‘The underappreciation of finely tuned process’ in the binary world of trading‘

The purest understanding of trading can be viewed as binary. Long or short, buying or selling, the option to be flat adds some variety to your array choices. Money is made or lost on any given trade, over a period of time or specific event. As a result of these deeply simplistic boundaries which traders operate within, our worldviews of success and failure become very apparent. Immediately, and more so over time the market taps into the dichotomy of the two states. What proceeds, is the extraction of unknown scarring fleshed out explicitly through market reflection.

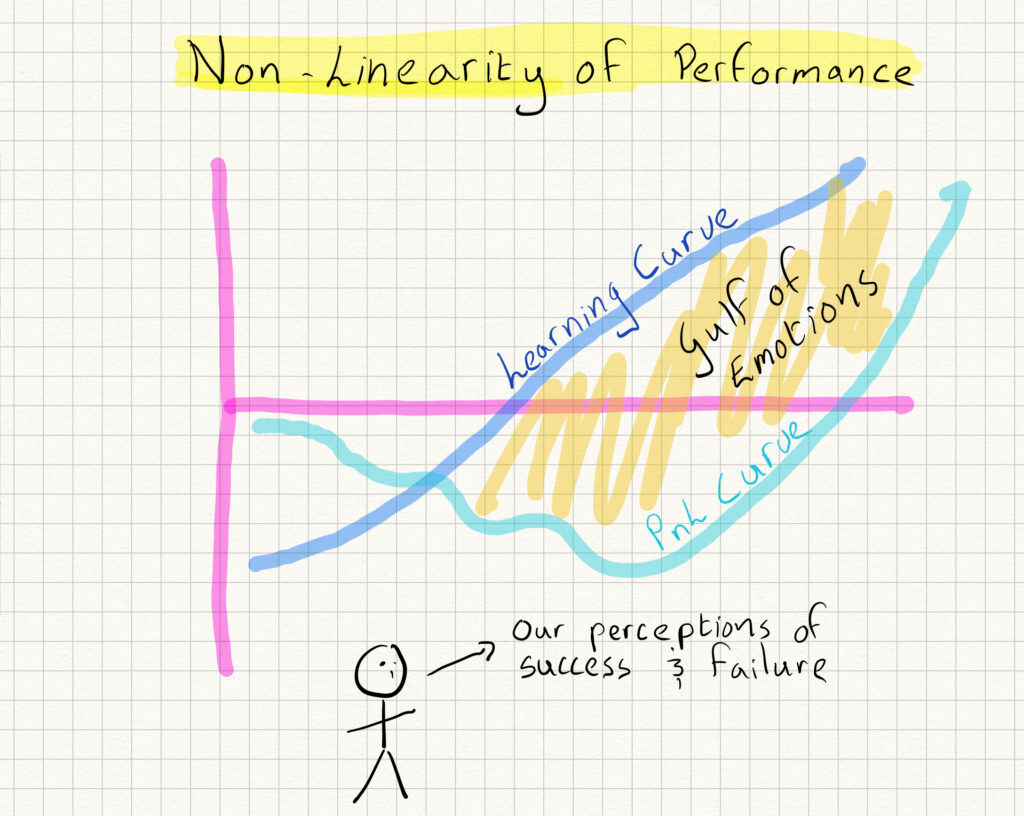

How an individual manages this should be bespoke, however, broad foundations can be laid in order to better understand our complexly intrinsic relationship with success and failure. It is dismissively simplistic to group people, actions and basically anything you can imagine into the two binary categories of success and failure. Moreover, the boundaries between the two are constantly blurred and often much closer than you realise. Throughout a period of profitable trading you view yourself as a success, believing you are creating a bigger divide between the stereotypes of success and failure. Only for this reality to be shattered entirely, how could it be possible to fail so badly – what has gone wrong? Without refined, as well as fluid frameworks which constantly evolve with success and failure, it is very easy to fall into counterproductive habits which flatten your learning curve and inevitably your equity curve. These market participants are doomed to drift between success and failure, as a result of unclear definitions regarding the two states and what they mean relative to their learning curves.

The first topic I wish to address touches upon the idea that a given success today can easily be deemed a failure tomorrow, how does this shape a market participant’s learning curve? What pushes a trader onto ‘greater success’ is how they compare themselves to their prior success, this is obvious. However, the vital and often overlooked part of this reflection is in the context of how this comparison is framed. If you frame your success entirely within the parameters of binary outcomes, profit or loss, right or wrong, you are suffocating the creative life from your learning curve. In this case, your learning curve no longer reflects personal growth, the deep perspective gained from changes in market personality and an overall appreciation for the challenge at hand – mastery of self. Instead, what it resembles is something much closer to your equity curve, a despondent and non personable entity, a scoreboard for those who aren’t willing to probe deeper into their decision making process. Getting to a place where a trader can make sense of success outside of their profit and loss, undoubtedly takes time, but also requires them to go through the infancy stage of their career in which their success is entirely dependent on increasing their equity curve. The juxtaposition between breathing life into your fragile trading career through increasing equity, versus the intricacies of learning about oneself in order to leverage your own strengths and weaknesses within the backdrop of the markets, is exceptionally challenging and in reality is an open ended lesson. As mentioned, this is a by-product of poor understanding regarding the two states of success and failure, but also the result of over reliance upon them in the first place. A trading scenario presents itself and you trade it according to your plan / strategy/ instincts, resulting in a profitable trade – potentially a sizable profit relative to your recent equity curve. How you go onto frame this event is frighteningly critical with regards to the path of one’s learning curve going forward. Not necessarily immediately, but undoubtedly at some point in the future. When we are presented with a similar situation, and feel as if we’ve underperformed, many are met with the feeling of failure. Anchoring themselves to said previous experience, losing all objectivity toward the information that led them to that decision. Was this trade of the same quality to the one you’re currently anchored to? How high was the original level of questioning? Did I in fact over perform relative to the opportunity that just presented itself? The cost of framing a recent experience entirely on the equity outcome of a given trade, instantly caps the outlook for growth, it numbs the sensory feelings of how you are interacting with the market – limiting the questions you are willing to ask of yourself as well as oversimplifying an undefinable experience.

So, what is the solution to this innate human flaw most of us deal with on a regular basis? I believe it derives from the underappreciation of finely tuned machines, in relation to ‘definable success’. What I mean by this, is that we heavily overvalue clear binary outcomes, over the natural development of ruthlessly diligent routine. Take the example of your pre-trading routine, the period of time between waking up and sitting down at your desk, whenever that may be. What is done during this time is hugely overlooked and underappreciated, relative to your end of day / end of week / end of month profit and loss. If you can build an environment in which success and failure is based entirely on the effectiveness of your incorporated machines, you reframe some of the binary elements of trading that pull on your psyche. By doing this, what you are creating is a self evaluating regime; detached from the craving to be categorised within the confines of success or failure. What you are doing instead is building confidence via clear controllables, which over time you can hold yourself accountable to – making these machines even more efficient with time.

I highlight pre-trading routine deliberately, with hindsight I significantly overlooked the role that it played within my overall cognitive machine. Prior to covid, this window of time was managed with extreme precision, minor but explicit details and nuances which could not be recreated in a working from home environment were so key on reflection. Knowing exactly what time I had to leave the front door in order to get a specific train, followed by dedicated time to breathing exercises once on said train, only once this part of the machine had finished would I transition to check overnight markets – deliberately avoiding any newswires until I had sat at my desk for half an hour. Yes, of course this could be re-created in some facet whilst working from home, however, I am trying to draw upon the significance of these tiny little processes. Their effectiveness accumulated over time. My body and mind became primed to these minor events, putting me in the best position possible to be ‘successful’ on any given day.

“Expectations also shape stereotypes. A stereotype, after all, is a way of categorizing information, in the hope of predicting experiences. The brain cannot start from scratch at every new situation. It must build on what it has seen before. For that reason, stereotypes are not intrinsically malevolent. They provide shortcuts in our neverending attempt to make sense of complicated surroundings.” Dan Ariely – ‘Predictably Irrational’

Success and failure are undoubtedly shaped by expectations, they are the underlying driver that define our ever changing view of the two states. Expectations are the misleading, unavoidable third wheel that further complicate our perception of success and failure. They are often a great hindrance to learning curves, unless monitored closely. This is not to say that there is no place for expectations or even bold aspirations; without these I believe it is impossible to maintain any level of trading consistency. Without expectations of oneself, you’re left to the mercy of randomness. What is of paramount significance is the direct relationship between expectations and your learning curve, if the market participant can shift their view of expectations to focus entirely on controllable variables, the development of a sustainable learning curve becomes more probable.

As a result of this thinking, the participants’ equity curve should follow a similarly sustainable path. I firmly believe that if you can get to this place of effective self criticism regarding your controllable variables, instead of jumping to the immediate extremes of profit and loss, the likelihood of positive returns increase drastically. As the opening quote states, stereotypes provide us with shortcuts in order to make sense of complicated situations. If you succumb to attaching success and failure to the two polar opposites of profit and loss, discreetly you will damage your learning curve. Trading is a never ending complex pursuit which seeps into your life, in many ways consuming your life. There is a danger of oversimplifying the open ended challenge of improving relative performance, by how you view success and failure, how you evaluate yourself relative to binary outcomes and in how your self-worth is packaged within recent ‘success’ or ‘failure’.

I warn of danger recalling recent experiences, it is worryingly easy to fall off the regimented route of finely tuned processes, in favour of chasing the dull comfort of binary success. I find myself craving the simplicity of stereotypes, when in reality at this moment you must ask the most introspective of questions. It is vital that you get to a place of believing in constant questioning and live by it undeniably. One of the hardest things a market participant can do, is reflect on a profitable period of trading and recognise it as unsuccessful – relative to their controllable expectations. During these periods of equity growth and depleted self reflection, you are creating a divide between your learning curve and your equity curve. This divergence can persist long before you see a correction in your equity curve, it’s at the first juncture of binary failure that you are given an opportunity to reassess and return to the original sustainable path. The gut wrenching feeling of hard binary outcomes has its place, it is essential, but if you are dependent on them solely to fuel growth, you are only scratching the surface of broad and sustainable trading success.

As touched upon, there is an important place for binary success and failure. What I wish to deter people from, is accepting progress through an entirely binary worldview, once this mindset takes control it indicates your ideology for learning has become stale. It is essential to be checked by yourself, third parties whomever it may be, to stay in motion with the ever changing states of success and failure. Deliberately using these perspectives to reaffirm a positive learning curve, in exchange for delayed positive outcomes in the future. The majority of factors influencing learning curves are lagging your current equity curve. When your thinking is restricted to binary scenarios, you are past the point of holding yourself accountable to a growth mindset. Instead, you’re held hostage to the simplicity of definable success or failure, disregarding self accountability to your own controllable variables. Proclamations of success and failure entrap you, they instantly cap the ceiling of your learning curve. Undoubtedly you need to take stock to recognise growth of account, increased position size, but many miss the underlying yet discrete successes which lead you to these binary outcomes. Once you become attached to the latter as opposed to the former, your worldview regarding progress can become extremely tainted as well as damaging. I believe this is the biggest hurdle that any aspiring, let alone experienced trader faces everyday of their career. The never ending balancing act between a learning based worldview, and the unavoidable reality of hard binary outcomes is extremely challenging. I say the biggest hurdle, as it is one that is constantly in motion and impacted by infinite inputs. You are constantly forced to re-examine and evaluate the intricacies of yourself, in an attempt to stay true to a positive path regarding your learning. You need to embrace this dilemma with curious fascination, it is the untapped well that can drive you from relative mediocrity to unimaginable realities. The backstop that reverts you to a place of synchronicity after a period of mental block.

In totality, it is hard to measure how much of an impact our understanding of success and failure impact our learning curves. I believe that most severely underestimate their influence, often requiring very blunt reality checks, in the form of large drawdowns to even consider their worldview needs readdressing. There is nothing wrong with developing finely tuned processes in the aftermath of violent market experiences, arguably this is the best way to incorporate such machines into your trading system. It is more the consistency of this approach that is so key for survival in this game, if only traumatic market experiences force you to question your current learning curve you are treading a futile path. Riding the highs and lows of this pursuit is simply human, in the moments of neutrality you must take most responsibility to address your current path of learning – ignoring the binary nature of your equity curve. With success and failure come expectations and excuses, unavoidable obstacles which nullify learning. They dull the surprise of new events, particularly ones which we don’t understand, creating potentially huge blind spots within our systems if left unchecked. One can take reassurance in knowing that the dilution of your learning is inevitable, it is how you respond to this realisation that will shape your career – for however long it may last.

Joe

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Facebook: https://www.facebook.com/AXIAFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy