Trading Market Profile Reversal Signals Introduction

In this blog post, we will review trading around market profile reversal signals. In detail, we will combine two Axia Futures videos about market profiles and dissect best practices around trading reversal patterns. Specifically, we will focus on the V reversal pattern while using tools such as Volume, Market Profile, and Footprint. By breaking down each step of the developing story, we will learn how an understanding of the “how we got here” plays an important role in “where we might be heading next”. If you like similar articles to this one, don’t forget to check our previous piece: “Trading Clues In Market Profile Structures”

Anatomy Of Market Reversals

When we are dealing with market reversals, we need to understand the risk of playing these reversals. The risk of any reversal lies in our understanding of market participants and their intentions. It is much harder to read the intention of the market when it is driven by a pure initiative move (market selling or buying in a one-directional fashion).

During these market-moving initiative times, we have a massive disadvantage: we don’t have a crystal ball. We do not know what type of players will step in and what size they will play with. And we won’t know that until they do step in. Therefore the first rule of reversal anatomy is:

understand what type of reversal you are dealing with

There are so many ways how a market can reverse. We all like different strategies, but if we can understand a couple of principles, it can give us clues if the market reversal is truly happening. We will explore both principles further down in the article but in a nutshell, here they are:

- How We Got Here Principle – this principle is all about understanding how the market got here. And what has changed since it got here.

- Is This It Principle – build your own variables, that will guide you through the reversals you have researched. Great clues for this principle are:

- Volume – some traders set 3x or even 5x the average volume as a trigger for their reversal to be in play

- Delta Reversal – is the aggressiveness shifting from buyers to sellers or vice versa?

- Tails – are tails being created around reversal?

- Overlaps – do candles that did not overlap suddenly start to overlapping?

- Time – how much time we are spending in the territory where price should not get really accepted.

- Value – where is the value being accepted and is it in line with our expectations?

- Single Prints – where do we want to see single prints develop?

- Power Of X – how many times the market has tried to attack a reversal tail and failed. Some metrics-driven traders can set this variable to 2 for example. “I want to see at least 2 failures at retaking the tail in order to initiate my position”.

- HL’s, LH’s – with an attempt to take the tail, is HL (for bullish reversal) or LH (for bearish reversal) being created

- Rejection vs Liquidation – is this move driven by rejection or liquidation?

- Basing/Two Way Trade – where and how do we want to see the basing/two-way trade develop after the rejection has happened?

- etc.

If you want to learn how we build and work with clues like these, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

Trading “How We Got Here” Principle

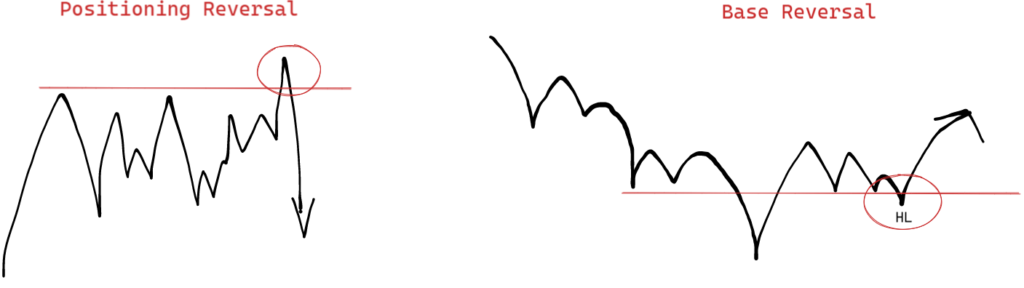

Down below we can see two examples of market reversals. Main difference? The way the reversal was constructed prior to making the reversing move aka “How We Got Here”. They both produced tails at the reversal point, but the positioning prior to the tail was different. In the first instance on the left, the market was positioned for the breakout and failed to follow through. A positioning unwind happened.

In the second instance, the market was a bit over-extended and reached a point where the stretched tail ended the over-extended move.

Here is the question for you. Using our “How We Got Here” analogy, what market reversal type has Isaac explained in this video starting at 1:51? Was it more of a positioning reversal or base reversal?

Watch the full video if you want to learn more about different types of reversal moves.

Trading “Is This It” Principle

Now, let’s have a look at a different angle of the reversal. This time we will look at the Initiative To Initiative move, sometimes called a V reversal. When there is an initiative, there is very little response from the other side. This creates a big volatile move since nobody is willing to provide the liquidity to that initiative. When the initiative stops, a responsive type of move usually happens. But if that responsive move gets traction, a new initiative can start resulting in a V reversal move. You can read about it in greater detail in our previous post: “Trading Key Market Auction Reversals“.

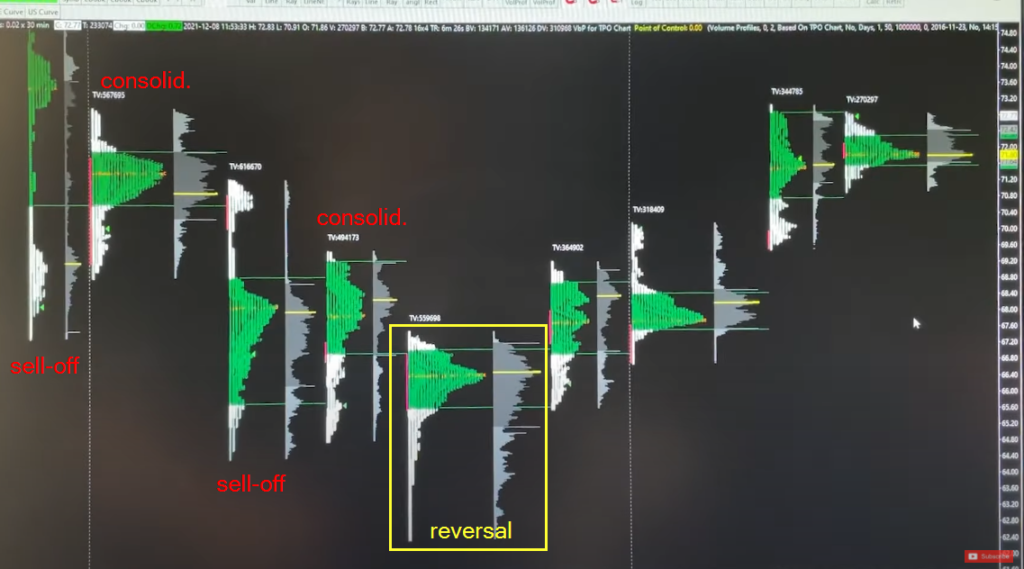

On the chart above you can see the move we have just described. Very little overlap between candles on a way down (selling initiative). For 22 down candles, the market produced only 3 up candles. Then, the market stopped and produced a two-way trade. Then new initiative started and the market turned from bearish to bullish. How?

After a basing two-way trade, the market broke with 4x volume. Delta supporting this move started a new initiative buying resulting in a V reversal move.

Here is the question for you? What clues from the “Is This It” principle Bran has used in his trading example? Let us know in the comments under the video.

For the full video, watch the episode here.

Hopefully, this was helpful. Don’t forget, that any reversal you will ever trade, should have a clear and consistent plan of execution. There is nothing worse in a trade than not knowing what to do and messing it up. Watch your risk, and trade well.

If you want to learn how we do it, don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- Trading the V Reversal Price Action in the Dax | Axia Futures

- Reversal Entry Trade In The S&P | Axia Futures

- How To Trade The Delta Reversal Strategy [FOOTPRINT CHART]

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK