2 Ways To Scalp The Exhaustion Move Introduction

In this blog post, we will discuss two ways to scalp the exhaustion move. In trading, exhaustion moves are usually characterized as short-term extensive runs that have a one-time-framing character. The end of the exhaustion move can provide a short-term scalping opportunity that can be spotted by using the price ladder and order-flow reading skills. The idea behind profit-taking in the exhaustion move is its’s nature to mean revert. Simply, the move has traveled “too far” and participants have lost the energy to push the move forward. If you like scalping patterns, don’t forget to check our previous article about the Jump Orderflow Pattern. Let’s get to it.

Exhaustion Move Trading Examples

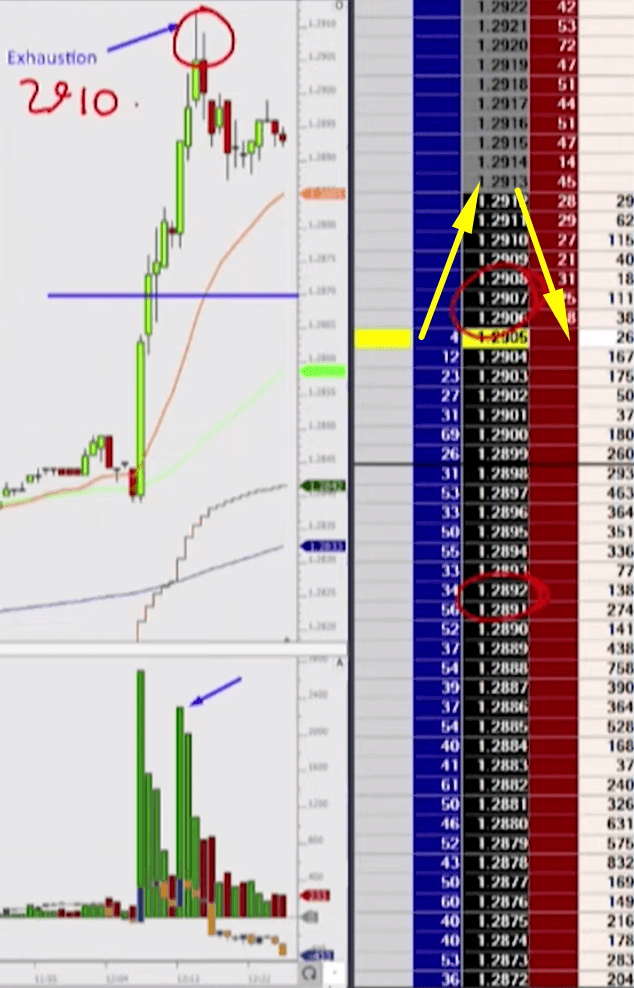

Trading Exhaustion Move In British Pound

As described in the introduction, the exhaustion move is a move that is one-directional, is one-time-framing (has a sequence of higher lows for an up move or a sequence of lower highs for a down move), and has usually increased volatility.

In this exhaustion move, we are looking for the order-flow pattern that can signal the short-term end of the move. We must be aware that this is a short-term scalp and quite a dangerous one if we forget the rules about the nature of this move. What are those rules:

- short-term scalp – you are going for a quick profit, not a big distance target

- one clip type of trade – this is not your full-size type of trade, you go with your Tier 1 size

- try once and move away type of trade – if by any chance the move keeps on going higher (or lower), let it go, don’t try the trade over and over. You might be facing a trending day, a day where you can do big damage to your account if you are trying to pick the top or bottom

- you are essentially fading the high or low of the day, therefore the previous rule is very important

- you only trade when the order-flow pattern appears

Down below you can see all the criteria we have described in a trade.

Zooming in on the order-flow pattern, watch as the pattern starts here. Now if you watch carefully the video, you can see the last flick up. That last move signals that people are forced to buy, not choose to buy. It is that sudden change in the rotation when the price drops quicker down and can’t lift the offer anymore. That struggle to lift the offer to take the last high is our order-flow pattern and our moment to initiate the scalp short.

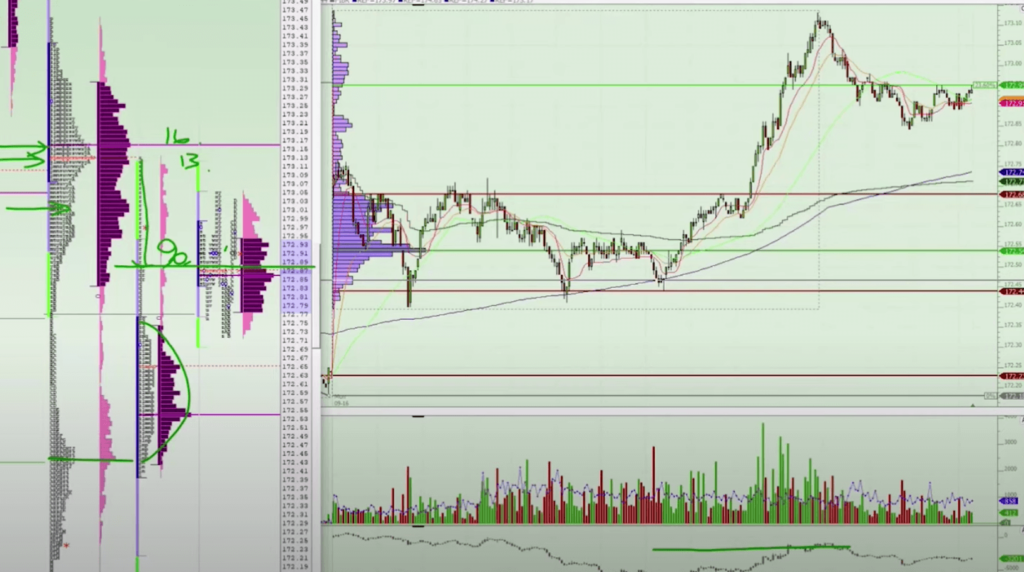

Trading Exhaustion Move In Bund

Now let’s have a look at a different example. In this case, we can see an over-extended move as well. In this case, the market stretched itself without moving value.

Order-flow starts here. Again watch the order-flow and observe the pattern. This time it is different. This time, there is no flick up (excess), but an absorption. Every time we are trying to lift the offer, someone is happy to sit there and absorb. Given we are over-extended, and the location of value, we can target this trade further down. This is not a scalp like in our previous example but a trade we can hold for bit longer. The idea is still the same, reversion to the mean.

Watch both examples. Try to understand the difference. Understand the risk profile of this trade. When do you scalp and when you are holding short-term swing? Use the clues we have discussed and never fight the trend. If you are wrong once, there is a chance you will get it wrong a few more times before the market turns. Don’t fight it, move on to another trading idea.

If you want to learn how Axia Traders trade other volume-derived patterns, visit the free workshop we are running at: https://go.elitetraderworkshop.com/Free

If you liked this type of content, you might check these videos as well:

- How To Trade Using CUMULATIVE DELTA | Axia Futures

- 2 Ways Of Using Volume Delta | Axia Futures

- Cumulative Delta Explained ❗ [CONTINUATION vs REVERSAL] | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK