Elite Trader Price Ladder Scalping Introduction

In this blog post, we will revisit the Axia Futures YouTube video archive and watch the Elite Trader’s price ladder scalping. We will specifically focus on the execution of the Elite Trader by providing you with the specific time, where the price ladder execution begins. If you haven’t watched our previous post on a similar topic, don’t forget to check the Elite Traders Price Ladder Execution Playlist.

Each video will be accompanied by a theme and a learning question dedicated to improving your trade management skills so you can make the most out of the order flow mastery of these traders. On the importance of high-quality questions, we have also written an article (Trading Techniques To Become More Profitable Trader) you might find helpful.

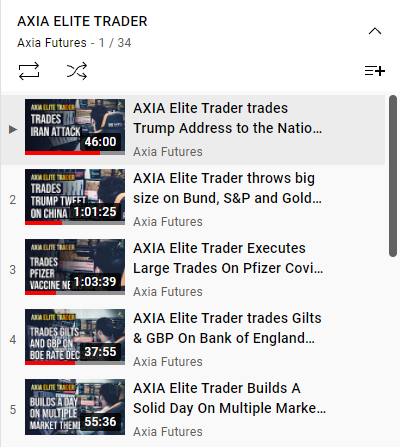

Axia Futures Elite Traders Playlist

In case you have not been aware, there is a whole list of high-quality content of Elite Traders videos that we have shared with the trading community.

Click on the image above or this link to find the full list.

Axia Futures Elite Traders Scalping Execution

AXIA Elite Trader Aggressively Executes July 2019 ECB Rate Decision

Theme: To be an Elite news event trader, and understand the international cross-market correlation flows, you not only have to have a highly refined trading execution skill set you have to have a powerful visualization process of the same level of the greatest sportsmen on earth. In this video, our Head of Trading and one of the most aggressive central bank traders execute in two key stages of the ECB.

1. In the rate announcement

2. In the press conference

Our key focus for the takeaway question would be around trading the statement announcement. After this announcement, this trader is caught on the wrong side of the trade. Watch the Bund and the DAX as he operates himself out of the initial wrong position.

Question: When a lot of participants enter aggressively short on the back of the news, but there is no follow-through in that direction, how this can impact the velocity of the next move in the opposite direction?

Price Ladder execution starts: 5:27

AXIA Elite Trader Scalps Around A Big Trade That Goes Wrong

Theme: This live trading review of an elite trader on the Axia Futures desk shows not only how he executed a large trade into an Italian news comment, but how he managed and minimized losses while holding 250 lots long in the Bund and seeing the trade quickly snaps back against him (seen at 11:50 minutes into the video).

The initial comment came out on 12 September around midday and stated that “5-Star will seek Tria resignation if they do not get 10 billion Euros for universal income.” With this being fresh information to the market and with no developing story, this held potential for a big unwind of the narrowing Bund-BTP spread. A denial of this comment then hit news wires unusually soon after the first comment and stated, “senior 5-Star source tells Reuters there is tension over budget resources but no threats to remove Tria”. At this point, the trader was still long in the Bund and artfully minimized losses by keeping a cool head and scalping around his core position to profit from the possible mean reversion trade.

Question: What is more likely to happen? Continuation of the short after the denial of the news has been confirmed or a short-term rebound long from the original price? What is the underlying logic that explains your answer?

In order to fully understand the question, don’t forget to watch the trade debrief by Adam that starts here.

Price Ladder execution starts: 10:59

Thanks for reading.

Don’t forget to check out articles you might also like:

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK