Initial Balance Lead By Other Correlated Market Introduction

In this blog post, we will look at the initial balance break led by other correlated market. But not only that. We will have a look at how a change in pace and aggressiveness of market participants can have a telling impact on the successful break of the initial balance. When structure gives us additional conviction, the initial balance trade can provide good trading opportunities. Like in the other Eurostoxx trade which was executed by one of our Elite Trader.

For full context of this post, please watch the video down below:

Clues Leading To Successful Break Of Initial Balance

Market Context For The Initial Balance Break

As the title of this post suggests, one of the key nuances apart from structure and price ladder action you could lean on during this initial balance break was a correlated movement between EuroStoxx and DAX. DAX was in this instance leading EuroStoxx and that could have increased your conviction in holding onto your breakout trade in EuroStoxx.

Now let’s have a look at how the break developed and what clues you could collect early on to get onto this trade. On the left side, you have an image of the EuroStoxx chart and Dax chart on the right. The initial balance is highlighted with yellow box (1) and increased average volume down below also in the yellow box (2).

Here is the list of clues you could collect prior to the break of EuroStoxx (Left), to have a higher conviction on the break of the IB:

- Energy – in the first place, it was the energy of the move that really showed its hands. That pick up in pace after the cash open was a good telling sign but something that cannot be relied on only on its own.

- One directional move to the IB low – by observing the price ladder, you could have noticed that the move went down one by one from 56 to 40 without the ability to properly lift the offer and produce a decent bounce.

- Larger relative volume in comparison to other days cash opens

- Correlated market DAX leading – This was one of the important points when DAX was leading EuroStoxx, which could give you additional confidence to hold onto a trade.

- Break and hold below of IBL – after the IB low was broken, we could see a little two-way trade with almost no ability of the market to lift the offer at least to the mid of the range of the IB. Sellers were just too strong, to keep the buyers down at the IBL before the market started to move down again

- Previous market structure

- Large orders chasing the market all the way down through the IB from the mid-range to the IB low

Apart from the leading DAX, it was these large orders chasing the market down that particularly caught my interest and although they were not the only thing moving the market down, they provided a little extra information to feel even more confident in a trade. By the way, if you are interested in other correlation plays traded by Axia, check out our video How To Use a Correlated Market with the Price Ladder for Timing and Execution.

Now let’s have a look at what I mean by large orders chasing the market down.

Large Orders Chasing The Market Down In The Initial Balance

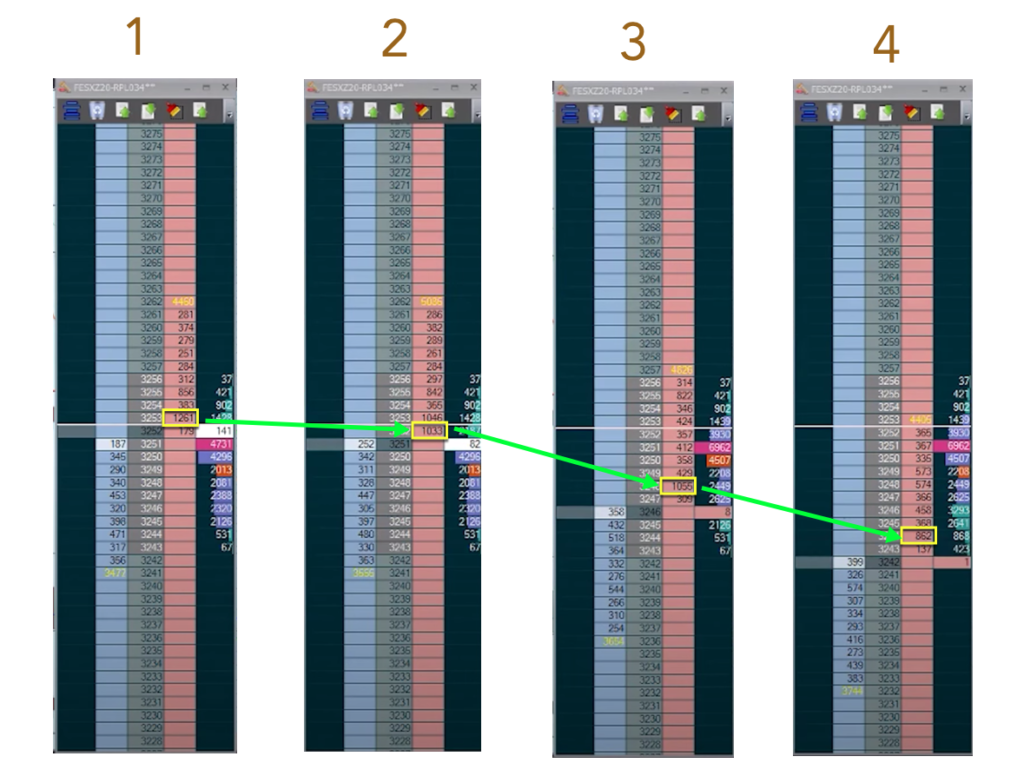

The key to understanding the image below is to watch the replay of the video from the moment the large order appeared at 3255. From that moment on, you could understand, that someone wanted to execute large size, passively in the market. That meant, that this large participant was willing to sit passively on the offer, waiting to be filled by the buyers. The image below describes the progression of this passive seller moving his orders lower as the market was moving lower and constantly being filled passively, reloading throughout the whole IB move down towards the IBL.

Key Takeaway From Trading This Particular Initial Balance Breakout

The reason why I wanted to highlight more clues, not just one is that we always try to use the confluence of multiple factors that are working in our favor. In this case, it was the leading correlated market, prior structure, change of pace, large order passively chasing the market down, and other clues, that could give you extra conviction to enter this type of trade and execute a breakout to the downside. Especially in a market, that does not always provide a clean initial balance breakout.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- Breakout Absorption With Large Order

- Eurostoxx Initial Balance High

- How To Use a Correlated Market with the Price Ladder for Timing and Execution

Thanks for reading and until next time, trade well.

JK