The Federal Reserve has already shaken markets in recent weeks with Chairman Powell’s speech at Jackson Hole, where a new average inflation target was introduced, as well as a shift to focus on employment over inflation in future in the Fed’s updated Monetary Policy Strategy. As such this meeting, which includes updated Staff Economic Projections (SEPs), will be well watched by all at Axia Futures – looking for possible new forward guidance, what average inflation rate of 2% actually means, whether any of their stimulus programs could be changed and what the impact of the weakening Dollar is having on policy deliberations, if any.

How to Plan Your Federal Reserve Trading Strategy

Going in a Federal Reserve decision without a clear plan and matching trading strategy is like driving a car blind folded – you can operate the controls but have no idea where you are going or what is coming towards you. Firstly work out what the Fed can do/change that would be market moving and then prioritize the importance and impact of each scenario. What can the Fed do? And what is important?

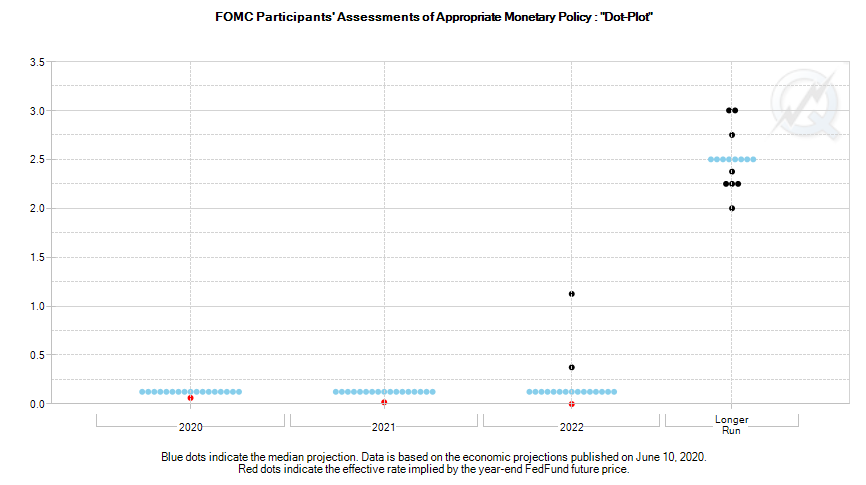

- Updated SEPs going out to 2023 – the Fed’s Dot Plot which forms part of the SEPs gives a view of every member’s expectation of where interest rates will be at the end of the next 3 years. Below the blue Dots indicate a median expectations of rates remaining at the their present 0-0.25% until end 2022. If the 2023 Dots also indicate no rate change this pushes the next hike into 2024 – a dovish sign. Whereas, if the Blue Dots for 2023 are higher than the current 0-0.25% range then this sends a hawkish message. The 2 Dots in 2022 showing to 2 votes for a rate hike then will also be important – will they join the others or will more members vote for hike?

2. Update Forward Guidance – by linking the end to the current stimulus ($120bn/month of Treasuries and MBS) or Interest Rates to a date or data point the Fed can give clarity to the market that stimulus is staying and will likely to be seen as a dovish change for them. This could be done by changing the current guidance “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” to include reference to date of data like they did in December 2012 using the statement

“at least as long as the unemployment rate remains above 6½ percent,

inflation over the period between one and two years ahead is projected to be no more than half a percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.”

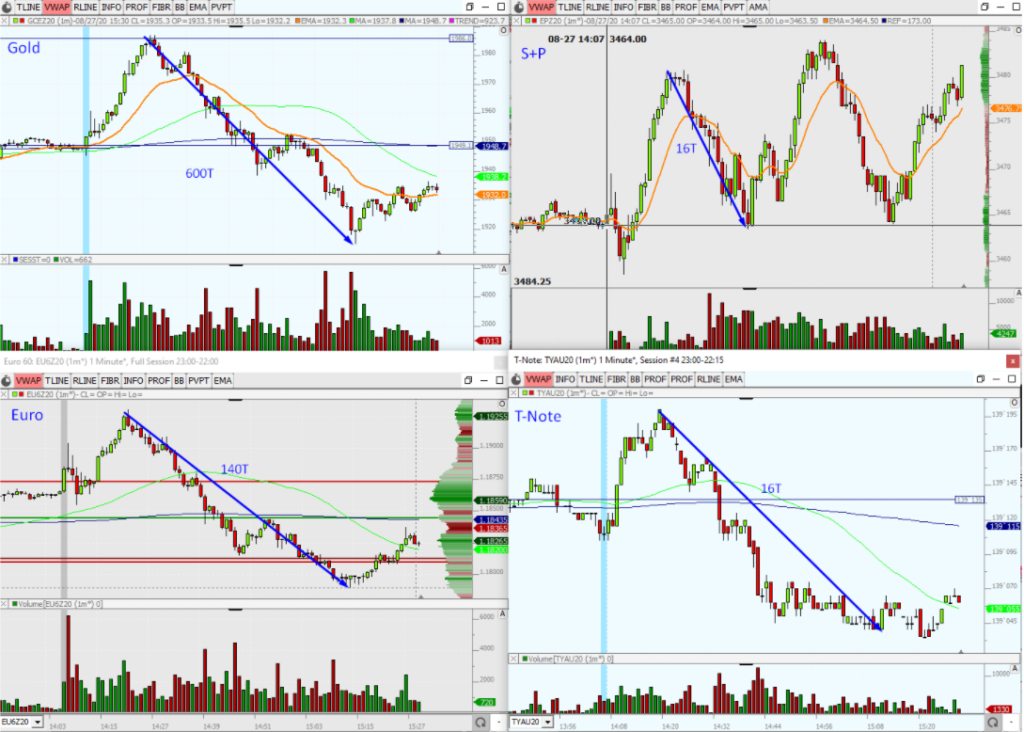

3. Average inflation – what does it mean? Rather than being in the statement, this is likely to be a question for Powell following his Jackson Hole speech. Monetary Policy Strategy was updated to include this reference and was taken very dovishly by the market initially although without further clarity this reaction was quickly taken back particularly in EURUSD, Gold and T-NOtes (see below). The above statement, if brought it could preemptively answer this question by giving both a time horizon and maximum above 2% the Federal Reserve would tolerate before acting

What Market to Trade Over The Federal Reserve Decision?

Once you have your Federal Reserve scenarios outlined and prioritized – above is a not exhaustive list of possible options, although some of the main themes showing in analyst research – then it is time to choose your markets to trade. Here you have 2 options: either stick to one market whatever the outcome or or change depending on what is said. If you are uncomfortable trading multiple markets or moving away from your core market in time of high volatility then option one will suit best – you must be aware that some outcomes may not suit your market though and not provide a trading opportunity, whilst watching other markets move. Option 2 affords a greater chance to ‘get involved’ although this must be balanced against whether the change form the Fed is worth a trade being taken. In picking a market, looking at recent reactions can give guidance – above the reactions on Jackson Hole show strong correlation between Gold, EURUSD and T-Note whilst the S&P 500 doesn’t follow the same pattern. Furthermore, Gold and EURUSD reacted the most in both directions – this would suggest that perhaps the greatest opportunities lie in Gold and EURUSD and each can be expected to move in a similar fashion.

Federal Reserve Trade Execution

The key to execution is to have a clear idea of how you chosen market will react to dovish (more stimulus) or hawkish (less stimulus) and where it can go – i.e. key levels and potential distance. This gives prevents hesitation when you see one of your scenarios come into play and also allows you to carry a trade by knowing where it can get to and leaning on correlation in other markets as can be seen here from one of our Elite News Traders

Methods on how to develop and execute your own Federal Reserve Trading Strategies are taught in detail in both our Central Bank Trading Course and Intensive Career Trading Course.

Best of luck during the Fed’s decision – remember to have a clear plan and if you planned trades aren’t available you don’t need to trade immediately – don’t go in blindfolded – your competitors won’t.

Richard