Two Breakout Strategies For Futures Markets Introduction

In this article, we will review two breakout strategies for futures markets. We will have a look at the breakout that worked, and the breakout that failed and was cut and reversed. For our analysis, we will use footprint in one instance and price ladder in the other. Both of these tools derive value from the orderflow and that is what we are going to focus on today. We will review several key highlights of the orderflow that can help you stay in the right direction and reverse the position quickly when participation changes. If you like these concepts, don’t forget to review our previous article on How To Trade a Failed Break Pattern.

Two Breakout Strategies

Breakout Strategy With Follow Through

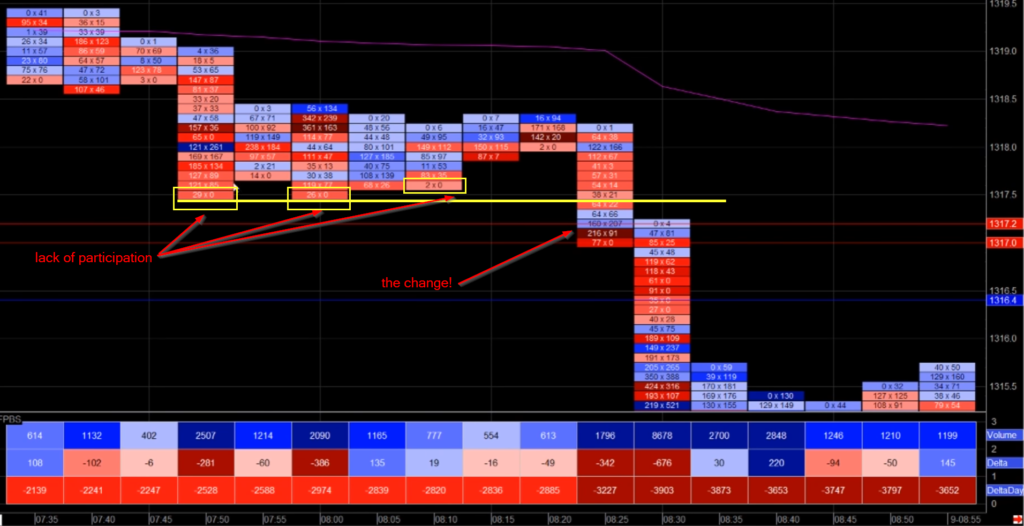

If we were to analyze the break explained in the video above, we would focus on highlighting two aspects that trader Bran has mentioned:

- The best breakouts come when markets consolidate ahead of the break

- When we see a lack of initiative at the low prices, it is a signal that break won’t have follow-through until it does

What do we mean by these two points? Point number one is about seeing consolidation prior to a break. The longer the consolidation, the more energy has been concentrated in the range and this should help the expansion of the range when the range breaks.

Point number two is about seeing the initiative with the break. We want to see THE CHANGE at the location, that lacked initiative in prior instances that failed to break.

Strategy That Failed To Have Follow Through

In the second instance, we are actually witnessing how the follow-through fails. Trader Joe is explaining well one crucial aspect in which he is willing to hold the trade while being down a couple of ticks:

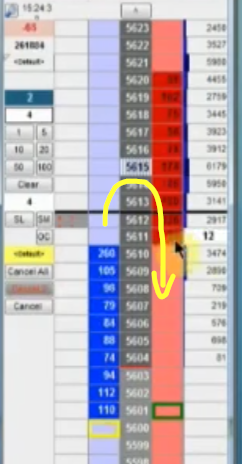

- when you see churning and absorption happening at the bid, you are constantly thinking, this must go any time soon and then you see how those bids got pulled, that is your time to exit and cut and reverse because you are left with vulnerable position

Down below is a price ladder showing you a trader that is still long, but cutting and reversing his position quickly. That reversal is key because now the market needs to go fast down so you can manage your risk accordingly when you flipped your position. And it does, it collapses 20 more ticks to the downside. Here is the cut and reverse part of the video that is very interesting.

Key Trading Takeaways

There are several aspects one must consider when one anticipates the follow-through or a breakout such as general market rhythm, the quality of location, the maturity of the location, and the quality of the participation. When participation changes, that is the time for the change. Something to be aware of going into your future breakouts.

If you want to learn how we trade the markets in detail, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- Trading the V Reversal Price Action in the Dax | Axia Futures

- Reversal Entry Trade In The S&P | Axia Futures

- How To Trade The Delta Reversal Strategy [FOOTPRINT CHART]

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK