Elite Trader Price Ladder Scalping In Bund Introduction

In this blog post, we will revisit the Axia Futures YouTube video archive and watch the Elite Trader’s price ladder scalping in Bund. We will focus on traders’ ability to read the inverse correlation between two fixed-income products. Based on this correlation, widening spread between German Bund and Italian BTP, this trader was able to place large bets in Bund and hold onto buying as long as BTP has offered. Truly amazing market reading skills that are worth your attention if you are serious about trading the market themes. If you haven’t watched our previous post on a similar topic, don’t forget to check the Elite Traders Price Ladder Execution Playlist or Elite Trader Price Ladder Scalping article.

Each video will be accompanied by a theme and several learning questions dedicated to improving your trade management skills so you can make the most out of the order flow mastery of these traders. On the importance of high-quality questions, we have also written an article (Trading Techniques To Become More Profitable Trader) you might find helpful.

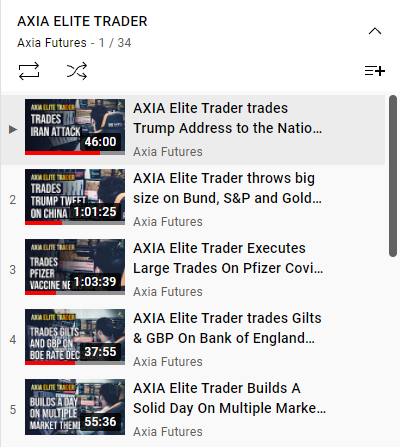

Axia Futures Elite Traders Playlist

In case you have missed this, there is a whole list of high-quality content of Elite Traders videos that we have shared with the trading community:

Click on the image above or this link to find the full list.

Axia Futures Elite Traders Scalping Execution

Elite Trader Price Ladder Scalping In Bund – First Leg

Theme: This price ladder trading session reviews the inverse correlation between the Italian 10 Year BTP bond and the German Bund during the Italian government crisis. We see how an elite Axia trader was able to use the order flow within the BTP to safely build a Bund position while markets reacted to the announcement of Euro-skeptic Paolo Savona being a possible candidate for the economic minister.

Price ladder recording starts here.

Questions:

- What happened to the correlation throughout the week?

- How did this trader use the correlation in his favor, meaning what product was he leaning on?

- Did the BTP-Bund correlation move the best in the Risk On or Risk Off environment?

Watch the recording, answer the questions, and once you have completed your part, head over to the end of the post to find the right answers.

Elite Trader Price Ladder Scalping In Bund – Second Leg

Price ladder recording of the second leg starts here.

Questions

4. How does this trader scale into trades?

5. What is the signal for the end of the move in Bund?

Finding the remaining answers at the end of the article.

Elite Trader Price Ladder Scalping In Bund – Summary

By watching the recording of both legs, you could have noticed several key clues this trader leans on during his trading:

- Understand what market theme is in play

- Understand the correlations between markets when these themes are in play

- Identify what type of strategy is in play: BTP-BUND spread widening

- Notice the diminishing value of news throughout the week – correlations breaking apart as the news are getting discounted

- What moves best in Risk-On and Risk-Off environments

It has become clear from watching the video that this has not been fixed “if this do that” type of strategy. This strategy can be sometimes explained as a “feel” strategy. For new traders, this is usually very hard to grasp because there is very little to lean on. It is all about the experience. A great example of a strategy, where experience is key! This trader has seen a similar behavior of the market during previous European crises and could lean on market dynamics he has seen in the past. Something we should all learn from and codify into our own interpretation for the future.

Thanks for reading.

Don’t forget to check out articles you might also like:

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK

PS: Answers for the questions above:

- It was diminishing

- BTP going short, for Bund going long

- Risk On Environment

- Either by hitting market or resting bids directly below the current price

- Fast 5 ticks jump in the BTP