Did the ECB do enough at the December meeting? The general consensus is yes they did and therefore they have bought themselves time to sit back and and reassess at the January meeting. This does not mean there will be no trade opportunities just that the nature of the opportunities will differ from the those last month. And the approach to this meeting may fall more towards a technical rather than event driven strategy as it was last time out.

What Did The ECB Do Last Time?

In line with expectations the ECB took a number of decisions including increasing their Pandemic Emergency Purchase Programme (PEPP) by €500 billion to a total of €1,850 billion and extending its duration to March 2022. Extending the duration (to June 2022) and reducing the pricing of TLTROs (to -100bp). At same time they brought in additional minor changes: 4 more PELTROs and and extension of their swap lines until March 2022.

However, markets were still disappointed; for 2 main reasons: a small expectation that the Asset Purchase Programme could be increased from €20 billion to €40 billion was not fulfilled and perhaps more significantly confirmation that the entire PEPP envelope may not need to be used stating: “If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full.”

So What Can The ECB Do?

To decide where trading opportunities may be and what the ECB can do, one needs to pay attention to the inter-meeting guidance and importantly ECB sources – these are unnamed sources that will ‘leak’ information to the press. Whether intended or not, they serve to set the tone of expectation for upcoming meetings and consequently trade opportunities. Even during the blackout period where Governing Council Members are prohibited from talking about monetary prior to the meeting sources still abound. On 20th January 2021 this headline appeared on Bloomberg:

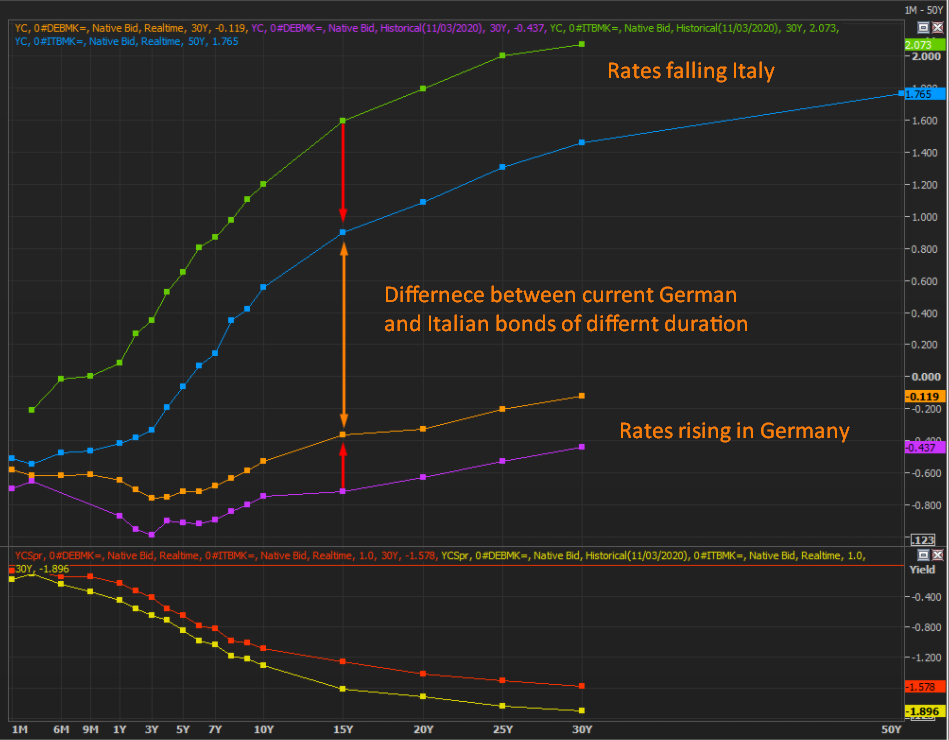

As a trader your job is to discern where the trade opportunity is in the story – in this case the suggestion is that the ECB is using its PEPP to buy certain countries bonds in greater proportions than others in order to narrow or maintain spreads between EU economies. As this information is now in the public domain but not yet confirmed or denied by the ECB, Christine Lagarde may well face questions on whether the ECB is doing this. So where is the trade? First we need to understand what has been happening which can be illustrated by the yield curves below: Each dot along a line shows the yield on bonds of different duration from 1 month to 30 years. The top 2 curves are Italy – green was at the height of the pandemic (11th March) and Blue is current – yields have fallen. At the same time the purple German curve from 11th March has moved up to the Orange current curve showing yields have risen. The spread (distance between the 2 curves has narrowed).

So the trade depends on Lagarde’s answer – a confirmation of what may be termed spread control (not the same as Yield Curve Control) suggest that the spread may continue to narrow – implying a trade of buying BTP and selling Bund. Conversely any denial or reiteration of the policy guidance that “flexibility of purchases over time, across asset classes and among jurisdictions will continue to support the smooth transmission of monetary policy” could widen the spread in the short term.

Process to Create Trade Opportunities

As illustrated above a process to compare expectations to current market data and conditions is crucial to developing trading ideas and strategies. From and expectation, the first task is to decided which market(s) will be most affected by a change to that expectation. Second, consider the potential outcomes – what would be bullish/bearish unchanged for that market. Third, assess where the trade can be executed and how far any move could go (this can be done by reviewing previous decisions). Fourth, as discussed in last month’s ECB blog priortise which change is going to be the most significant. Finally execute according to your plan – if you haven’t planned for the result that comes you don’t have to trade something you don’t understand or can’t quantify.

If you want to learn more about how plans can be formulated, check out our Central Banks Trading Strategies Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 6 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.

Richard