Top Three Strategies Every Trader Should Master Introduction

In this blog post, we will have a look at the top three strategies every trader should master. Even if you would not be an active trader in one of the strategy domains, being aware of how the strategy works can improve your own trading. This post will be about picking the best articles that provide enough details for you to build strategies based on these concepts. We will focus on the breakout, reversal, and macro trading strategies. Let’s get started.

Top Three Strategies Every Trader Should Master

Breakout Strategies

When it comes to breakout strategies, usually you have one big advantage: tailwind. You are ideally going with the momentum and trying to attack a vulnerable spot. The problem with breakout strategies is, that you might get chopped to pieces before your break finally goes. What are the clues that can help you stack the odds in your favor?

- energy build-up – has there been enough intraday positioning built prior to the break?

- breaking volume – are we breaking on an increased volume?

- velocity/pace increase – has the velocity increased, the pace changed?

- large orders in the opposite direction – don’t produce the anticipated move

- large orders in the direction of your move chase price – such as 500 lot chasing prices down

Have a look at how trader Harry executed his Gold trade and how 500 lots chasing the market could have helped you get bigger in your trade.

There is also another way to play the breakout. For a very short-term spike. How?

Here is the list of clues:

- Identify the poor high using a market profile or price action

- Watch the price ladder and look for:

- Watch how the market reacts when it gets closer to the poor high

- You want to see force breaking higher, ideally, more volume lifting the offer, bigger size

- No reloading or very minimal reloading from sellers – a sign that sellers are not willing to defend

- Bid holding (bid being sticky), not really backing off – sign that buyers are willing to push

- Exit – you can either exit for a couple of handles when the market jumps, or wait after the jump for a bit and if it does not back off, keep holding the move for a bit longer

Do you like breakout strategies? Here are other resources you follow:

Let’s have a look at the opposing strategy, a reversal strategy.

Reversal Strategies

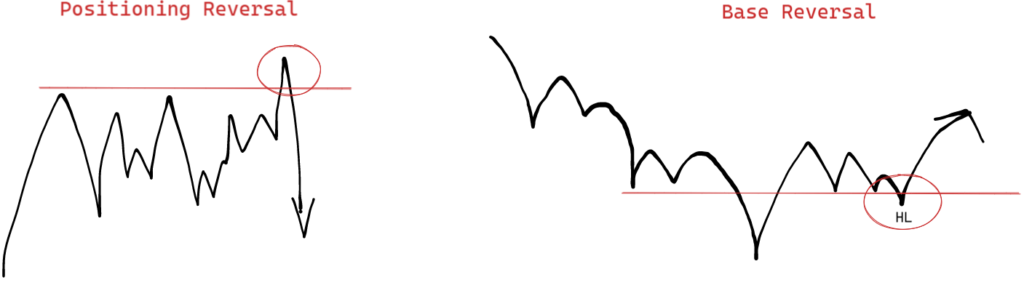

When we go against the primary momentum, we must be sure that we are truly at the inflection point and our main objective is the unwind of those that have positioned towards the breakout.

When we are dealing with market reversals, we need to understand the risk of playing these reversals. The risk of any reversal lies in our understanding of market participants and their intentions. It is much harder to read the intention of the market when it is driven by a pure initiative move (market selling or buying in a one-directional fashion).

Here are a couple of clues that should get you an idea, if the reversal has a chance:

- Volume – some traders set 3x or even 5x the average volume as a trigger for their reversal to be in play

- Delta Reversal – is the aggressiveness shifting from buyers to sellers or vice versa?

- Tails – are tails being created around reversal?

- Overlaps – do candles that did not overlap suddenly start to overlapping?

- Time – how much time we are spending in the territory where price should not get really accepted.

- Value – where is the value being accepted and is it in line with our expectations?

- Single Prints – where do we want to see single prints develop?

- Power Of X – how many times the market has tried to attack a reversal tail and failed. Some metrics-driven traders can set this variable to 2 for example. “I want to see at least 2 failures at retaking the tail in order to initiate my position”.

- HL’s, LH’s – with an attempt to take the tail, is HL (for bullish reversal) or LH (for bearish reversal) being created

- Rejection vs Liquidation – is this move driven by rejection or liquidation?

- Basing/Two Way Trade – where and how do we want to see the basing/two-way trade develop after the rejection has happened?

- etc.

In order to use these clues efficiently, check the detailed explanation of how those clues can be practically used.

Do you like reversal strategies? Here are other resources you can have a look at:

Now let’s move on to News strategies.

The News Strategies

Trading the news is a beast on its own. The key is knowing when to hit the news, what to do while you are in the trade and when to sit tight and not do anything.

There are four main principles that Elite Axia Trader follows:

- In with size quickly, out with small clips laid on bid/offer

- Never hold full-size offside

- Aim to stay with a trade until exhaustion

- Front run denial if signs of exhaustion/news is ‘TGTBT’ (too good to be true)

What is the actual application? Read How To Execute Like AXIA’s Elite Trader.

Here are the best resources to get you started trading the news:

- How To Trade Geopolitical Conflicts

- Elite Trader Price Ladder Scalping In Bund

- Elite Trader Price Ladder Scalping

- Trading Moderna Vaccine News Across Multiple Markets

- Global Macro Trading: How to trade the ECB Rate Decision

- Trading the Fed Rate Decision

Thanks for reading.

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK