In this video, Richard points out how to read the order flow at a key point in two correlating markets, specifically Bund and Eurostoxx futures.

What is the ‘key point’? It’s the point in the market where based on previous insights you are expecting something to happen. There are misconceptions about observing order flow, some people are focusing on every up tick and every downtick that presents itself. This can be useful if your main edge is scalping and mostly focusing on exploiting very short time frame price ladder trades. However, what’s really important is to understand how to match what is happening on the ladder to what you’re looking for and then how to use that information when it doesn’t work out your way.

The example we to use here is a Bund and Eurostoxx interplay from Monday the 1st of June. We take a look at the context of these markets and at two different patterns of order flow that emerged and gave an indication on how to trade the expected move and how to use it to trade a counter move in the secondary market.

Order Flow Must Match The Trade Type

Whenever you develop a new trading idea or work on a new strategy usually you are going to be using many tools to do that. Remember that order flow should fit that strategy. This could be your final check in the box of conviction on a trade. Without seeing matching price action to what you previously observed your confidence should be significantly impacted. Only when you are recognizing what is happening and matching that with your expectation of what should happen you can really apply bigger size in the market.

Order flow is giving you the key information – never dismiss it, as it indicates what size you could apply and even if you should take the trade at all. Often it happens that when we take a loss on a trade we quickly forget about it and move on without asking any questions and taking any information from it. Always ask yourself: what’s that telling me? Where there any clues indicating that this could not work out this time?

SIZE = SETUP + ORDER FLOW

Knowing when to trade big size in the market is one of the most important differentiating skills of Elite Traders. They know that the size applied to trade is a function of SET UP and ORDER FLOW. The more they align the more size should be put on a trade. If you have a setup and not fitting order flow you can still take it, however, you should be very careful with putting too much size on it. Including the information that Depth Of Market gives you in your observations will help you to exploit opportunities in the future.

Just think about it, price action gives you the clearest and most raw information about market participants, not seeing orders acting the way you expect them to is telling you something about other people willingness to act there. Therefore, if the people are not willing to engage there potentially you can use that information to actually execute in the other direction. This type of observation can then develop a new trade idea.

Constant monitoring of EXPECTATION vs REALITY enables you to build your own pattern inventory. Asking yourself questions like: what did I think would happen? what “should” have happened there compare to what did happen? will really change your understanding of participants’ positioning and what they believe about the market.

- How to manage risk in choppy price action

- How to use market profile in morning prep

- How to trade volatility

Market Profile Context

Firstly, we will have a look at the Bund Initial balance break. Context wise on the Market Profile you can see a strong open drive down that breaks previous day value area, then trades back to the bottom of value but not higher, after that approaching the cash open we get the breakdown. This is a strategy taught in our market profile trading course but here we will also talk more about why a pick up in pace is what favorable price action should look like in these types of trades.

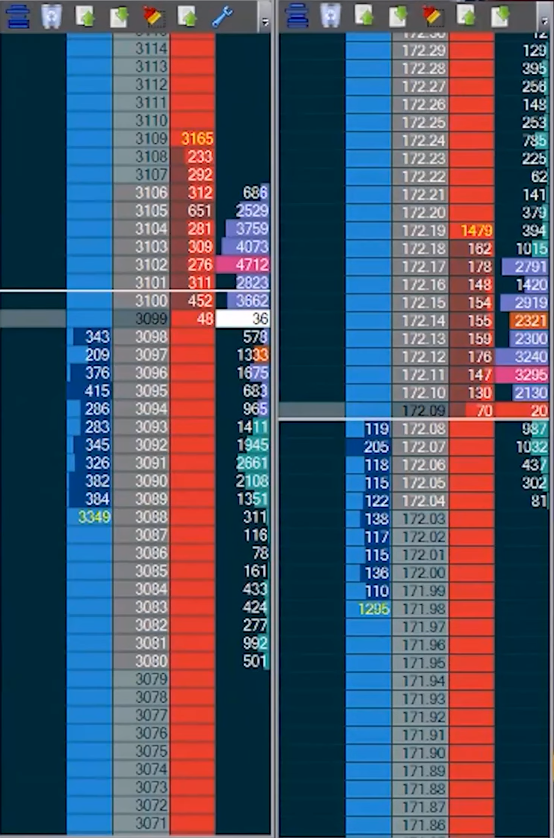

Secondly, looking at the Eurostoxx at the same point in time we can observe it opening above the previous day’s value area with a relatively strong initial balance to the upside. At the cash open, we are very close to the top of it. What’s really important is that these prices are the highest we have seen since early March. Additionally, Eurostoxx broke the high of 3096 something that participants looked for. The technical landscape, therefore, is very bullish, at this key point we should see strong buying as we are moving to the open space toward the upside. However, the buyers’ strength is not showing up, and this is very important information.

So looking at the ladder you can see Eurostoxx Initial Balance high is 3106 level and for Bund Initial Balance low is 172.04. For a start, the markets are pretty steady, not much aggression is yet there, but what we are looking for is the price action to speed up at the break of 172.04. It will mean that there’s an urgency to sell there and that the buyers step out of the way. Approaching the level we see the volume to pick up – 400+ lots traded into the bid, goes straight on the offer, and trades the next price immediately with very little buying coming into the offer, which then leads to snap down trough the IB low. This is what we wanted to see there’s an initiative here and as long as we stay below .04 this move has the potential to go.

At this time Eurostoxx should be going higher – there’s a technical set up and signal from the Bund breaking IB with pace. While approaching 3105 level which has more than 600 lots sitting on it, which is not a lot for this market, the buyers cannot take it down. As soon as we trade into it, offers keep reappearing and pushing the market lower. Each time Bund trades into the lower prices more offer orders appear on the Eurostoxx – that’s the big warning you get from the price ladder while maybe trying to execute the long position. Moreover, when Stoxx backs off quite quickly you don’t see any buying initiative in the Bund.

This is the point in which you still can feel good holding the short position in the German Bond as the initiative is still on the sellers’ side – low volume traded indicates that the buyers are stepping out of the way. On the other hand, executing on the negatively correlated market is not advisable as the order flow there does not match what you wanted to see and there’s a visible buyers weakness there.

How To Trade Correlated Markets?

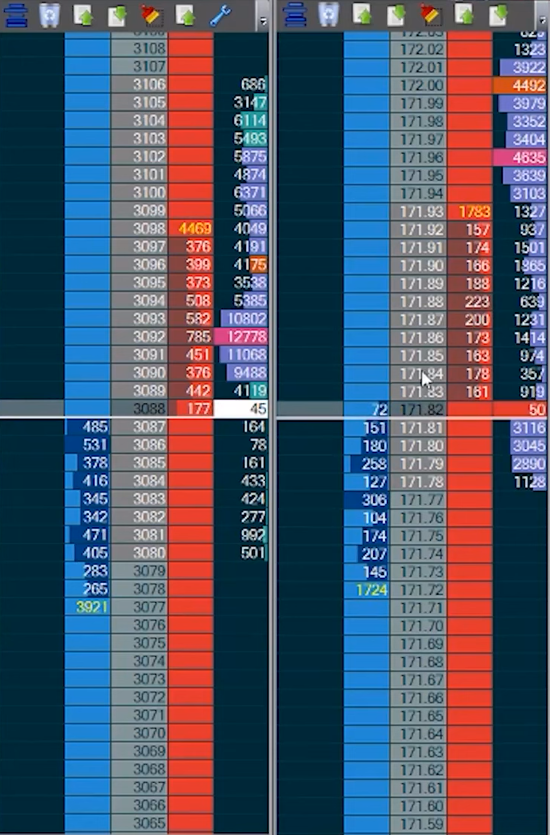

Looking back at what happened, you can observe that while Bund sold off after breaking the Initial Balance low, Eurostoxx not only didn’t break the high of Initial balance but also went down all the way to 3087. The equity index is clearly very weak. How do you exploit that weakness? Perhaps Bund going lower was one of the factors actually stopping the price to already rollover. So if the Bund starts to show any buying initiative you then get a potential for Stoxx to really pick up speed in what it already wants to do.

The point for this comes at around 171.80 area. This is the area in which the market is stabilizing for the next phase of the potential move. You have to be sensitive to any change in the order flow. The time we’ve spent there and volume traded already shows you that the buyers are present, as they prevent it from going down. What’s more, you have a clear low volume at 171.84, if we trade trough that price there is a big potential that sellers are going to give up.

Because there are new sellers entering the Bund you get positions that will be most responsive to the reversal. If you notice that buyers have it easy to trade trough prices above .83 and there’s no aggression on the sellers’ side this then can be an additional push for selling off in Eurostoxx. The order flow pace which we trade trough the 171.84 is very similar to the one on the way down when we first traded below 172.04 – fast snap, almost no pullback, and clear initiative change. Additionally, all the people that sell below .84 are now trapped. You can use that to this time not only to buy Bund but also to sell Stoxx, as it already showed the weakness before. Now, as long as you stay above 171.84 and below 3087 in Eurostoxx you can feel reasonably calm and let that markets play out.

Learn How To Trade Order Flow

To learn how to build your own market approach and inventory of day trading patterns, check out our order flow course and a range of other Trader Training courses on offer. Our flagship 8 Week Career Programme can be attended live on our London Trading Floor or virtually from home as an online trading course. These are the most comprehensive training programmes in the proprietary futures trading industry and are based upon years of successful in-house skills development.