One of the key qualities of some of the most successful traders is their ability to interpret and analyse new information at lightning speed, so that they can take a position in the shortest possible time.

In order to do so, a trader needs to always be up-to-date with current market themes, from global macro news to central bank policies so that as soon as fundamental news hits the wires, he can quickly gauge how several markets might be impacted. This will enable him to execute in the fastest and most efficient way.

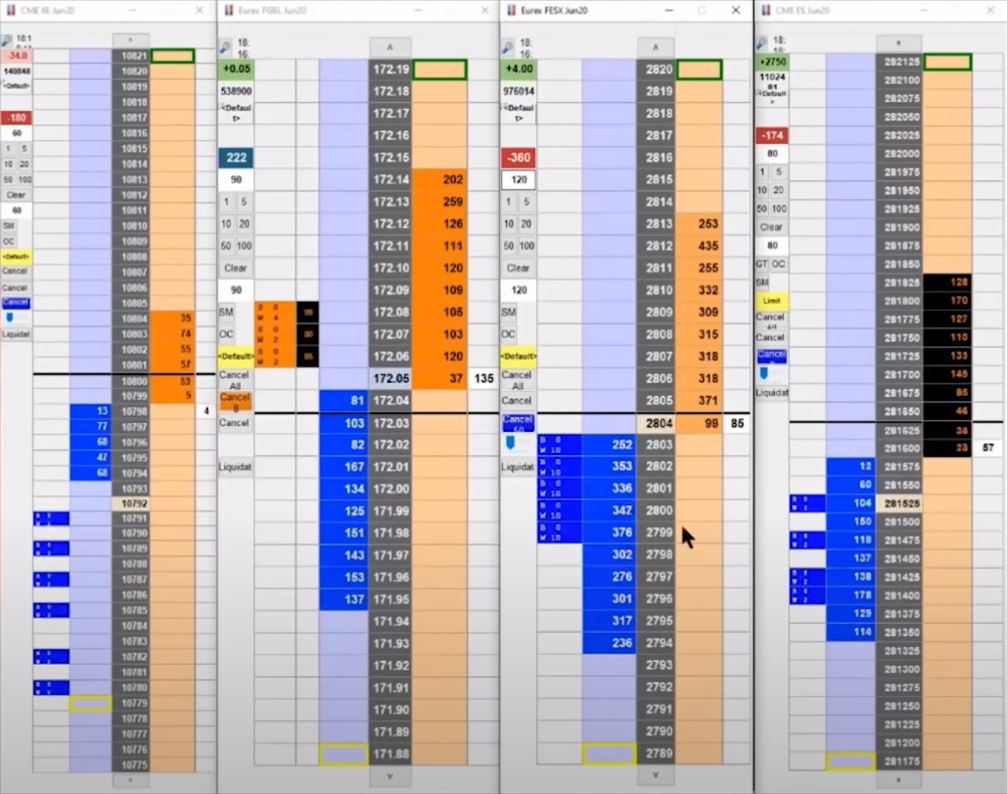

In this video, Adam is going through the execution of our AXIA Elite Trader on Thursday 23rd of April 2020.

Watch The Live Trading Recording:

This was a day that didn’t start very well for our trader as he was caught short on a Gilt (UK 10-year Bond) position early in the morning and took a decent loss. However, he managed to stay focused and turn around the day to build a very solid upday. He did this mainly by executing big positions on several news comments throughout the day.

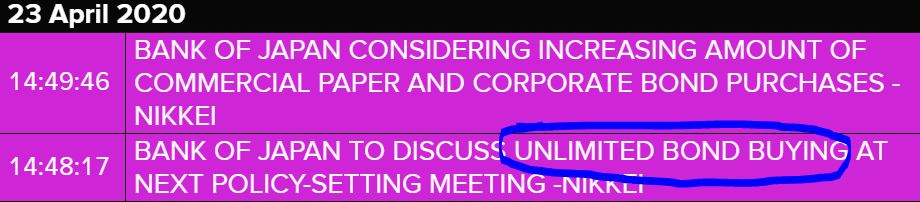

BOJ Sources

The first one came from Bank of Japan sources, where they hinted that the BOJ was ready to conduct unlimited bond buying in order to boost the economy after the Coronavirus fallout. This put pressure on the yen and our trader managed to get on the move and capitalise on it.

Merkel Comments on EU Summit

After this, German chancellor Merkel came on the wires urging the EU leaders to take a huge response to tackle the pandemic. The fact that Germany showed willingness to a big monetary response was taken as a positive by the markets and the trader managed to catch the risk-on move by selling the Bund and buying the EuroStoxx.

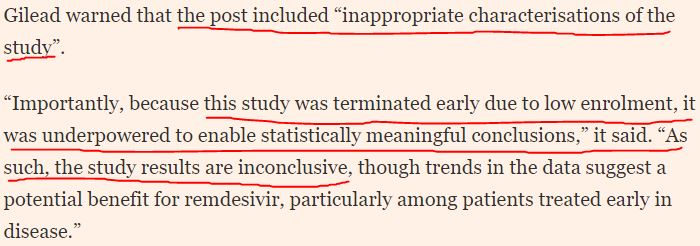

FT Article – Remdesivir Trial flop

Following this, there was a news article from the Financial Times with a headline that Gilead’s Antiviral drug Remdesivir had flopped on Clinical trials. The market had big hopes that this therapeutic drug was going to slow the spread of the virus, so when the negative news hit the wires, the stock markets sold off aggressively.

FT Article – Gilead’s response to the study

However, in the contents of the article, Gilead had commented that the results of the trials were inconclusive and thus not accurate. Our elite trader managed to first sell the S&P and capitalise on the knee-jerk reaction that was caused by the headline of the article, but he also managed to cut and reverse his position after he realised that the article had contradictory headlines.

EU Leaders fail to agree on stimulus

Finally, about half an hour later, news from the EU summit started hitting the wires, indicating that EU leaders failed to reach an agreement on a stimulus package to tackle the coronavirus. The trader took a big risk-off position by selling the EURUSD, the EuroStoxx and the S&P and buying the Bunds. Although the market was a bit slow to react, eventually the risk-off move happened and our trader managed to finish his day with a very solid P&L.

Learn how to trade global macro and central bank news

Summing up this blog post, we realise that the different pieces of news throughout the trading session caused significant market reactions, in which an experienced skillful trader was able to capitalise on.

Our elite trader is renowned for trading global macro events and his execution skills on such situations are second to none. To review more in-depth examples of this execution style, have a look at our Price Ladder and Order Flow Strategies training.

Moreover, to understand execution over geopolitical and central bank events, the central banks training covers in-depth central bank trading strategies.

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Twitter: https://twitter.com/AxiaFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Instagram: https://www.instagram.com/axiafutures/

Facebook: https://www.facebook.com/AXIAFutures/

Medium: https://medium.com/@axiafutures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy