As with last month, expectations of the European Central Bank (ECB) changing policy at its September meeting are rather limited. Opportunities, however, will still be available to the well prepared traders, the main focal areas of trade strategies now revolve around the recent rally in EURUSD (chart below) and changes in the Federal Reserve’s inflation targeting policy.

European Central Bank Trading Strategies

Often research and analysis prior to any Central Bank decision is more based predicting what they can do; as a day trader your focus needs to be on what will you do in any particular event? and which market would be optimal to trade? This way clear scenarios and trade execution plans can be created. So, what can the ECB do? What are the implications? and what markets are likely to be affected?

Addressing the Euro Strength

The strength in EURUSD can be attributed to the positive reaction to dealing with the Covid crisis in Europe and the Fed indicating a more dovish policy going forward, however this has a negative impact on the competitiveness of Eurozone exporters and also inflation. Whilst the ECB often suggests they do not target the exchange rate, recent comments from Lane suggest it is bothered by them at these levels, leading to expectations Lagarde may try to address the Euro strength. This can be done either by policy change or via verbal intervention, both would be expected to have a similar impact on the Euro exchange rate, however policy change will have impacts on other markets too.

Verbal Intervention: Using similar phrasing in their statement as September 2017: recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability. The implication here is that if the Euro doesn’t fall then policy action could be taken, this potential should be priced in causing a possible Euro fall.

Policy Change: The ECB has options here – none are really expected to be used, all will have impacts on other markets at he same time .

- Signal additional PEPP purchases – €350bn increase is the general expectation by December, an earlier or larger increase should weaken the Euro as well as giving a boost to bonds as this where the purchases will be conducted

- Cut rates – Current 0.0% refinancing rate and -0.5% deposit rate, less return on money should reduce demand for Euro, this could also negatively impact bank stocks as banks depositing money at the ECB will receive the new (negative) deposit rate on their money.

- Increasing the Tiering Multiplier – increasing the Tiering Multiplier from the current 6x alone could signal a rate cut in future, as this gives banks the safety of not reducing profit margins if this were to come. See here for a more detailed explanation of the Tiering Multiplier.

ECB Staff Forecasts

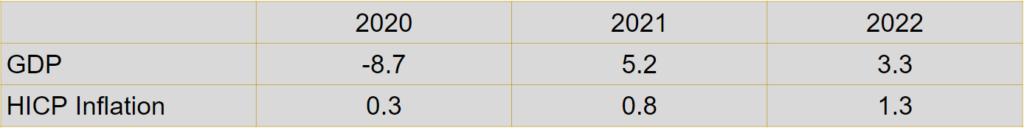

Near term forecasts are subject to great uncertainty so are less significant in signalling any policy change, so focus will be on longer term forecast, 2022 in particular. This will give a clue as to how long the current stimulus measures may last. June forecasts are below a drop in 2022 HICP inflation would indicate longer lasting or more stimulus, whilst an unchanged or higher reading would suggest a faster withdrawal than some expect. This likely be negative for bond markets, especially Italian BTPs as they benefited greatly from the ECB PEPP.

Which Market to Trade on the ECB Decision?

Reactions to recent comments provide great information as to how willing certain markets are react to change. A Bloomberg sources comment suggesting no need for more stimulus, the day before the ECB decision created fast reactions in EURUSD as well as Bund and BTP (charts below), however equities markets were unmoved indicating greater opportunity may lie in trading any change in currency or bond markets.

Whilst structural plays for a continuation of the equity market bounce after a recent sell of may be more viable in the event that the ECB, like last month, remains non-committal and provide the market with nothing more than the current muted expectations

Make sure you have a plan to trade any central bank event, the above ideas should in no way be deemed advice and you should formulate your own plans as to which market to trade in each scenario you create. If you want to learn more about how plans can be formulated, check out our Central Banks Trading Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 8 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.