In last week’s blog I discussed the difficulties traders face when having just a map and no way of getting to their destination; and the need to understand how a market moves from point A to point B. The sharp eyed among you will have noticed no mention of stops. This is because where to place a stop is a subject that alone makes day trading far from simple and one that we are about to cover.

Where to Place a Stop

The simplest answer to this question is: where you are wrong! This should be a guiding principal when considering not just a stop but also where you enter a trade – if where you are wrong is more risk than you are willing to take on a trade then taking the trade has to questioned. So, how do you decide where you are wrong? This all comes down to the trade you are trying to execute. In the image below we have an expected move through the large range (boxed on the right) and two different ways to enter the trade each with it own stop placement.

In the blue trade when a short position is entered mid-range the market has not yet confirmed that a move down is happening and so it could continue to move within range without showing that the position is wrong and would suggest a stop placed above the high of the range. Whereas, in the red trade, a short is entered after the break of the current day’s low, if this expected move is to play out, the market is unlikely to move back above aforementioned lows and so allows a tighter stop. Each trade has its own skill set you would need to learn to trade the set up – Blue requires a willing to sit through uncertainty and have a strong grasp of technical analysis; Red requires the ability identify momentum and execute based on order flow.

Should I Move My Stop to Scratch?

This is a very common question, along with when can I move my stop to scratch? that I receive during our Career Trading Course as well as from traders that I mentor. It is a rare occasion that a stop can be moved to scratch/break-even; the motivation to do so is based on trying to protect profit and not take a loss after having been on side, it fact often what it serves to do is limit profit when you are right whilst not doing anything to protect you when you are wrong. Meaning that over time many trades that could be a winner are cut at precisely the worst point. Take for example the trade below which was discussed in the Daily Debrief. The aim of the trade was that whilst above the open (blue line) then a move to yesterday’s value are high was on – entering on a pull back with stop below the open would be the initial trade plan but having gone on side many trade will want to ‘protect’ themselves by bring in the stop to scratch – this gets you out of the trade with out being proved wrong but arguably more damaging is fact that talking a scratch has guaranteed not taking any potential profit.

Stop at a Scratch

Day Trading is About Probabilities

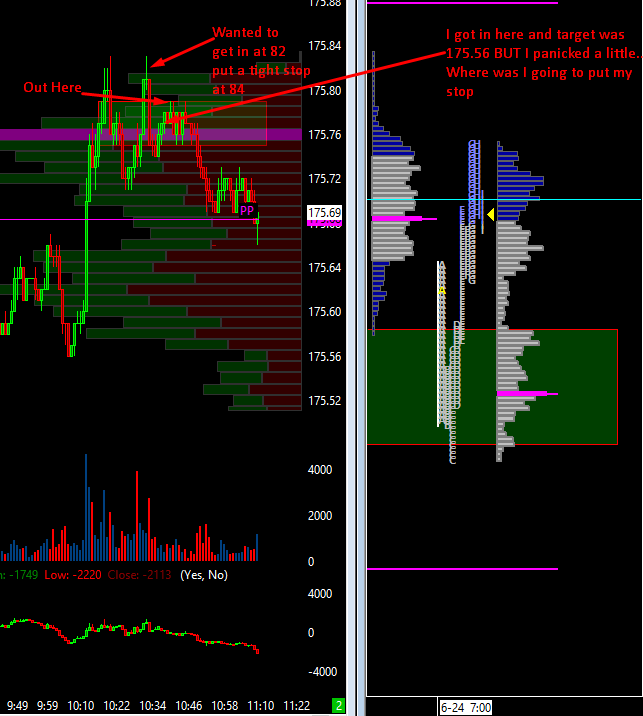

The desire to take a trade is sometimes overwhelming and so an entry is taken without full consideration for the stop, this then leads to protective stop placement rather than where a trade is wrong, below is a perfect example, kindly donated by a trader I mentor. Having missed the original entry following the move higher, illustrated above, this trader then jumped into a short and having realised they didn’t want to take a stop above the high they put in a ‘tight’ stop of 3 ticks to protect themselves. The problem here is that by not having a stop where the trade loses the probability of going (above the high) you have a higher chance of the stop getting hit, so whilst it may feel like only taking a small loss, the probability of taking that loss is high. Contrast with a larger loss but a low probability of taking mean that over time the larger loss may well to be the favorable choice.

We will visit probability in a future blog but for now consider where you are wrong when placing a stop and how this affect the trade you are about to take.

Richard

Learn To Trade Futures

For more information to learn to trade futures and develop your career as an elite trader then check out our range of Trader Training courses on offer. Our flagship 8 Week Career Programme can be attended live on our London Trading Floor or virtually from home as an online trading course. These are the most comprehensive training programmes in the world of proprietary futures trading and are based upon years of successful in-house skills development.