Trading The Multiweek Range Gold Breakout Introduction – Part I.

In this blog post, we will be looking at trading the multiweek range Gold breakout executed by Harry. This will be a two-part blog series where we will look at the details of the range breakout that happened in Gold. Our main focus in Part I. will be the structure of the trade and prep leading into the trade. What were the important market profile characteristics and how Harry leaned on correlated markets and their risk-on sentiment after the cash open. This is a momentum breakout type of trade and if you are interested in a similar type of trading, check out our previous article with Oil example.

This article is based on the video made by Harry down below.

Building The Narrative

As the structure of the Gold has been building, Harry, mentions that the longer the structure was forming, the more he was focused on how he could tackle this trade and get big. He was asking himself how he can prepare for this trade when/if this trade happens. A crucial part of successful trading is the anticipation and the ability to build the narrative, and piece out your if/then scenarios. Let’s have a look at how he combined the trading puzzle pieces together to execute this not-so-easy and straightforward breakout.

Overall Structure Prior To Breakout

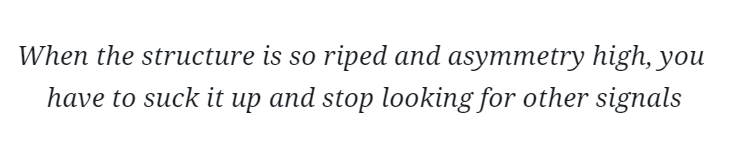

Starting with the higher-level candlestick chart (down below), we can all identify the range. A general rule of thumb is that the longer the range is being built, the more energy (movement) is gonna be released once broken. The problem with range breakouts is the timing. If you would be selling too early, you would get destroyed by many unsuccessful attempts. Of course from hindsight, it is always easy to pick one particular point when breakout worked and neglect all the previous ones, but if you were actually trading this setup, it is a different story. I personally was watching this breakout as well and on that particular day, when the breakout worked, I hesitated and did not pull the trigger. It cost me a trade of the week. Why hesitation? Because of the fear of being washed like many times when Gold tried to break before and washed the sellers. I have discussed my hesitation with AXIA Elite Trader and this is the advice he gave me:

Now what was particular about this range was how long it was forming and under what circumstances. This structure was formed over two weeks, the daily ranges were getting very compressed and the structure swallowed events such as FOMC. That is a lot of energy to absorb in such a structure. Structure captured also an inside week. Given all these clues, we were set for a good break. The only problem was, … TIMING.

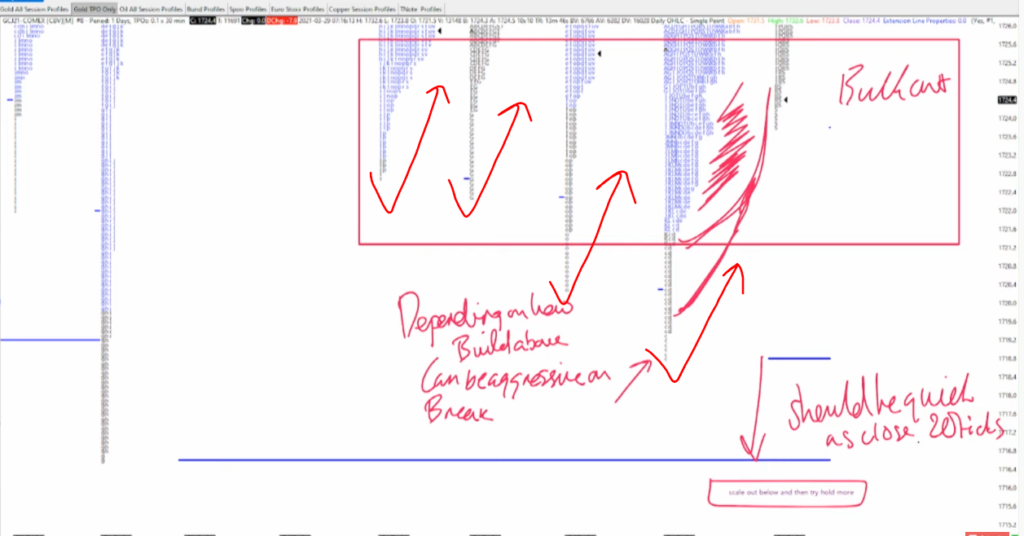

Timing And Structure Of The Lows

As we are nearing the proper maturity of the multiweek structure, the market keeps reacting with buying tails (see red arrows). This is not a structure we want to see for the breakout. We want to see positioning being built near the tails. We need to “bulk it out”.

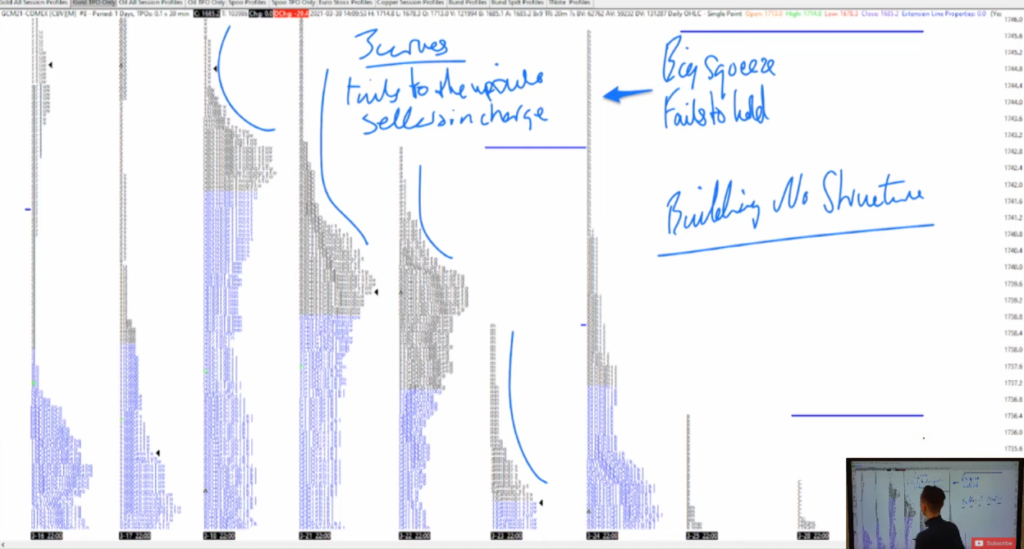

Structure Of The Highs

Looking at the highs, we are also seeing selling tails. Actually, the quality of the selling tails is better than those of buying tails. This slowly increases our conviction on the breakout to the downside given the bigger picture downtrend we are trading in.

As we are nearing the breakout, we can see that more and more pressure is placed to the downside bringing the structure close to the key breakout level. See down below how both Highs and Lows were forming a full picture view prior to the breakout.

The Trade

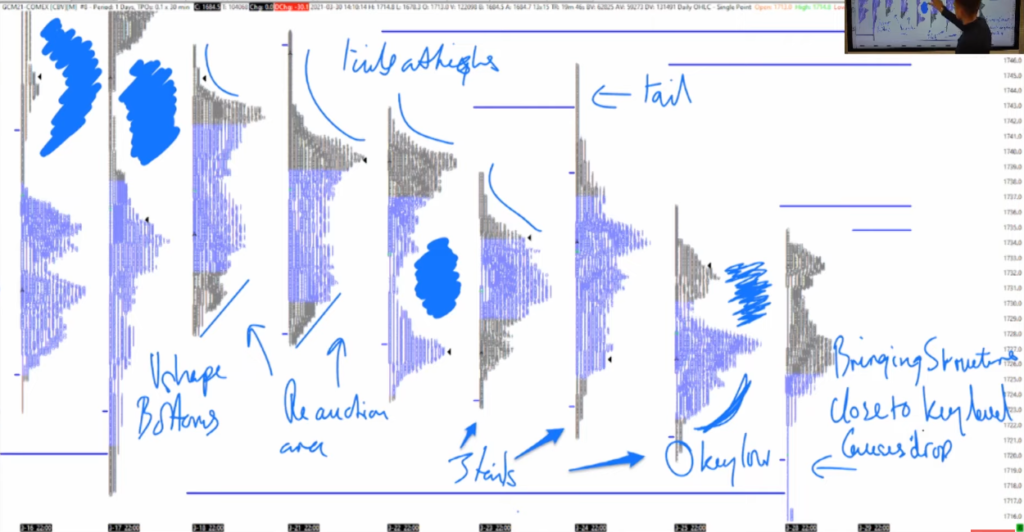

On the day of the breakout, the execution was not so straightforward. Being aware of the fake V reactions, we either must hit the market and cover the moment we are getting squeezed or sit through the pullback. The problem with sitting in the pullback is that from previous experience, we know the market can squeeze hundreds of ticks higher with ease given the previous buying tails. There is one clue and that is positioning after we broke the red line. Although we have created a V reaction on a short timeframe, compared to the last time, the reaction is not met with follow-through. This is the first difference, the first clue that is telling us that maybe, this time it is different.

The second clue that held Harry’s conviction high on this trade were the correlated markets. As we were breaking out, the US Equities Cash session just opened in an open drive fashion. Bonds were offering, Spoo was bidding up. The feeling of “risk-on” mood was something that could help the Gold moving lower.

Key Trading Takeaway

We have learned that it is always easy to judge from hindsight when was the best time to enter the breakout. Reality is a different thing. Our guiding light can be the usage of market profile in assessing if the structure is mature enough. And then, when the moment of execution comes, lean on correlation pull the trigger, and suck it up.

Looking forward to seeing you in Part II., where we will break down the execution, debrief, and key lessons from this Gold breakout trade.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK