How To Execute Like AXIA’s Elite Trader Introduction

In this post, we will discuss how to execute like AXIA’s Elite Trader. We will start with using the “adverse selection” analogy and then break down techniques that Elite Traders use, for maximizing their profits and minimizing the potential damage when a trade goes against them. In 4 simple steps, we will discuss how early aggressive action, can lead to asymmetrical gains and how small partial profit-taking keeps the Elite Traders always tuned to the market until trade exhaustion. If you enjoy similar articles about the way top traders manage their trades, don’t forget to check our previous article: “Elite Trader Price Ladder Scalping In Bund“.

Elite Trader Execution Techniques

Trading With Adverse Selection Principle On Mind

The fundamental element of aggressive trader behavior is the understanding of the Adverse Selection principle. At 20:49, Bogdan explains this principle very well. In a nutshell, the principle can be simplified like this:

- when you want it (want the trade), it is hard to get it or you can’t get it

- when you don’t want it or get the trade too easily, you probably do not want it

Yes, there are caveats to this principle, it can’t be taken too literally and applied to everything in life, but the core principle stands. Why? Pause for a second and ask yourself: When was the last time you wanted to get a fill on a trade but did not get it? How did those types of trades work out eventually? And what about all those trades you got filled easily, how did those trades play out?

So how can this principle improve your trading? It can help you with being more aggressive when there is an opportunity that you really want it. Let’s have a look at what I mean by that.

4 Trading Techniques Elite Trader Uses

In the live trading session video above, Axia Trader Adam looked at 2 examples of how he has incorporated execution techniques into his own trading that he learned from Axia’s Elite trader. This recording specifically focuses on the second phase of a trade when it has started to work and needs to be managed with scaling techniques.

The four main techniques from Axia’s Elite trader have been:

- In with size quickly, out with small clips laid on bid/offer

- Never hold full-size offside

- Aim to stay with a trade until exhaustion

- Front run denial if signs of exhaustion/news is ‘TGTBT’ (too good to be true)

Now let’s break down each technique in greater detail using the price ladder with the example of trade management.

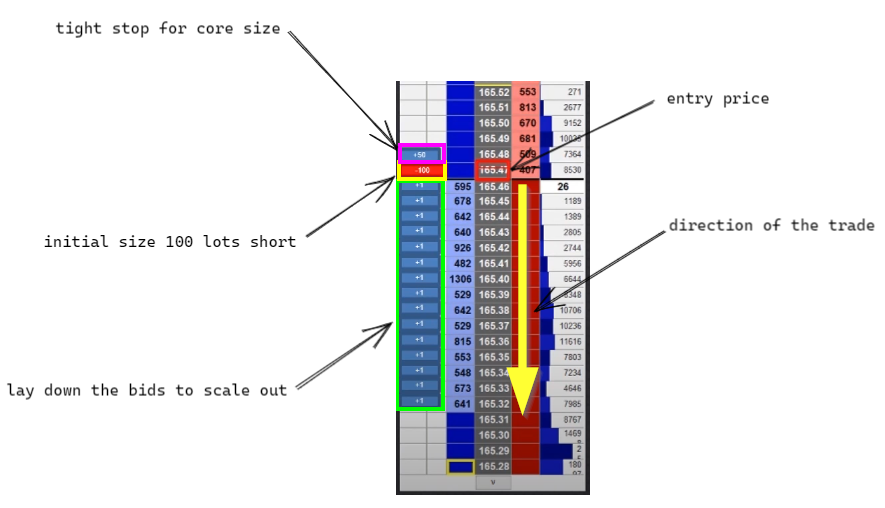

To reference trading techniques 1 to 4, we will use the image above. Starting with technique number one, using the adverse selection principle, you must be aggressive and get in as early as possible with your maximum size. This means lifting the offer or hitting the bid, not passively sitting to get hit. Then it is all about laying down small clips on the bid or offer depending on trade direciton. This ensures you can maintain your core position still in play while taking profits as the market moves in your favor.

Being early gives you more room. Trading technique number two is to never hold full-size when offside. On the image above, you can see that after 100lots have been placed in the market (yellow box), 50lots sit just above (purple box) to exit the market in case the market moves quickly against you.

The idea of technique number three is to stay in the trade until exhaustion. Since you laid down small clips, you can maintain your core position for the final exit when the price ladder personality shifts. If you want to find out, how to recognize price ladder personality shift and exit trade ahead of the crowd for the best possible price, join us at the free webinar we are running at: https://www.elitetraderworkshop.com.

The final, fourth technique requires a full set of additional steps and we will devote a separate article to it. Just be aware, that there is also a market opportunity to be exploited in this technique.

As we have finalized the four trading techniques Elite Traders use, let’s have a look at some trading examples.

Trading Examples

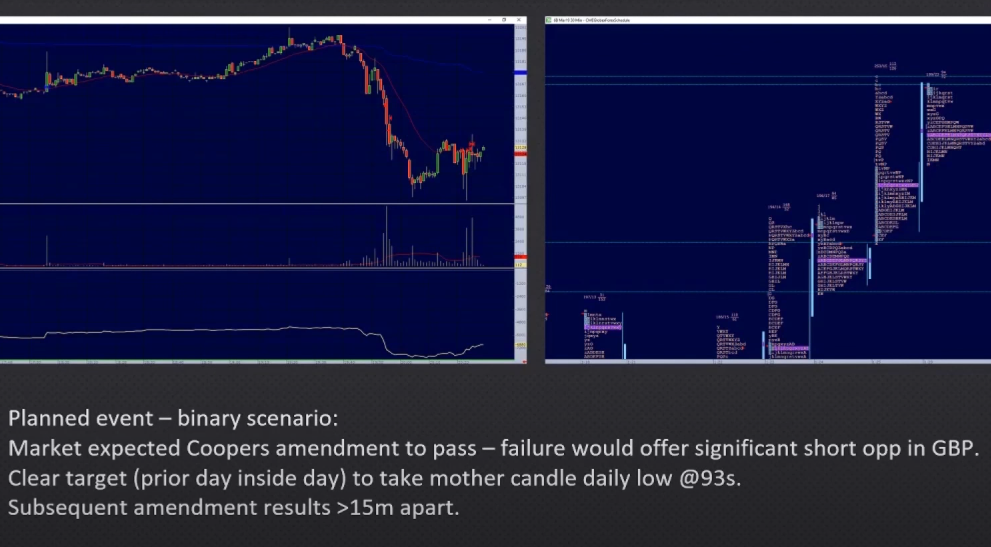

In trading examples below, we will look at the Brexit amendment vote on January 29th, 2019, and a US/Chine comment.

In this first example, which starts at 7:56, Adam trades the Brexit comment. The key takeaway from trading the GBP move was that Adam has laid down the bids too quickly and too narrow therefore the majority of his position was out of the market before the final exhaustion has happened. This prevented him from using technique number 3.

In the second example, which starts at 16:55, Adam trades the US/China comment. If you observe his trading execution on a price ladder, his techniques for managing the trade were very similar to what we have described. The key takeaway for Adam from this trade was his speed. The comment did not offer much-anticipated follow-through, but if early, a good 15tick move could be taken from the market on a decent size.

Key Trading Takeaway

Speed, aggression, max. size and small clip scaling until exhaustion. That is in a nutshell what we want you to take away from this article and incorporate into your own trading.

Thanks for reading.

Don’t forget to check out articles you might also like:

- AXIA Elite Trader Executes a Smash & Grab Trade on ECB Minutes | Axia Futures

- AXIA Elite Trader Trades a Trump Tweet | Axia Futures

- AXIA Elite Trader Trades the ECB Press Conference | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK