Trading Strategies Around Poor Lows And Poor Highs Introduction

In this blog post, we will introduce and discuss trading strategies around poor lows and poor highs. Trading around poor highs and poor lows can provide opportunities where the market is skewed in your favor. These opportunities either lead to the burst of trading activity through the poor level or a liquidation away from the poor level. We will discuss how to identify these poor areas, what price ladder trigger points you can look for to manage the trade, and what to do when market signals that the liquidation move might happen soon. We will provide you with three strategies our traders use, to profit from this market vulnerability. If you find these types of trading posts interesting, don’t forget to check our previous post: “VWAP Trend Trading Strategies“.

This blog post is based on the video down below.

Anatomy Of Trading Poor Lows And Poor Highs

How Are Poor Highs And Poor Lows Constructed

When we are trying to identify a poor low or a poor high, we are primarily looking for multiple tests of the same level within one daily interval. These tests should create something that we can also call ledge. A ledge is an area, where the market tested that area multiple times and that happened to be the high or low of the day.

Sometimes we use TPO to tell us if the extreme is poor or not. Why TPO? In Market Profile terminology a TPO represents an interval of 30minutes that is represented by the letter. This letter represents a time when this character was created. A one TPO tail (one latter) can be characterized as a poor level if it was formed either at the high or low of the day (see the first image down below).

Rule of a thumb:

- Poor highs and lows are flat tops or bottoms that lack a tail. An indication that the move is not over and should be repaired at some point in time.

Why Are Poor Highs And Poor Lows created?

As the market goes through the process of price discovery, the auctioning process is halted by one or multiple participants holding the price. Either, one side runs out of steam naturally or stops going because of the high absorption of the other side. When that happens, the market creates a poor high or poor low.

Trading Strategies To Profit From Poor Highs And Lows

Directional Strategies

Now let’s have a look at a practical example of how you can profit from these strategies:

- Step 1 – identify the poor level using the analogy above

- Step 2 – prepare scenarios for either

- a) taking a level – directional move through the level

- b) waiting for a failure of that level

My preferred strategy is to wait for accumulation prior to the poor low or poor high and then get on the directional move using a price-ladder in which the break of the poor level will give the market a bit more acceleration thanks to the stops that will be triggered.

If you want to learn how we structure these trades in detail, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

Down below we can see two examples:

- The first was a failure that reversed – the scenario of Step 2b

- The second was to break through the poor level – scenario of Step 2a with a twist I have described in italic above

Let’s have a look at one more example of a poor high with a directional break. This time in Spoo (S&P500). The market has formed a poor structure over multiple days. This is even better. We are going with the directional break, but this time we are using the price ladder to tell us if we should stay with the move or cover on a jump.

Strategy:

- Identify the poor high using a market profile or price action

- Watch the price ladder and look for:

- Watch how the market reacts when it gets closer to the poor high

- You want to see force breaking higher, ideally, more volume lifting the offer, bigger size

- No reloading or very minimal reloading from sellers – a sign that sellers are not willing to defend

- Bid holding (bid being sticky), not really backing off – sign that buyers are willing to push

- Exit – you can either exit for a couple of handles when the market jumps, or wait after the jump for a bit and if it does not back off, keep holding the move for a bit longer

Don’t be greedy. Identify the level, play it for a scalp, unless you really expect a big directional move.

Reversal Strategies

There is a scenario when the market is really positioned to break the poor high, but after several attempts (ideally 3 or more), simply cannot take the poor level. This clue can be used to your advantage as well. Imagine all the people that speculated that the poor level will get taken. Those short-term traders and speculators will have to cover their positions and the market does a :

LIQUIDATION MOVE

It is all about identifying those failed attempts trying to attack and break the poor level. Usually, the failed attempts are presented throughout the day, but the next day, it is clear to everyone, that if the market did not push through and repaired that poor level yesterday, it will most likely liquidate today.

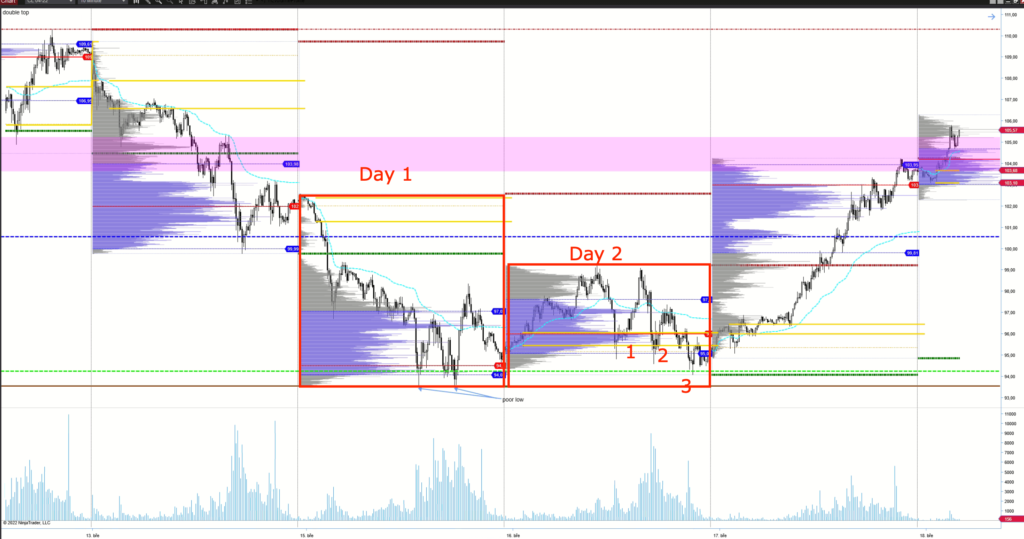

Here is the more recent example from 16.3.2022. This is the chart of the Oil. Notice how the double bottom and poor low were formed on Day 1. Then the next day market has attempted 3 times to the last minute trying to break it. Then, the next day, the unwind. P shape type of a move on day 3. This is a the liquidation move we have described.

Remember. Identify the poor level, design scenarios for what can happen next, and use the price ladder to read the market for the best execution. If you want to learn how we do it, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- Poor Value Areas Explained | Axia Futures

- Understanding Poor Highs On The E-Mini S&P 500

- How To Trade Into A Low Volume Node Zone | Axia Futures

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK