Breakout Absorption With Large Order Introduction

In this blog post, we will cover breakout absorption with large order being present on the price ladder that happened in Oil recently. Many times, our breakout trades do not materialize in the direction we have expected and if we observe the price ladder carefully, we can scratch the trade and prevent unnecessary losses. This article will provide clues about what to look for when the anticipated direction does not offer the follow-through. It will be even more interesting for a reader to compare the previous article when breakout in Gold produced the anticipated follow-through. Can you spot the difference?

The video down below provides insight into what happened on the price ladder when the break occurred.

Breakout Absorption Context

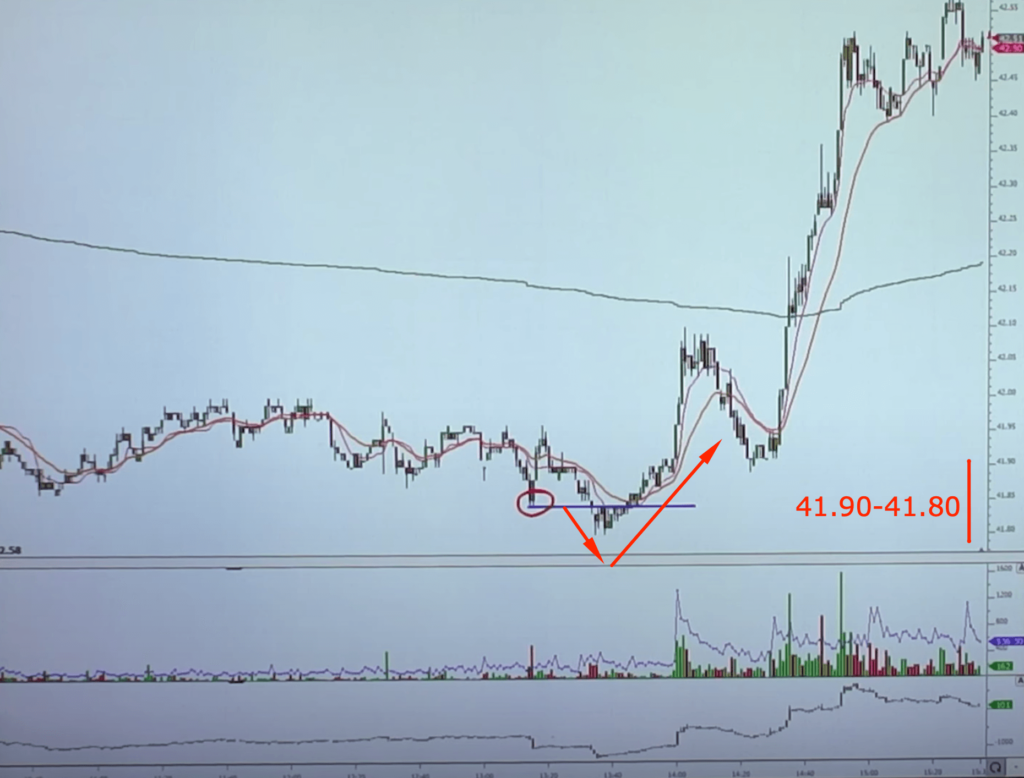

We will be looking at the area of previous resistance and absorption zone at 41.80’s. As you can see the 80’s zone proved to be an important tipping point for buyers to defend and sellers to fail on 4 previous occasions. We are also trading on the last day when this (Sep.) contract is still liquid with rollover being just one day away.

Now that we zoom into our execution zone, you can see a couple of distinguishing clues, that will give us an insight into this breakout failure. Let’s zoom in on the 80’s zone, particularly at the 85 level where large order has been absorbed with the first attempt and then was able to hold on the second attempt.

Breakout Absorption Execution Zone

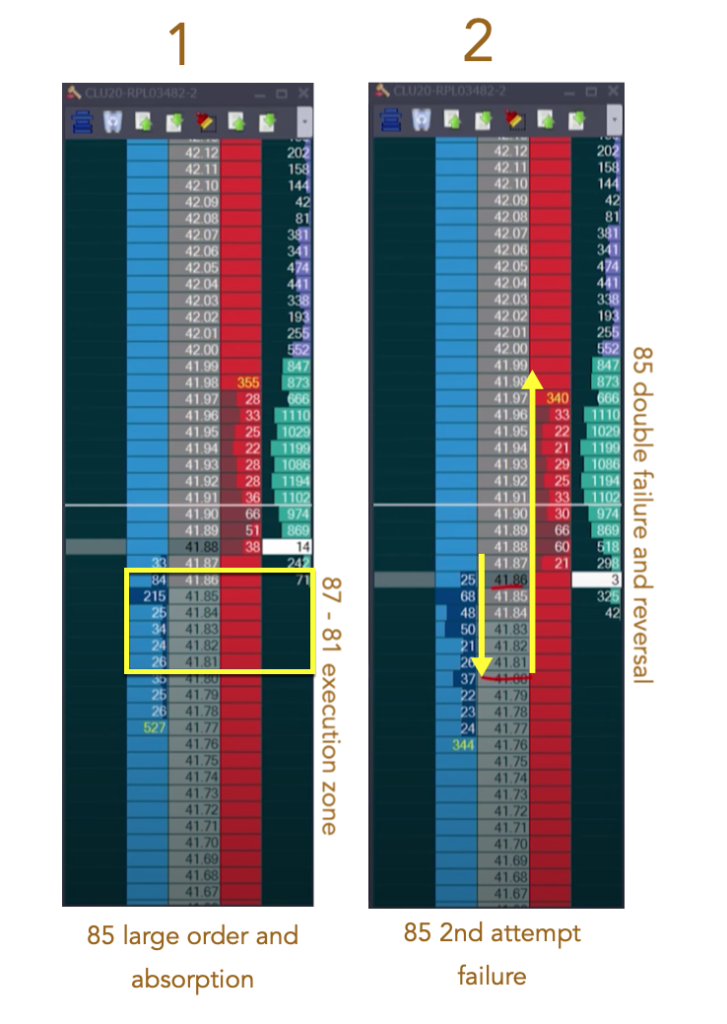

It’s price ladder time. We are starting to move from 87 into 85 where 215 lots are sitting on the bid. By patiently observing price ladder action, we can identify these trading nuances:

- Large Order No Fudge – after sellers hit the large 215lots bid, the new volume is coming straight back onto the bid. This is not a sign of strength by sellers but rather buyers are happy to step in again.

- No velocity/pace follow through – after we have started trading in the 80’s zone with a little bit of increase in pace, the pace is not sustained. Speed is really not increasing leading to muted reactions by the sellers. What trades through is simply not strong enough and even with a little bit more pressure, there is no continuation.

What we can clearly see from observing the price ladder, sellers didn’t have the willingness to keep on selling even after a little pickup in pace after we started to trade below 90 level. This all can be considered as stage 1 of the clue (see image below with price ladders). Then stage two is the second attempt and failure to follow through below 80 level. This is our third clue:

- Second attempt and failure to follow through below 80 level – after we have tried to break below 80 once, we have failed. We have tried one more time and we have failed again, which led to trading above 90’s and potential flip in the direction of the trade.

Summary

These three clues could give you a hint to cover the trade if you were already short or even flip the trade and get long above 90 level. Have a look at the price ladder part of the video one more time to identify the concepts we have just described.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- What Markets Do You Select When Trading – Price Ladder Trading

- Key Observations To Stay In A Trade – Price Ladder Trading

- 3 Reasons To Get Into A Trade – Price Ladder Trading

Thanks for reading and until next time, trade well.

JK