Price Ladder Clues For Breakout Failure Introduction

How can one utilize price ladder clues in identifying breakout failure? Many times we are faced with a question if after the breakout the continuation move in the direction of the breakout is gonna come or not. In this post, we will discuss one of the price ladder clues that can give us exactly that piece of information. In case you are interested in other breakout strategies, check out our Breakout Trade Management Techniques article.

In order to get full context for this blog post, see the short video down below.

Breakout Failure Context

Gold prior to a breakout is sitting in a tight consolidation zone. Above 1904,5, there is the potential to go to the upside. Given the structure behind, buyers are currently dominant and although this move can look a bit more stretched, that is nothing unusual for Gold. Prior to a breakout, we have a large order on the ladder sitting at the edge of the breakout zone. Once the breakout happened, it is important to understand how it happened and what is left behind. Lets now have a look at the price ladder action to explain the thought process behind this breakout failure.

Breakout Failure Price Ladder Clues

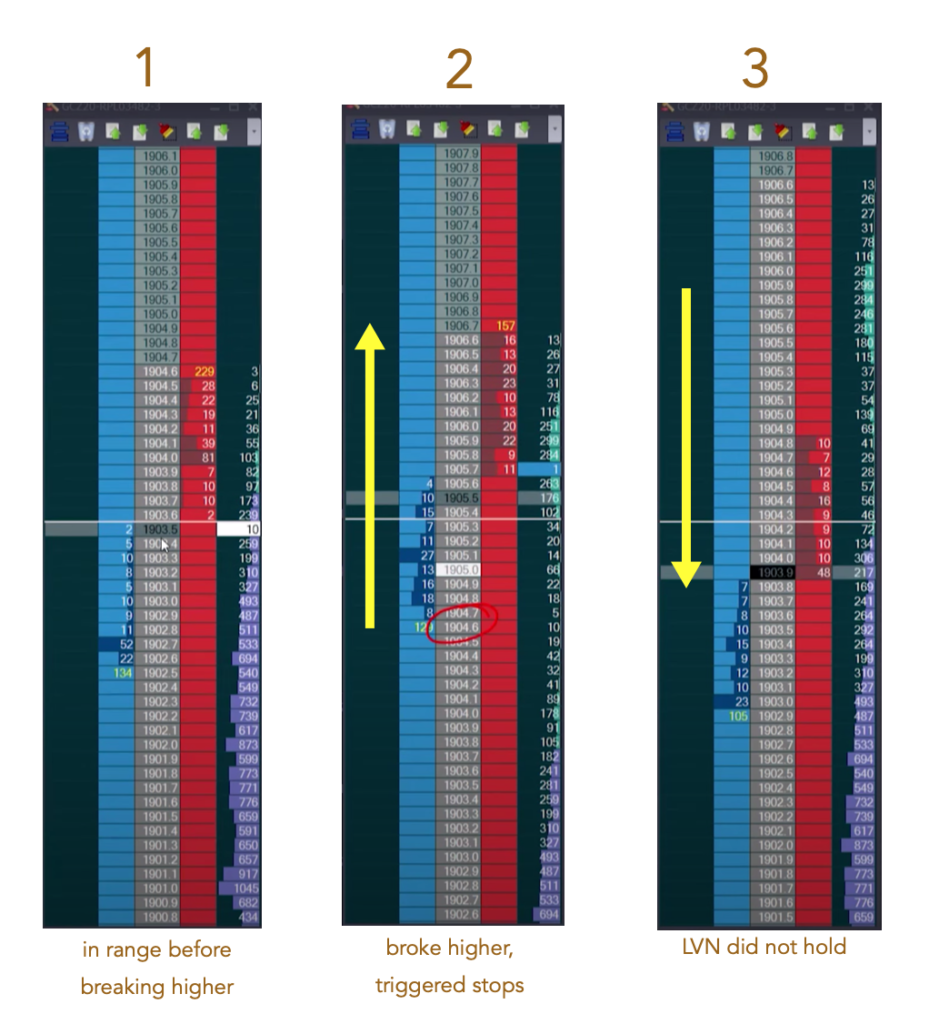

Down below we have three price ladders. The first one is the price ladder prior to the breakout. Second is after the breakout occurred and the third one is the confirmation of breakout failure. Now let’s examine what was price ladder telling us at each point in time.

- Price ladder 1 – as mentioned earlier, 1904,5 is our level for the breakout. It is the high of the tight consolidation range. At 1904 we have 81 sitting on the offer. Once we got through 1904,5, the expectation is that buying should be coming in for a continuation move higher.

- Price ladder 2 – once we broke 1904,5, the stops were triggered. It is very typical for Gold to break and trigger many stops, leaving shorts running for exit creating this low volume zone behind, and a spike in price. It is the buying pressure we need to see after, not just at the point of breakout. This is the first and most important clue we will carry on watching throughout this trade.

- Price ladder 3 – the moment we start trading below 1905,3, and keep holding below with no defense from buyers, this is our main clue, that is now in play. The deeper we go back through the 1904,6 – 1905,3, the more confirmation we are getting that this was indeed a breakout failure.

I would like to encourage you to re-watch the price ladder part and try to identify each stage described above. Ask yourself, at every price, what is the relationship between buyers and sellers, who is dominant and aggressive, who is patient and passive? Where are buyers losing their battle?

Understanding this breakout failure could set you up for a much bigger move to the downside with clearly defined risk above this prior breakout level of 1904,5.

In case you are interested in another great example of the breakout failure, check one of our other blog posts: “When A False Breakout Creates A Selling Opportunity“.

Summary

The main takeaway from the breakout failure described in this post is the low volume zone failure. Whenever you are faced with one side creating this LVN zone, you should ask yourself at what point is the one side losing the battle over the other side. The answer can provide you with the information not only to cover your trade if you are already in but also possibly reverse and trade the other side with clearly defined risk. In our case, it was the buyers who could not defend the breakout that eventually resulted in the Gold selling off.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Thanks for reading and until next time, trade well.

JK