In a previous article, we had briefly discussed the importance of understanding what data to draw the market and how to intuitively organize it for edge. This part served as a prelude to clarify the correct mentality needed to understand and learn how to use the footprint, but this in essence this exemplifies all of trading itself. I felt that this part warranted deeper investigation, both as a concept but also a useful opportunity to use the footprint as an example within this framework.

To reintroduce this concept, we can begin with an example where it is most apparent. From observing other new traders and remembering my own previous naive ‘rationalizations’ the issue centers around having no intuition, deep thinking or simple questioning of the trading tools that are being used. Expectations of obtaining edge are centered around just using the tool in and of itself. In other words, expectations are incorrectly set in that the scalpel is what makes a successful surgeon by merit of him picking up the tool, rather than understanding what it is used for and having the skill to use it.

As such, the wrong expectation creates the incorrect approach in learning how to use these tools. “By picking up this tool I have edge”. Using this logic the trader is doomed to frame his trading and learning through ‘Idea about Markets > Trading Tool > Observation > Edge’, where the trading tool organizes market data in a specific way for it then to be observed and traded as ‘assumed’ edge. The focal point of this mistake is that the trader first has an idea or theory about the markets first, and then looks for tools to filter this data within it. “Footprint charts help with order flow trading, where I think there is edge, so I will use footprint charts to show me the edge”.

Deductive Reasoning and (Un)Certainty

Let us go further. We have in effect stumbled upon deductive reasoning. This reasoning begins with an idea or theory first in which all following observations and conclusions are filtered through under this ‘idea umbrella’. To borrow from a common textbook example – “All men are mortal. Harry is a man. Therefore, Harry is a mortal”. Deductive reasoning is the cornerstone of much of the world – the sciences, research, academia, and games like Chess which feature complete and transparent information. For these domains, the fixed and ‘true’ information is of great use since the conclusions are absolute and therefore are used to predict an outcome of ‘virtual’ certainty – a binary conclusion.

Certainty is not a word that survives the trading domain. Shifting probabilities, incomplete information, and emergent behavior make this a qualitative business. Decision making and reasoning under probability and opaque information must be aligned with the type of domain you are operating in. To borrow from complexity theory and the Cynefin framework, as traders we deal with the ‘complex’ domain not the ‘complicated’ domain. The ‘complicated’ domain is computable, binary (right and wrong) and linear. The ‘Complex’ domain is non-linear, emergent and ‘temporarily resolvable’ with trial and error but never ‘solved’. As intra-day discretionary flow traders, we intuitively discover this along the way but not without incurring large costs of time and capital. Perhaps due to the rigidity in the schooling system, many jobs and academia are steeped in static and ‘complicated’ domains which creates a default deductive thinking mentality to approach all issues. Therefore, the inability to shift away from deductive thinking when working on a ‘complex’ domain is what creates a high failure rate.

Ants and Aerial Combat – The Complexity Domain

Conversely, inductive reasoning is appropriate for dealing with a ‘complex’ domain – that of trading. This reasoning begins with pure observation first and the subsequent patterns that are observed create a hypothesis and later theory into why something occurs. In other words, the trader would be observing markets and data by simple observation, with no pre-established ‘lens’ as he would with deductive reasoning. Due to this, inductive reasoning has a wider range of conclusions or outcomes and is open ended by nature. There is no binary outcome, rather a likely conclusion that has been ranked higher by probability than other outcomes. This bottom up, constant re-evaluation of one’s observation is what provides adaptability which is vital when operating in the ‘complex’ domain. ‘Complex’ domains almost always feature ‘emergent behavior’. Simply put, the behavior of one component in a system cannot reliably predict or model the activity of the system as a whole. In other words, modelling the behavior or understanding the properties of a single ant cannot predict or model the behavior of an entire ant colony. A singular ant is simple but once part of a colony a different behavior emerges. Moreover, changes to the ant colony’s environment would usually result in new emergent behavior which cannot be reliably modelled or anticipated in advance.

Dealing with emergent behavior or an environment that constantly ‘changes the rules of the game’ is not only an issue concerning traders and markets, but anyone involved in the complex domain like in war and conflict. To paraphrase Nassim Taleb, one should only listen to the advice and practices of those with skin in the game. Whose practices would be better to study than those whose risk their own life during wartime? A deliberate practice of this would be the ‘OODA Loop’ developed by Colonel John Boyd and implemented by the US Air Force during the Cold War. This was an approach to help a human deal with the ‘complex domain’ under stress during aerial combat in the new jet-fighter era that required split second decision making. It being an inductive approach – the fighter pilot would be in constant ‘observation’ mode and would constantly weigh new information probabilistically to understand the developing patterns that are emerging from enemy movement in order to best deal with it and win.

This meaningful shift in thinking from deductive to inductive is key in effectively learning and using the trading tools you have at hand. Essentially, the explanation above is a fleshed-out version of what was emphasized in our previous footprint article – ‘To build a useful footprint chart you must have: Observation > Idea > Footprint build > Edge’. This process is inductive reasoning adapted to our needs and differs from the deductive mentality of – ‘Idea about Markets > Trading Tool > Observation > Edge’. This difference might seem insignificant at first but if a trader were to engage in deliberate re-framing of his debriefing and learning process to think inductively it would not take long to appreciate the difference. Let us illustrate this in the context of a footprint trade.

Footprint Charts, Inductive Thinking & You

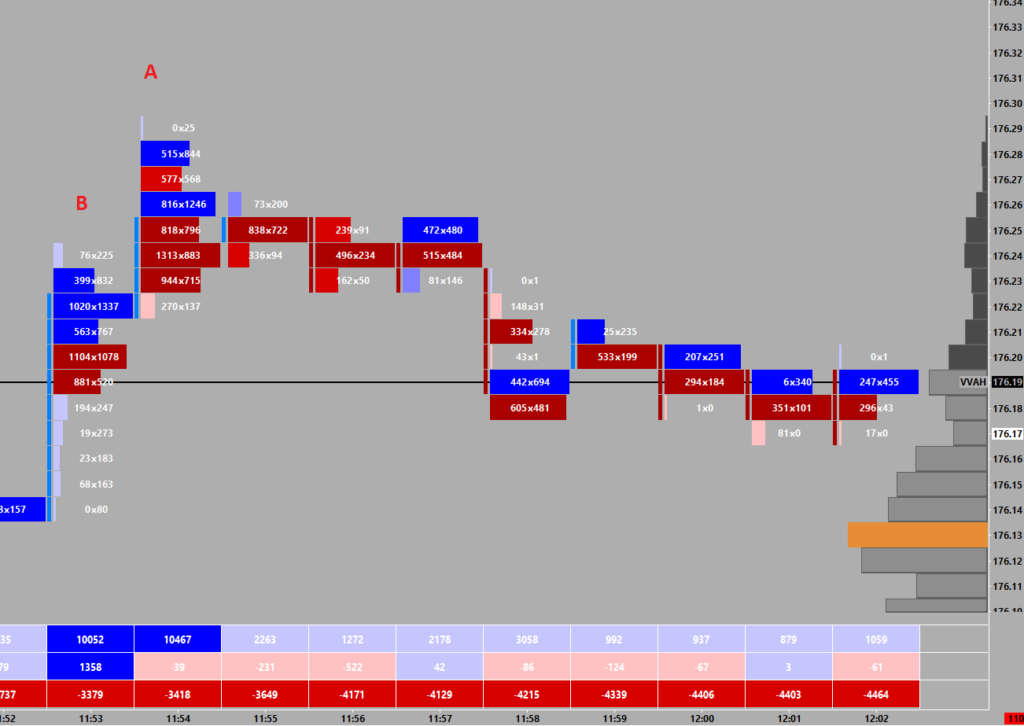

One frequent ‘setup’ that seems to trap a lot of traders into the inductive vs deductive issue as described earlier is the concept of ‘finished and unfished auctions’ via the footprint charts to either enter or manage trades. To summarize this concept, we can use the market auction framework. Market participants will keep transacting (volume) at escalating prices until they become too expensive (away from value). Volume will usually taper off until the high where buyers lift the offer into a price but never sweep the price and never stack the bid at that price. This leaves such a pattern on the footprint at point A:

Here the market bid all the way until only 25 lots lifted the offer at the high, but the buyers never swept the price to lift the next price, leaving (0x25) on the footprint. Likewise, an ‘unfinished auction’ can be seen at point B where both the bid and offer were hit at that price (76×225) once the buyers swept the price and then stacked the bid at that price.

The ‘standard’ trade setup that uses the footprint in this way usually concludes that ‘finished auctions’ are usually featured at the high or low of a move and that ‘unfinished auctions’ usually are re-traded through until another ‘finished auction’ pattern is displayed.

It is at this juncture where the outcomes of inductive vs deductive approaches become apparent. The deductive new trader approach will usually understand this by default as ‘Idea about Markets > Trading Tool > Observation > Edge’. He has learnt (heard) that finished auctions are seen at reversals, and therefore using the footprint he will watch his screens until a finished auction is spotted and trade it every time he sees it. From here his thinking is constrained linearly (A=B, but B = C, so A=C). The existence of this finished auction at an apparent reversal point on his screen confirms the initial idea that finished auctions are always the high of a reversal and therefore there is must be edge in trading this. In effect, this information is being taken at face value, where the trader will be rewarded randomly at best or come away at an overall loss at worst. Lastly, due to the outcome (failed trades) being lackluster the deductive mentality will conclude that the reverse must be true. “I had a negative outcome (no edge), so the observation (finished auctions at reversals) must be wrong, and the trading tool (footprint) doesn’t work, so this idea about markets is also incorrect”.

Let us now consider the inductive approach to the same situation. Recall that we have adapted this as ‘Observation > Idea > Footprint build > Edge’. To continue the same example, these finished and unfinished auctions are generally observable with a price ladder and nothing else. This natural price action is likely to be picked up by a new user after some screen time in some form or another. Naturally, the trader would then further develop these observations to see that the fight for price between long and short participants becomes more uncontested as prices trade higher, ultimately resulting in lower volumes with one last buyer trying to lift a higher price but progressing no further. Initiative sellers step in and take prices lower instantly. This price action is what can be summarized as a finished auction and creates the market high and subsequent reversal. This trader (through more observation) would realize that the probability for this chain of events to create a ‘reliable’ (high probability) reversal are skewed higher in certain market conditions and prices (levels) or areas.

In effect, the trader has piecemealed different market information and observations from the bottom up to then create an idea about what is currently happening. Critically, the trader has arrived at this conclusion (market reversal) through observing a chain of events with no pre-conceived idea or ‘lens’. Like John Boyd’s’ fighter pilots, this bottom up, constant re-evaluation of one’s observation is what provides adaptability which is vital when operating in the ‘complex’ domain.

Due to the trader understanding about what is likely (but not is certainly) going on he can use his trading tools to effectively summarize these observations (finished auction on the footprint). There is weight, depth, and intuition of the pattern he is seeing, he is not taking this pattern at face value like the deductively default trader. Further, the idea of the ‘footprint build’ is deliberate. The trader notices these finished auction events are happening frequently and therefore he can build a tool around this idea, and then decides that a footprint chart would be of best use to him to aid in observation consistency and speed – especially in volatile and fast conditions. Conclusively, the trader has built a tool for his purposes to help his observations and decision making which is the edge. This contrasts with our deductive default trader that would sit at his screens and just pick out ‘random’ finished auctions and walk away disillusioned at the futility of it all.

Ultimately, this footprint setup, or even the tool itself is only an example that can be interchanged with in any other since we are dealing with a general principle – and is the main takeaway of this article. For the correct usage of trading tools and general learning there must be weight and depth behind what you are observing. Place deliberate emphasis on inductive questioning and observation in your trading domain to ensure adaptability to the current market environment. Constantly prune through your trading plans and debrief approaches to make sure there is no ‘face-value’ and shallow deductive-like assumptions that likely create blind spots in your own process.

Good trading to you all,

Bogdan

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Facebook: https://www.facebook.com/AXIAFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy