DEVELOPING TRADERS INTO ELITE PERFORMERS

DEVELOPING TRADERS INTO ELITE PERFORMERS

REGISTER FOR FREE WEBINARWho we Are

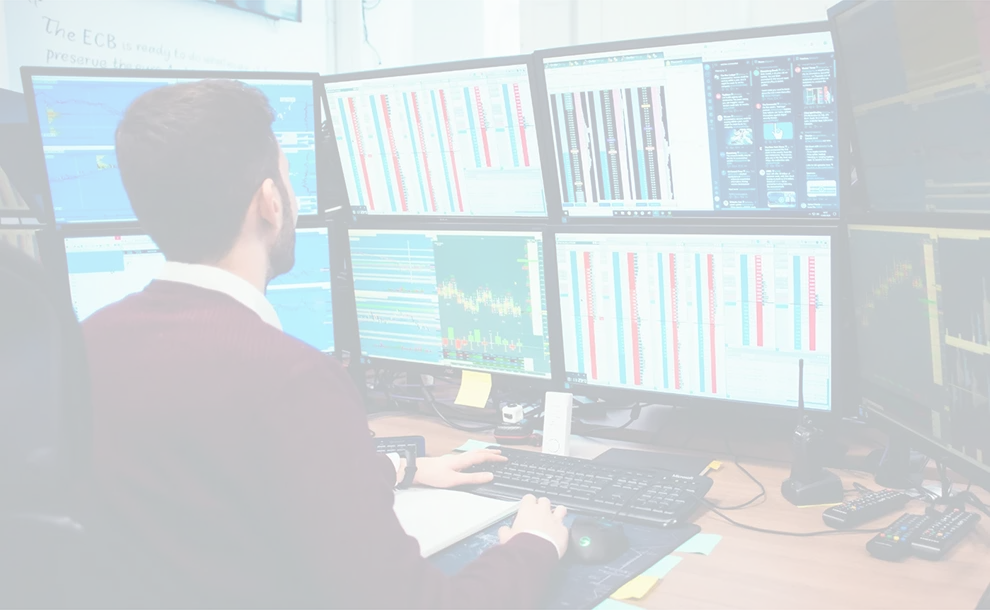

AXIA FUTURES is a trading education firm based in London offering trader training and trading courses that model the best practices and skills development techniques of a group of top performing futures day traders.

This elite group of traders form the core of the AXIA Trading Team who are cleared and risk managed by AXIA MARKETS PRO, an FCA regulated trading firm with a history that dates back to 1984 trading CME and LCH trading pits.

AXIA FUTURES and AXIA MARKETS PRO joined forces to form the AXIA TRADING GROUP with the goal of providing professional proprietary trading services and world class trader training in order to help traders reach their full potential.

The AXIA offices are located in London (UK) and in Limassol (Cyprus), and host both the AXIA Trading Team and the Axia Futures Training Facilities.

Learn to trade today with Axia Futures!

A team of 6 traders and friends within the London prop trading industry come together to set up a small trading floor in Aldgate Tower, cleared and risk managed by FCT Europe.

The AXIA Trading team expands and moves to a bigger trading floor in Crown Place, in the heart of the City of London. Axia Futures is launched with the aim of developing training protocols that model the skills and best practices of AXIA's top-performing traders.

The London AXIA Trading Team expands further to over 15 traders and relocates to larger offices in Endsleigh Street, owned by FCT Europe.

FCT Europe re-brands as Axia Markets Pro and the London AXIA Trading Team grows to over 40 traders whilst the entire trading group of remote and satellite professional teams grows to over 100 traders.

Due to the explosive success of traders in the Axia Trading Group, the team opens another trading floor in Cyprus. Axia Futures launches a 6-month coaching programme for remote traders who wish to experience hands-on training with a world class trading team.

Our team expands to a 2nd trading floor in Cyprus. This state-of-the-art facility includes an indoor and outdoor gym, complete with a pool, designed to help our traders maintain a healthy balance of mind and body. We are pioneering innovative methods of collaboration, scaling the intelligence of both individual traders and the entire team.

As our world-class training programmes continued to expand, we introduced a new focus on relative value spread trading strategies across the futures market. In partnership with Axia Markets Pro, we successfully transitioned new traders from training to live accounts.

We proudly launched Traders of Our Time, a book that chronicles the journeys of 10 AXIA Elite traders, sharing their experiences of becoming seven- and eight-figure traders with our growing community.

Learn To Trade

4-WEEK TRADER TRAINING CAREER PROGRAMME

Our flagship programme for aspiring

traders modelled on the skills of

successful traders

3-MONTH X-PONENTIAL TRADING PROGRAMME

Personal tailored 3-month coaching programme with weekly group sessions and weekly or monthly 1-on-1 mentoring sessions

Apply Now