The Federal Reserve decision has become a tricky one this month. Whilst no decision to change policy was taken at their last meeting in early November, the Minutes suggested that members felt a change in policy could be coming soon with the statement: “While participants judged that immediate adjustments to the pace and composition of asset purchases were not necessary, they recognized that circumstances could shift to warrant such adjustments”

The Federal Reserve has to answer that question – as traders we have to answer the question of what will the Fed do if circumstances have shifted and how will we trade the change in policy

What has Changed For the Federal Reserve?

Since 4th November a lot has changed.

- A vaccine is now available and starting to be rolled out – a positive development which should see the economy able to get back no track

- Generally data has continued to improve – unemployment rate has fallen further to 6.7% – below the Fed’s own estimate of 7.6% by year end from the September meeting

- A stimulus program, so often called by the Fed has still not quite got over the line and this is having an impact on house spending and they are beginning to run out of savings

- Covid cases have begun to surge putting pressure on the economy in the form of lock-downs and business closures

- Non-farm payrolls missed estimates 245,000 vs the expected 469,000 jobs created and Jobless Claims have risen suddenly to 853,000

- Yield curve is steepening – meaning borrowing costs for consumers which are tied to longer end rates are getting more expensive

The Fed has to balance the longer term positive of falling unemployment and a vaccine again the immediate risks of sharply rising cases, jobless claims and no fiscal stimulus help. Without the vaccine their decision might have been much easier

What Can The Federal Reserve Do?

Their QE program is where the Fed can have an impact with much of the expectation relating to how they can guide on future changes to the program in order to “sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.” Currently the Fed buys $120bn worth of treasuries and MBS but there is no sense of how long they will sustain this with some expectations of a tapering (reduction of purchases) beginning in H2 2021 particularly no with the vaccine being rolled out.

Asset Purchase Guidance

One option available to the Fed would be to link the asset purchases to a data point or their inflation target and maximum employment, as this is already how they guide on interest rates the implication is that QE will not be tapered until 2023 before a rate rise in 2024. This would be seen as dovish and save the need for the Fed to increase it purchases when the impact of a increase may not be felt until the economy is already improving in Q1 2021

Yield Curve Control or Twist

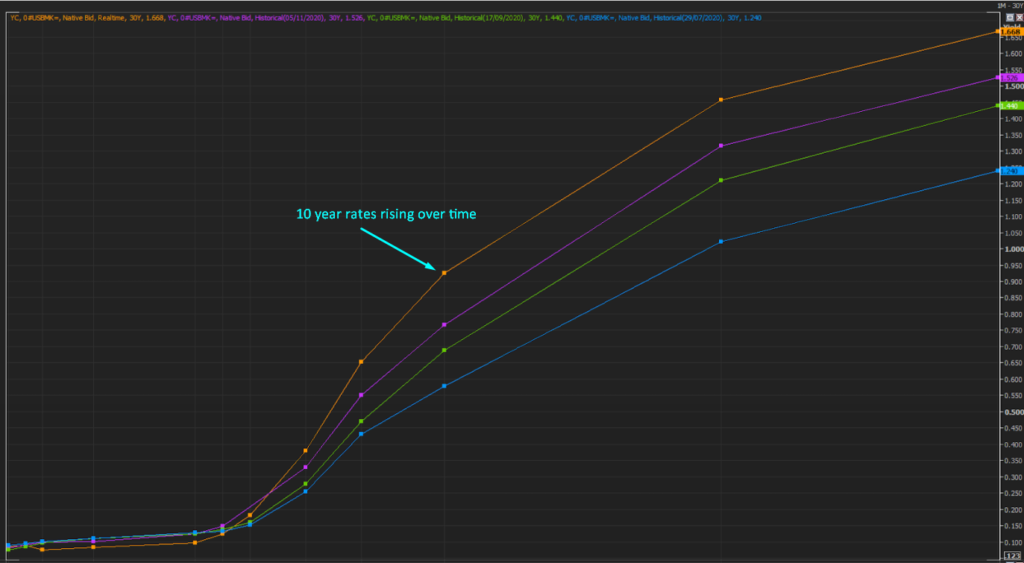

Yield curve control or operation twist would serve the purpose of reducing borrowing costs for the households. As can be seen below are the yield curves after the July, September, November meeting and the Current curve (orange) progressive rising. Yield curve control would put an explicit cap on rates of a certain maturity so effectively see the Fed buying more, say 10 year bonds as yields approach their cap. Currently 10 year yields are ~0.95% a cap below this will create immediate buying until yields reach the capped level. Operation twist will have a similar effective on more buying in longer dated bonds but without an explicit target, the Fed has experience with this having done so in September 2011

Be Ready to Trade the Outlier

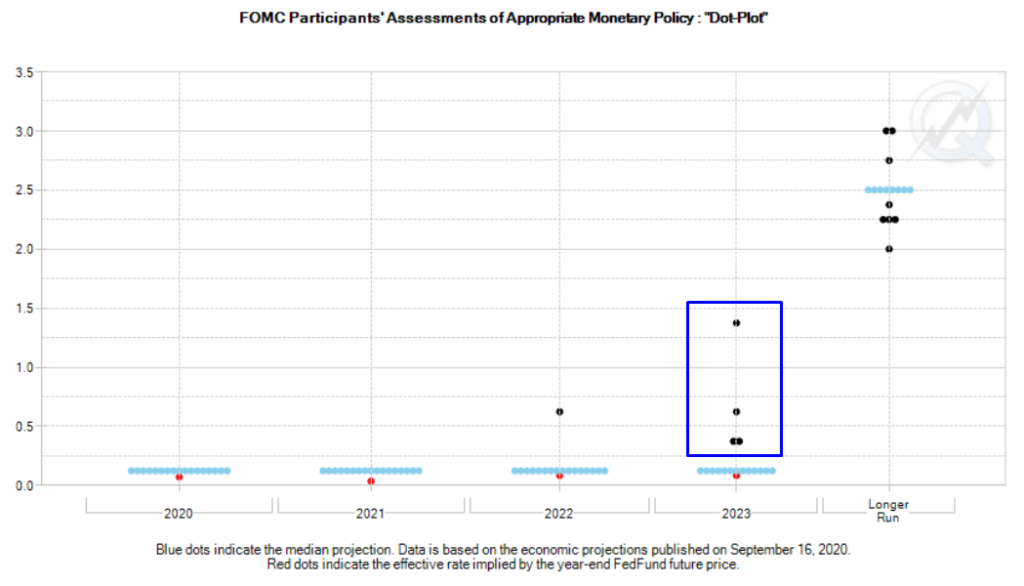

Always a good thing to have visualised before a decision is an outlier – this week it could be the Dots: every quarter each member of the FOMC gives their expectation for where interest rates will be set at the end of the coming 3 years. The 17 Dots guide expectations of when a lift of from the lower bound will come – the light blue dots indicate the median expectation. 4 member expect ‘lift-off’ in 2023 if 5 other members join them this brings forward rate hike and also tapering expectations – whilst a huge outlier it is always worth being prepared for something very few other will be

As always. Make sure you have a plan to trade any central bank event and if you want to learn more about how plans can be formulated, check out our Central Banks Trading Strategies Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 8 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.

Richard