Deep dive analysis of the trading execution of AXIA Elite Trader Demetris Mavrommatis over the February 2022 European Central Bank Rate Decision

Trading over Central Bank policy decisions has been a key edge for the AXIA prop trading team and our traders are always prepared for any opportunity arising from a central bank policy shift. Following closely the communication and narrative from central bank speakers is hugely important, as any change in language has the potential to cause market repricing and therefore huge trading opportunities.

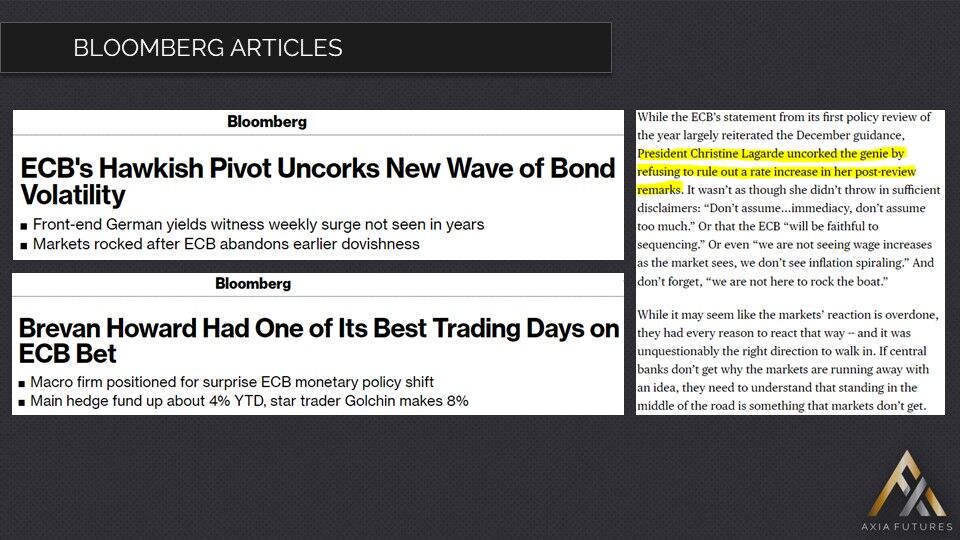

On 3rd February 2022, at its monetary policy meeting, the European Central Bank finally jumped on the hawkish bandwagon. After many months of resisting to change its guidance of ultra-low rates even as Eurozone inflation was running above 5%, President Lagarde finally acknowledged upside risks to the Inflation outlook and signalled openness to interest rate hikes in 2022.

AXIA traders, having observed the hawkish pivots from the FED and BOE at the end of last year, were eagerly awaiting such a policy shift from the ECB.

In this article, we will explore how an elite trader executed big short positions in the German and Italian Bonds as Lagarde started dropping the hawkish bombshells that sparked a broad Eurozone bond sell-off.

Watch the live trading execution

In this video, our co-founder and head of Strategy, Alex Haywood, is going through the trading execution of AXIA Elite trader Demetris Mavrommatis, over the ECB Rate Decision on 3 February 2022.

Market Context

Whilst most big central banks including the FED, ECB, and BOC have acknowledged upside risks to Inflation and prepared the markets for rate hikes, the ECB has distanced itself from other central banks by communicating that rise in Eurozone Inflation is only temporary and not a cause of concern.

Although the US and UK Yield curves have flattened aggressively since the FED and BOE turned hawkish in anticipation of rate hikes, the German Yield Curve has remained relatively steeper as ECB maintained its dovish guidance.

Scenario Analysis

There was not much expectation going into the meeting as the vast majority of analysts expected the ECB to reiterate its dovish guidance on rates and QE, and repeat that the recent inflation spike is only temporary and will eventually converge to the 2% target.

The fact that there was not much expectation for any change is what creates an asymmetric risk-reward for traders. In the scenario where the ECB did nothing and reiterated the last meeting’s commentary, then not much reaction is expected in the bond space.

On the other hand, any change in the ECB’s Risk Assessment, whereby the ECB acknowledges upside risks to the Inflation outlook and signals its readiness to take action has the potential to create a powerful market reaction as this is not priced in by the markets. In such a scenario, we expect a broad Eurozone bond sell-off led by the short-end of the German curve as traders will start pricing in rate hikes. Peripheral bonds that have benefited the most from loose ECB policy will also get hit hard, as Core vs Peripheral spreads are expected to widen

Trading Execution over ECB Press Conference

As expected, the 12.45pm ECB Policy Statement did not contain any significant changes from the previous meeting so there was no trading opportunity there. Attention turns to the 1.30pm ECB Press Conference where Lagarde is expected to expand on the ECB’s deliberations and explain their assessment in detail.

Lagarde starts her press conference by making upbeat comments on Inflation and the bond markets are on the move. At this point, she is just commenting on the Inflation readings from last month stressing how price rises have become more widespread, however, there is still no explicit comment on the Governing Council’s views on the medium-term inflation outlook. AXIA elite trader Demetris Mavrommatis starts positioning short in the Bund (German 10-year) and the Bobl (German 5-year) but with relatively small size at this point.

1. “Risks to Inflation outlook tilted to the upside“

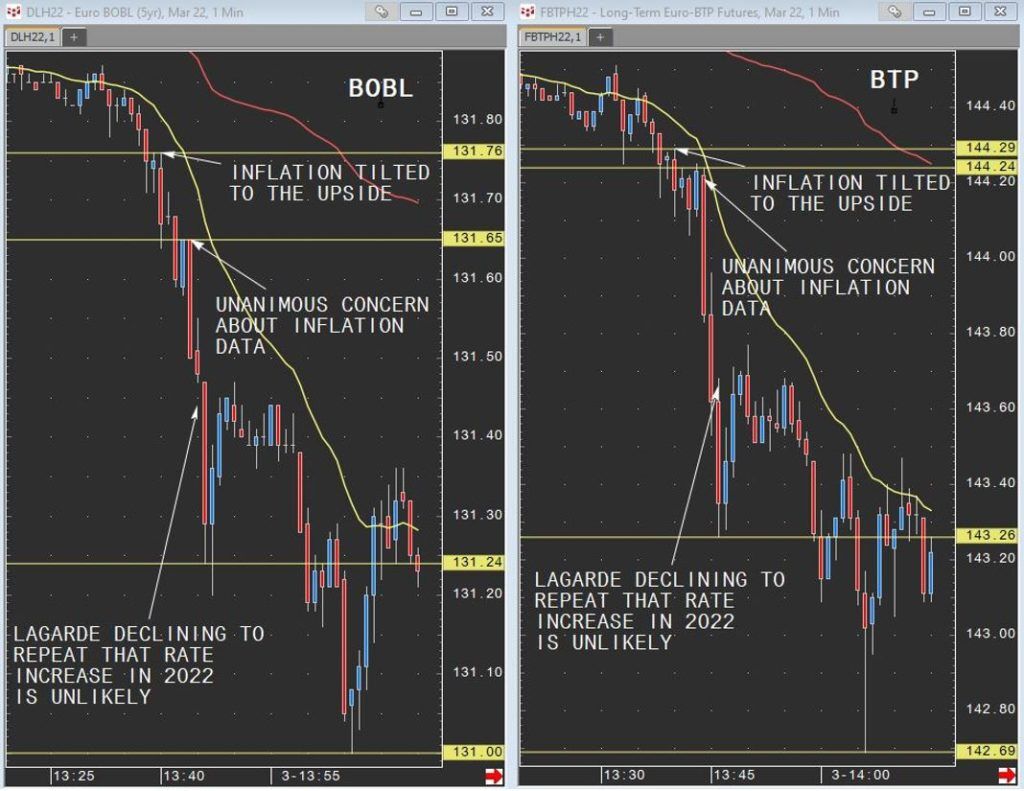

Lagarde moves on to ECB’s Risk Assessment. This is a key paragraph in the ECB Statement where Lagarde comments on the risks to the economic outlook and Inflation outlook. Although the risks to the economic outlook are “broadly balanced” over the medium term, the risks to the inflation outlook are now “tilted to the upside”. Lagarde drops the first inflation bomb.

Compared with our expectations in December, risks to the inflation outlook are tilted to the upside

ECB President Christine Lagarde (3 February 2022)

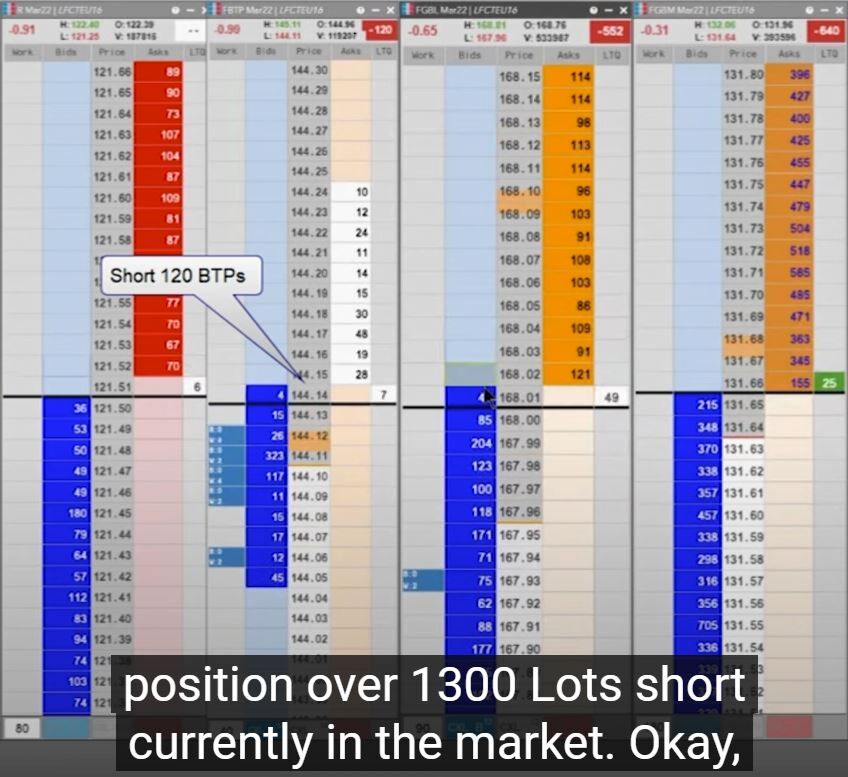

This is the first time the ECB has explicitly stated that the risks to the inflation outlook are tilted to the upside and this commentary sends a hawkish signal to the markets. The ECB’s mandate is to achieve price stability by aiming for 2% inflation over the medium term. A view that risks are now to the upside means that the ECB will pay very close attention to inflation and potentially act to control it by raising rates. This is the first trigger point of execution. As soon as Lagarde says this, Demetris executes big short positions of over 1300 lots in Bund, Bobl and BTP.

2. “Unanimous concern on Inflation numbers“

Although there was an initial spike lower in the bonds after the first hawkish comment from Lagarde, the markets quickly stalled and the focus is now on the upcoming Q&A. The key is to see how the ECB is prepared to respond to the upside inflation risks and whether they are ready to stop the QE and begin raising rates this year. Q&A will be critical in order to gauge ECB’s reaction function to the upside inflation risks. Lagarde starts answering the first question by saying:

I can tell you there was unanimous concern around the table of the governing council about inflation numbers

ECB President Christine Lagarde (3 February 2022)

This is the second trigger point that adds to Demetris’ conviction. Expressing concern shows that the ECB is growing uncomfortable with the high inflation readings, and it’s a signal of its willingness to act to control Inflation. This comment sparks another wave of sell-off in Eurozone bonds as Demetris Mavrommatis adds to his short positions. Short-end of the German curve (Schatz/Bobl) and peripheral bonds (BTP) underperform.

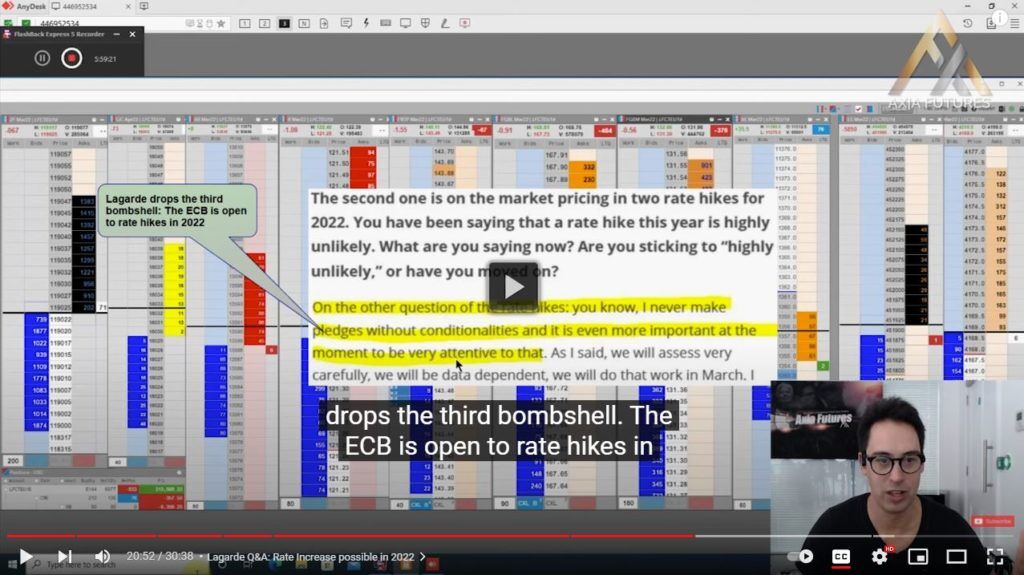

3. Leaving the door open for 2022 rate hikes

As the sell-off in the bonds accelerates, Lagarde is asked to comment on whether she is open to rate hikes in 2022. Unlike the previous meeting where she explicitly stated that a rate hike in 2022 is highly unlikely, this time she refuses to rule out a hike in 2022. This is the third trigger point in execution.

By declining to repeat that a rate increase in 2022 is unlikely, Lagarde officially opens the door to rate hikes. The short-end of the curve, led by the 2-year (Schatz) takes a very big hit as traders start to aggressively price in rate hikes this year. Bobl, Bund, and BTP follow while EUR/USD rallies.

Demetris rebuilds a big short position in the Bonds while buying the Euro. As the moves continue to accelerate as markets are digesting the unexpected ECB Hawkish pivot, he starts exiting his positions achieving a multiple 6-figure P&L

Key takeaways and summary

This article takes a deep-dive analysis of how our elite trader Demetris Mavrommatis executed big positions on the most recent ECB hawkish pivot. We go through the market context, and scenario analysis, but most importantly we closely analyse the key trigger points in Lagarde’s press conference where he executed his biggest size in order to achieve a multiple 6-figure P&L.

Such a policy shift from a major central bank does not happen often, and when it does, it presents a very unique trading opportunity for day traders.

At AXIA, we train our traders to be prepared for these kinds of events and use clues from other central banks to identify asymmetric high risk-reward trading opportunities. At the end of last year, we were preparing our trainee traders on our 12-month coaching programme to be ready for this in 2022.

A deep understanding of yield curve dynamics is impeccable for traders to understand the relationship between bonds and global markets in an inflationary driven environment, and how to execute most efficiently in such types of events.

To see more examples of Demetris Mavrommatis’s execution on other big fundamental events such as geopolitical events and other central bank policy meetings, visit the AXIA Elite Trader playlist on our YouTube channel.

And for those who seek deeper understanding, we analyse many more of these elite execution videos in our internal training, both on our Career Programme and on our Blueprint Coaching Programme. To register your interest in free training and see more of these, visit www.globalmacrodaytrader.com

FREE Webinar Sign Up: https://www.globalmacrodaytrader.com

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Twitter: https://twitter.com/AxiaFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Instagram: https://www.instagram.com/axiafutures/

Facebook: https://www.facebook.com/AXIAFutures/

Medium: https://medium.com/@axiafutures/

Contacts:

Demetris Mavrommatis — Co-Founder, Head of Trading

Alex Haywood — Co-Founder Head of Strategy