How To Improve Your Trading Edge Introduction

In this blog post, we will discuss how to improve your trading edge. Every trader seeks the edge. Trading edge is what gives you the ability to make money in the market. On the surface, we all understand the idea of edge, but we consider the edge to be something static. We consider the edge to be a particular setup but if it were so easy everybody would be making money. There is a distinction between market setup and edge and that difference lies in the deeper understanding of all contextual nuances. That’s why trading as a discipline is closer to art rather than flying a plane for example. Also, a great way to improve your edge in the market is to understand your strengths and weaknesses.

This post is based on the video down below.

Understanding Your Trading Edge

As we have laid out in the introduction, trading edge is not as straightforward concept as it seems. We should be aware that all chart/orderflow/market profile patterns just formalise market behaviour. They provide abstraction into composable clues. That abstraction is great on one hand, because it gives our brain ability to quickly recognise patterns. On the other hand every abstraction introduces compression a simplification of a very dynamic system. Just because you are able to highlight pattern that form a setup, it does not mean you have an edge. Here is the list that Richard has wrote on the topic of edge vs setup:

- Edge comes from your implementation of strategies in specific environments

- Edge differentiates you from others

- A setup can be learned and follows specific rules – it can have a statistical edge if taken every time it’s available

- Edge comes from a deep understanding of context and how your market is moving – this gives conviction in direction of a market and a greater probability of certain setup working

- A setup occurs and gives an opportunity to execute your trade in line with your conviction

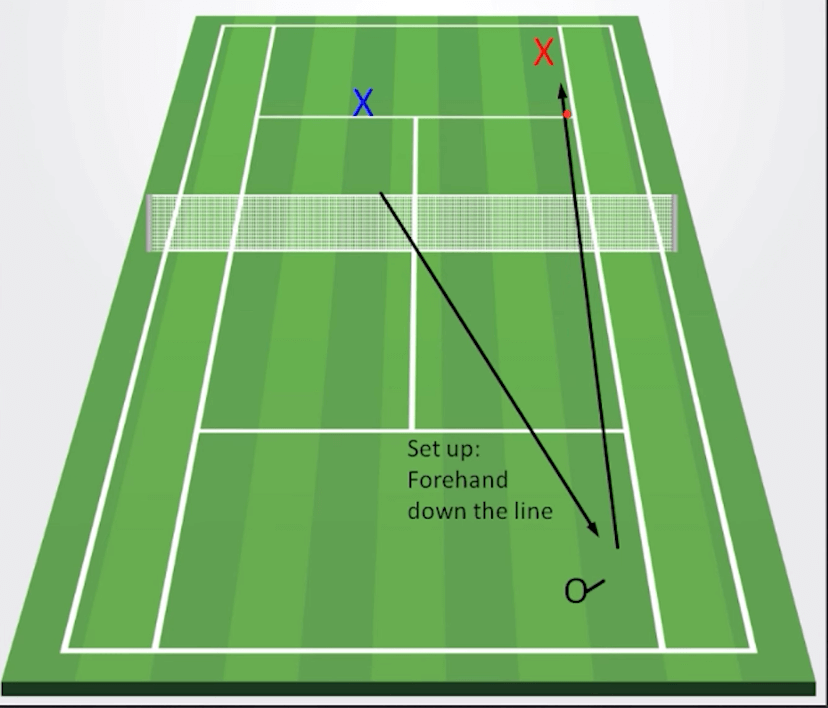

Great analogy Richard used was the one from tennis. Imagine you are great at hitting forehand down the line. Just because you are good at hitting that specific stroke, it does not mean you can hit it every time and expect a winning point (red X down below in the image). Position of your oponent matters a lot, therefore that forehand down the line should be used only when odds are in your favor (blue X). The same applies to trading.

Now, lets have a look at specific examples in Euro and Bund.

Improving Your Trading Edge

Euro And Trading Edge

Down below we can see on the right side the blue zone. That zone is a key reversal zone. We have a crucial location in which we want to observe orderflow and price action.

We can see that market breaks strongly through, but closes below. This can be considered a double top with strong exhaustion move. Our edge is in the execution the move down towards first support. If trader recognises the lack of buying and increased selling back below 73 level, you can enter the trade with the favorable risk-reward.

The point of this double top trade is to show you that the crucial location we have chosen, the excess it has created and orderflow all came together and created a trade with edge. The setup in Euro was the double-top, but other contextual nuances effectively created the edge of the trade.

Bund And Trading Edge

Now if we compare it to the Bund trade, where market reached important location, the context is different. Yes, market produced double top but the bullish structure from last two sessions clearly suggest that the point at which we want to initiate our short (see below line “confirmation point”) might become difficult for shorts to push through.

If you compare both Euro and Bund, they tend to share double top setup, but contextually both are very different. It is the nuances that essentialy create the edge, not just a pure abstracted pattern. Think about this concept in trades you usually take and ask yourself what can elevate the setup to a trade with edge.

Thanks for reading. If you liked this type of content, you might check these videos as well:

- Junior Funded Trader 2020 Performance Review

- Lessons From My Biggest Trading Loss

- Trader Training: How Long Does it Take a Trader to Become Consistent and Profitable | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK