Trading Moderna Vaccine News Across Multiple Markets Introduction

In this post, we will look at Harry and his trading of Moderna vaccine news across multiple markets. Although Harry executed trades on one type of news (Moderna Vaccine News), there are really two types of execution that deserve their own separate attention. Based on that we have split the video into two posts, Part I. that has been already covered, and Part II. which we will cover in this post. Let’s get started with the second reaction to the Moderna vaccine news that happened at 11:56:02 London time.

This post is based on the video below.

Trading Execution

Big Picture Overview

Let’s first do a quick recap of what Harry was looking at and what he so far traded. He has done his detailed due diligence (see section “Market Prep Leading To Trading The Comment”), chosen the right product to trade for this type of news, and executed the first round of trades. He has focused on Gold first, Stoxx and Bund second. Down below is the reminder of a landscape for the markets he has selected and a headline that triggered the markets to move:

We have ended the Part I. with this twist:

“Soon after he scales out fully from his Gold trade, Bund and Stoxx finally pick up momentum putting him well onsite. But then the market dynamic changed and started to squeeze making the position bit more uncomfortable. What to do in such a situation? Cover or hold? What can one lean on in such conditions?”

How Not To Get Chopped Into Pieces

Although it might sound obvious, the biggest advantage of Harry in holding the position during the deeper pullback was the timing on a trade. He had a good price location in the first place thanks to the good preparation and speed with which he has hit the market. This was one of the most important variables for staying in the trade. This is what he has said:

He has recalled videos of Joe’s trading (Axia Senior Trader) and his way of handling the pullbacks. Specifically:

- how LVN zones can be helpful when holding, not covering too early

- monitoring what other correlated markets are doing

Thanks to the experience with FOMC and ECB press conferences, Harry was aware that usually a second leg is presented and new flows of money push the market forward. As his position in Stoxx has been put under the test, he was willing to sit and not cover early. Then at 11:56:02 London time, the second wave of flows started to move the market and enable Harry to scale in even more size.

Second Leg Order-flow Execution

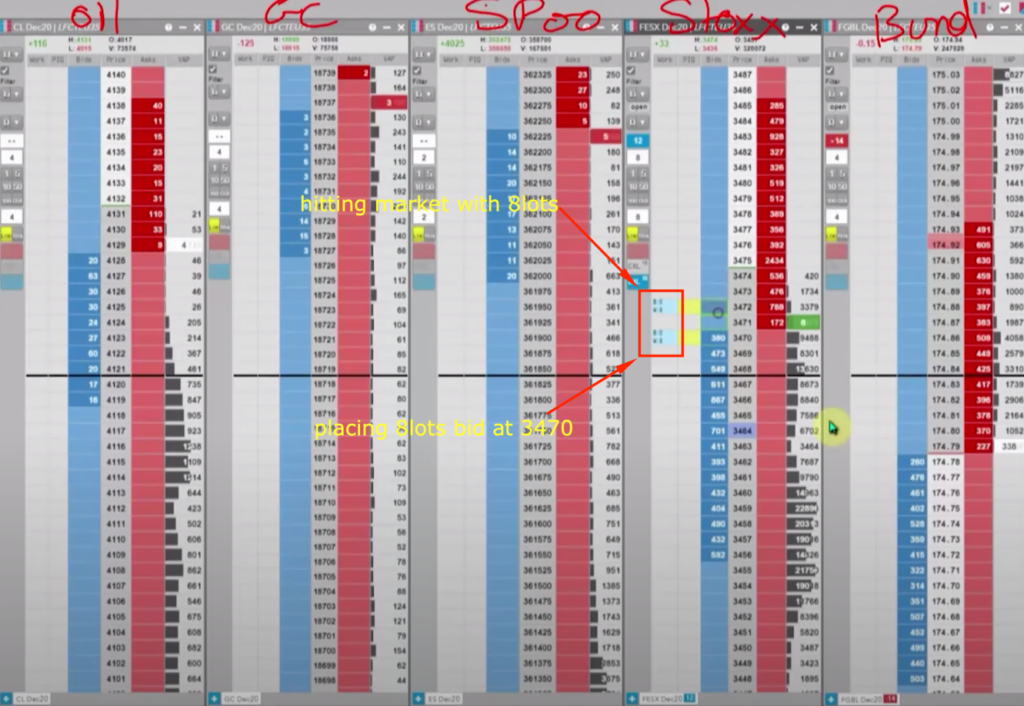

As you can see down below, the moment the second leg started he was able to enter the long in Stoxx with two clips of 8lots. One clip hitting the market and the other clip placing a limit order at 3470 on which luckily he has been filled.

From that moment market took off, took the highs in Stoxx, and made a new low in Bund. At this moment Harry has 32lots in Stoxx and 16lots in Bund. With Stoxx he is aiming at 3499 as a potential target. He is also confident to add more into the Bund as long as we hold below the 80’s. One thing he keeps reminding himself of is a balance between not being too greedy and holding+adding as the market makes short-term retracements. He keeps reminding himself to watch the correlations, monitors the health of auctioning activity (new flows still coming in), and not covering too quickly when adding at the low in Bund. Once the market started to trade in the 90s in Stoxx market started to stall a bit more and auctioning activity has changed. After a good bit of two-way auction, Harry has recognized that the market started to stall across the board and did not want to give away the good profits he has earned on a day and slowly started to cover both of his positions.

Key Trading Takeaways

Multiple opportunities have been captured by Harry making it one of his most profitable day so far. Here are the key lessons from his debrief:

- Adapting to what markets to trade learning from the previous reactions (especially the Gold I thought might be the best reaction and that’s why I have focused on it first)

- Getting in early was key and understanding the correlation plays between the markets was very helpful when in doubt if to hold or cover

- Sitting at my desk at 1145AM (London time) ready enabled me to execute this trade

- S&P500 gapped up each Monday in anticipation of this news was a little subtle clue

- Knowing that I should not be too greedy since it is not gonna be as game-changing move as the Pfizer move previous Monday

- Being aggressive on the second leg was key on the efficacy of 94%

- Knowing your market structures for the best markets to execute in

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK