise his PnL will need to have a full artillery of skill-sets.

Our elite trader is renowned for trading global macro & central bank events and his execution skills on such situations are impeccable. To review more in-depth examples of this execution style, have a look at our Price Ladder and Order Flow Strategies training.

Moreover to gain extensive insight into how our senior and elite traders prepare for trading key central bank events, take a look at the Central Bank Trading Strategies Course

FREE Webinar Sign Up: https://www.elitetraderworkshop.com/

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Twitter: https://twitter.com/AxiaFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Instagram: https://www.instagram.com/axiafutures/

Facebook: https://www.facebook.com/AXIAFutures/

Medium: https://medium.com/@axiafutures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy