How To Trade The Open Introduction

In this blog post, we will discuss how to trade the open. Trading the market open can be tricky. A lot of conflicting positions firing against each other can create pretty erratic and frustrating market movement. The increase in volume activity brings more volatility but also a moment that is harder to read from the order-flow perspective. In that case, we need to understand when is the best time for us to trade the open and when is the best time to let the dust settle and trade after the market showed its hands. If you like to trade similar trading ideas such as market open, don’t forget to check Two Breakout Strategies For Futures Markets from our blog post archive.

This article is based on the video down below.

How To Trade The Open Using Two Strategies

Strategy Selection

When we will be selecting our open strategies, we need to be really picky. The reason is simple: The open can be erratic and hard to read therefore we need more clues that will work in our favor for the market to truly move. There are two contextual clues that can give us a hint to trade the open:

- positioning unwind

- news gap

Let’s have a look at four trading examples and categorize each example into one of these two categories.

Trading The Open – News Gap in Gold

This market open can be categorized as a news gap. The market reacts to General Soleimani’s assassination over the weekend. This specific event impacted Gold and Oil the most. Gold because the increased tension can bring widespread geopolitical conflict, therefore creating a risk-off reaction. Oil reaction is caused by the higher risk of the impact on the Oil supply.

When we are playing the news gap, we are basically looking for two forces to be in play:

- old positions are being liquidated

- new positions are being added to the market

Our key is to understand what news can produce market-moving events such as this one and then trade them early in the direction of the gap.

Trading The Open – Positioning Break in Pound

In this particular case, we are looking at the pound trade, where a lot of positioning has been built at the lows, creating multiple touches of the low. Every rejection of the lows creates hope for buyers to lift the market.

This trade belongs to the positioning market open trade, where at the open, the market simply unwinds the long positions that have been built over multiple sessions. What can’t rally, usually offers. This was a textbook example that we can only test the resistance so many times.

The reason why these trades work is because we are mainly liquidating short-term positions of those traders that got long and also short-term traders adding short pressure when the market is unable to rally.

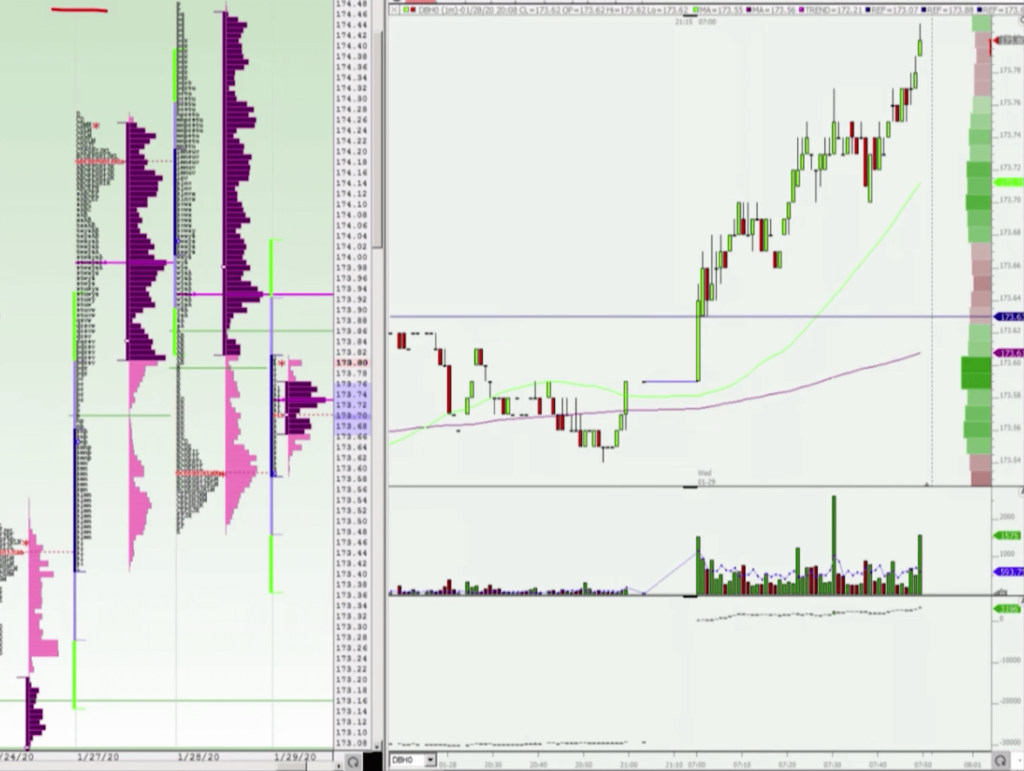

Trading The Open – Positioning Break in Bund

Similar trade to the Pound trade. The market is strongly moving premarket in the favor of longs, leaving the buildup of short positions in danger. As well as the above example, the market open will be a catalyst for the market to unwind all those short-term short positions that were built previously.

Another look here at the Bund, when we have built a positioning in a sideways range. If you were short, by the time Bund opens, you are well above your exit point (see market profile chart on the left) and your open short position is well above the range high. This creates a quick liquidation pop into the premarket.

Your role is to use this liquidation in your favor and ride the market pop after the open.

The last example but again similar to Bund is the Eurostoxx trade. Market gaps are unable to close the gap and provide an ideal spot for short-term shorts to liquidate their positions. This creates the directional pop and an opportunity to trade the market open.

Key Trading Takeaway Trading Market Open

It is key to understand what circumstances can actually create an interesting market open. The high probability trade is either a news gap, or positioning unwind. Any gap above or below the previous week’s range can provide an opportunity for at least a short-term market scalp for those, who needed to cover their positions.

Thanks for reading.

If you want to learn how we trade the markets in much greater detail, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- Trading The Futures Open Gap Strategy | Axia Futures

- 3 Rules For Trading A Gap

- How Market Gaps Affects Your Trading

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading again and until next time, trade well.

JK