Breakout Trade Management Techniques Introduction

In this article, we will discuss breakout trade management techniques. Rather than discussing how we have picked the entry signal and what clues led to picking up this breakout trade in Gold, we will look at how one can manage the trade itself. Trade management is not only about when to exit the trade but also what to look for to stay in a trade, where to add into a trade, and how do we know when to exit a trade. Very much like in an Oil trade we have shared with the trading community.

Checkout the video below to get full understanding of this article in action.

Questions To Ask In Managing The Trade

We will start with questions we are going to ask regarding our access point, trade management itself, and when to exit a trade.

- Access point

- What needs to change compared to recent price action? How did the price react at a similar point before? Is there a pick up in velocity for example?

- How does the trade need to be entered? Is there a chance our passive entry will be filled or do we expect an explosive move in which we need to hit the market?

- Trade management

- When to accept risk – Is the risk worth taking? Based on favorable RR or highly probable trade setup, can we accept the risk at this point in time?

- When to feel convicted – What is improving our conviction for the trade? For example a pickup in velocity, large orders entering the market, LVN’s left behind and holding?

- Rotations – What do I need to see to stay in? While we are monitoring the move, we are mentally updating the rotations (highs and lows marks). Was there any change in the rotation size? If so, how the rotation came about? Was it a fast blip down and up? This might be a sign of the end of the move.

- Exiting the trade

- Fixed target – Are you hitting the target level/target zone you have set for yourself? Great, exit the trade, your plan worked ;-).

- Order flow-based exit – Is there any change in rotations and volumes? This can be a sign of the move to end.

Now that you understand what questions to ask, let’s have a look at the practical application in the Gold breakout trade.

Breakout Trade Management Techniques In A Gold Trade

Context

First, let’s set a context for our four ladder stages we will be talking about down below.

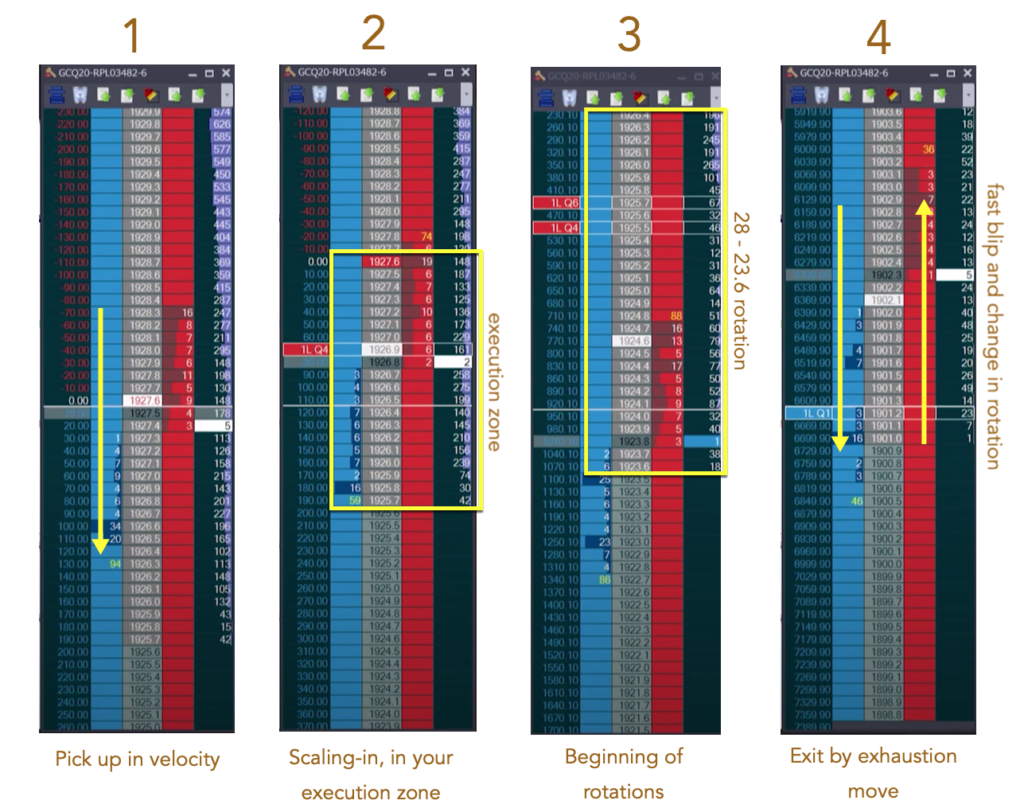

In the image above, you can see couple of important inflection points:

- Execution zone – we would like to sell between 1928 – 1926

- Rotations down – we would like to monitor rotation size not only to stay in a trade but also to scale more into the trade

- Orderflow based exit – we will exit based on price ladder action

Ladders

Now that we have a context in place, let’s have a look at the four price ladder stages that gave us answers to the questions.

- Stage 1 – Is all about a pick-up in velocity. If you compare the previous price action, you can see the price ladder moves were much slower. Then, the velocity changed. This is the first answer to our question regarding the access point. Check out the exact time, when the velocity changed.

- Stage 2 – As we got to your execution zone, how can you enter a trade? Will the passive entry work? If you have watched this part of the video, you can see that passive order was executed.

- Stage 3 – By observing the rotations, you can see the size of each rotation. First rotation starting from 28 – 23.6. Then others follow: 21.3, 19.6, 17.7, 16.2, 13.3, 12.0. Observing the change can give you clues if there is any change in the market dynamics and potential reversal which eventually came, see stage 4.

- Stage 4 – By observing the end of the move on a price ladder you can notice a change. Change in rotation size and the fast increases in the velocity. That last blip down and up, accompanied by larger volume is a sign that this move, at least temporarily is over.

Summary

The key takeaway from this article is that by understanding what questions to ask in a trade, it gives you a better chance not only to stay with the trade but also to add more size into a trade at favorable locations as well as giving you the ability to time your exit well. Execution zone velocity pickup, rotation size and rotation change are concepts worth exploring. All of this comes of course not only from asking the right questions but by understanding what each answer implies. You can learn it by experience or give a chance one of our premium materials in the links below.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- What Markets Do You Select When Trading – Price Ladder Trading

- Key Observations To Stay In A Trade – Price Ladder Trading

- 3 Reasons To Get Into A Trade – Price Ladder Trading

Thanks for reading and until next time, trade well.

JK