3 Steps To Trade Fundamental News Introduction

In this blog post, we will break down 3 steps to trade fundamental news. When dealing with the news, we need to be aware of the current narrative. Because narrative sets the expectations for the market, anything outside of that narrative acts as a surprise. So the fundamental narrative gives us the scope of where we are and where we can go if a change of that narrative occurs. Going further down the rabbit hole, we will break down the importance of positioning, price response, and the market’s ability to trend. A great example of the change of that narrative was the recent ECB’s hawkish pivot that our Elite Traders were able to profit from greatly.

This article is based on the video below.

3 Steps To Trade Fundamental News

As soon as we understand the narrative, we can start to model scenarios that would change the narrative. This is where fundamental news trading starts. There are other forms of news trading, but today we are focusing on the change in the consensus, the change in the narrative. Additionally, we can add a sentiment as well. That is how the market perceives the current environment: risk-off or risk-on.

Now let’s break down three important elements that we can add to our equation.

Positioning

What is the current positioning? Whether it is the positioning leading to the expected event or just the current positioning, we are looking into two things. In the short term (weeks and days) we want to know:

- what is the market structure?

- Who is the dominant player in that structure – buyers or sellers?

- how strong that structure is?

- Where are weak and vulnerable spots in the structure?

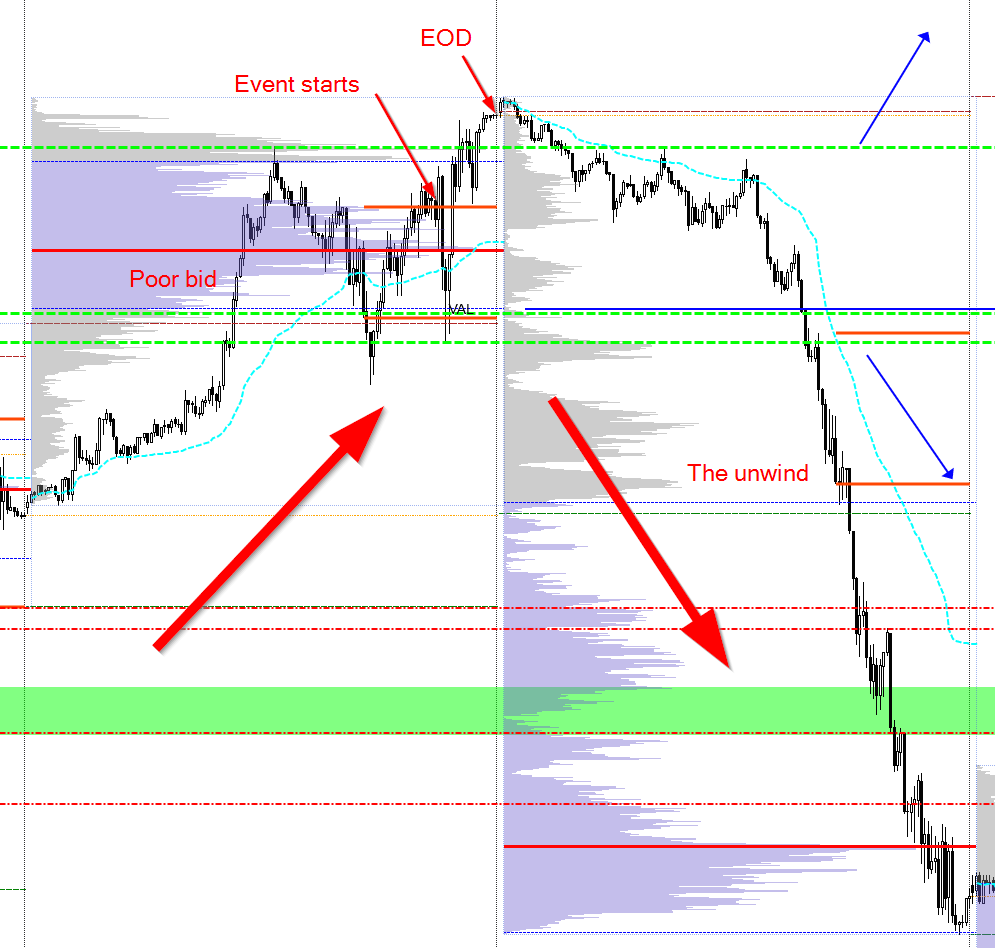

A great recent example was the positioning into the Jerome Powell’s speech at the Wall Street Journal event. On the day of the event, we bid strongly, leaving the poorly auctioned structure below. The result of that event was no change in the narrative. Given the current narrative and sentiment, this poor bid got unwinded with the close very quickly, when during the non-RTH open market tried to break higher and failed. Here is the look:

Price response

When we face the news, our immediate questions should be: does the price action supports our view with ease or difficulty? We want to see the initiative confirming our conviction. If it is a change in the narrative that has not been priced in, we should see a response. This can be added into reason2exit as an exit criterion if the price action simply does the opposite. If the market simply doesn’t care, don’t assume, that you are early or the first one to pick this up. But if a slight pick-up in the activity is clear, even if it is not all directional at first, the market starts to absorb the information. So in general, the rule of thumb is this: the price action should confirm the change in narrative. This leads us to the last step, the response.

Ability To Trend

The ability to trend is about how much liquidity is being provided in the opposite trade. The less liquidity the better because our move will have a cleaner move. The market’s ability to trend without deeper pullback is a good sign, that we are on the right side of the trade. Remember:

“The bigger the news the shallower the pullback”

Trade Example

Oil

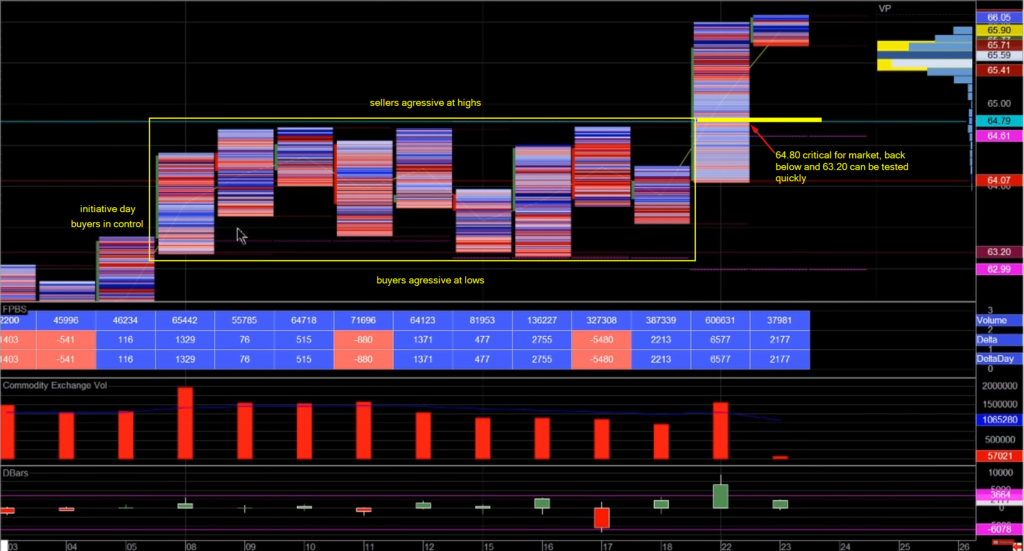

Now here is the question for you. What is the positioning prior to the upside break (prior to a break above the yellow line)? Look at the image above and below and try to identify:

- positioning

- price response

- ability to trend

First, think about these two images. Then watch the video that is part of this article.

Elite Trader News Trades

In case you want to learn from the Elite Trader execution about the concepts we have just described, watch this real-time price action, and also reading the How To Execute Like AXIA’s Elite Trader would be valuable. There are a lot of examples of narrative building, positioning, and confirming price action. Learn from these articles.

If you want to learn how professional traders trade the markets in greater detail, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK