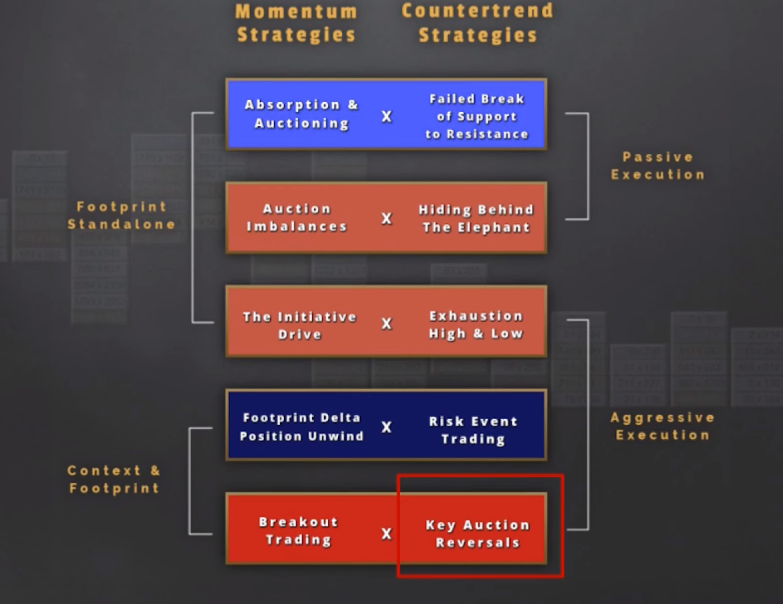

Trading Key Market Auction Reversals Introduction

In this post, we will be looking at how to trade key market auction reversals. Specifically, we will be interested in the architecture of an important reversal from the market auctioning perspective. Volume, volatility, and interaction between buyers and sellers will be the building blocks of the V shape reversal strategy described below. This strategy has similar characteristics to the strategy we have described in our previous post: Reversal Trade Catching The Stops In Gold. Only in this specific case, we will be looking at a slightly bigger picture timeframe. Nevertheless, the principles behind the strategy follow a similar price discovery process. Let’s have a look at what we mean by that.

For more, see the video down below

Principles Of Key Auction Reversals Strategy

In order to explain this Key Auction Reversal strategy, we need to highlight the important words that define the title of the strategy. Key, Auction, and Reversal. Why “Key”? Because we are particularly interested in seeing higher timeframe participants step in creating that big change in positioning, resulting in an increase of volume and volatility. Then we want to see an “Auctioning” activity that at one point flips the original initiative and drives the move in the opposite direction with the same force, hence the “Reversal” in the title of the strategy. We want to see that shift in positioning. With all these attributes combined, this pattern can become a lucrative one. Since it does not happen often on a bigger picture timeframe (daily/weekly), we need to squeeze as much as we can when we spot this type of reversal.

How To Trade Key Auction Reversals Strategy

As we have mentioned, the strategy is usually initiated by a one-directional initiative move (in this case initiative selling) and reversed with a sharp reversal (initiative buying), both happening on increased volume and volatility. We can call the first phase of the move a V Reversal, and the second phase of the move as secondary positioning. What is nice about this strategy is that we usually have clearly defined risk after the V Reversal part has been completed, and a form of a retracement followed. Why? Because in a Key Auction Reversal we should not revisit the low, we should not even come closer. If we do, it is not a Key Auction Reversal anymore. So how can we access (enter) this strategy?

On the chart above there are three blue circles. The very first one (on left) is usually the best area to access. Yes, the V has not been formed yet, so you have to use other tools (like your price ladder or a footprint) to recognize that this part of the movie is happening. The second best entry and the safest one is after the V Reversal phase has been completed and a retracement happened. Using tools such as footprint and previous support and resistance, you can spot an area of the highest likelihood of this retracement reversal. The third possibility of how to access the strategy is the low of the first retracement after the V Reversal has been formed. In all cases, the stop should be placed below the secondary positioning low of that first retracement that happened after V Reversal phase.

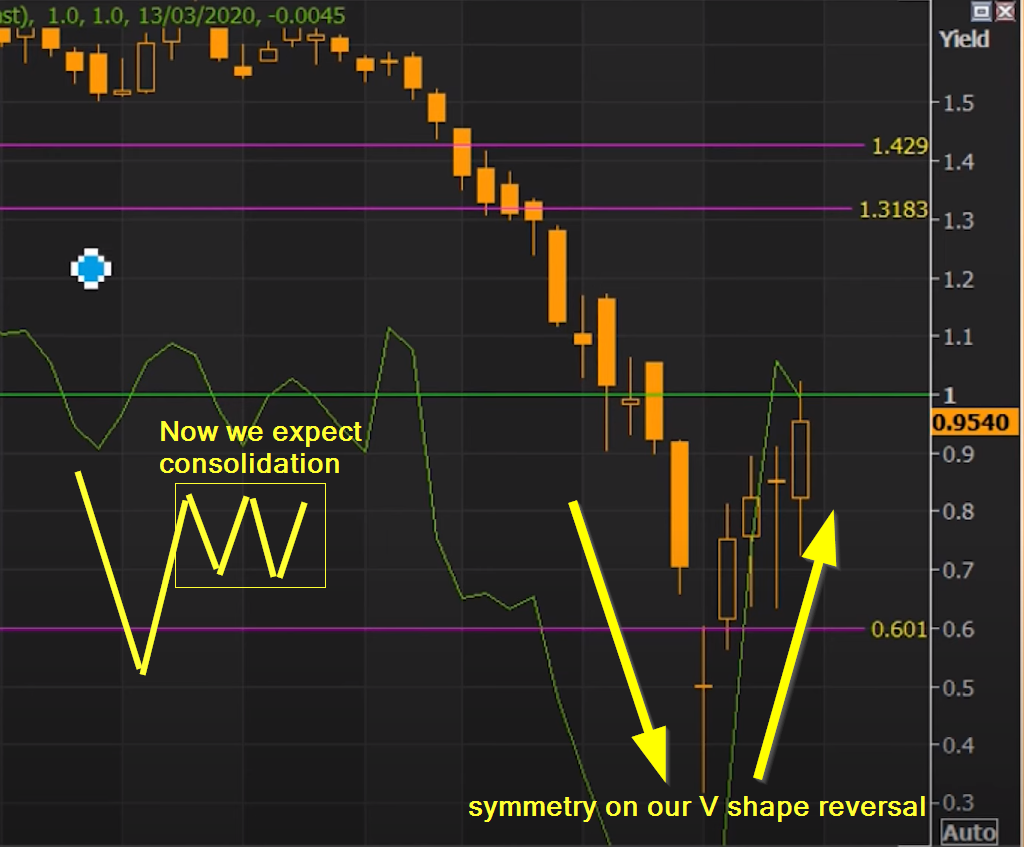

Here is one more example from a US Fixed Income market, daily timeframe.

Key Takeaways From The Reversals Strategy

In both cases above, we want to see a symmetry of our V shape reversal, which is followed by the phase of secondary positioning (consolidation). Playing the consolidating part can be more robust. Why? Because we can with better precision pick a location, where we are wrong on a trade, and manage our risk with a higher degree of consistency than picking a point of a reversal where that initiative buying steps in. Also, this strategy can provide a nice asymmetrical RR (risk-reward). So next time you will be looking for an opportunity similar to this one, remember that it is the change in positioning, increased volume, and volatility going into the unchartered territory that can create an opportunity for a Key Market Reversal.

If you liked this type of content, you might check these videos as well:

- The Exhaustion Reversal – Trade Strategies | Axia Futures

- The Famous Block Reversal Trade | Axia Futures

- How To Trade The Delta Reversal Strategy Using Footprint | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK