Trading German Bund On The Stimulus News Introduction

In this blog post, we will be looking at the Senior Axia trader trading German Bund on the back of the stimulus news. The key focus of our article will be primarily the logic that leads this trader to execute 300lots in the Bund and the ability to cut – and – reverse the trade when he recognized the move was over. The crucial aspect for this trader to execute successfully such a large size was his preparation. Preparation is key especially when it comes to trading the Macro events, very fast and with a massive size. One of the good examples of the preparation leading into the key news event is a blog post of Harry trading the Moderna news as well as our Axia Live: Finding Opportunity video made by Bogdan about a detailed description of how we prepare over the weekend for the week ahead. Let’s break down this trade.

In case you want to get a full depth of this post, I recommend you to watch this video as well.

Preparation Leading Into The Trading Execution

Sequencing Of The News

We will be focusing on the first part of the video where senior Axia Trader traded the news about potential stimulus change from the German government. Let’s run down bullet points that will shed light on the importance of this news:

- On Friday 16th August 2019 – Der Spiegel reporting Merkel and Scholz ready to run a budget deficit if Germany goes into recession. Citing anonymous sources in the finance ministry. Bunds sold off, equities bid up.

- On Sunday 18th August 2019 – Scholz suggests Germany is ready to counter the next economic crisis with full force. Suggestion to provide 50 billion euros.

Why are these news important leading into the next week when the update on the news hits the wires? Because the political culture of Germany is based on the budget balance. It is part of the German constitution and it has been for the last 100 years. This fiscal prudence is very firmly priced in the German Bonds market. Any change to this long lasted fiscal prudence will have an impact on the markets.

Now, given the information, a trader must prepare the execution plan so he can execute his plan swiftly without hesitation like a professional athlete who can’t think where to hit the ball, especially when under pressure.

Preparation For Execution

Here is a basic checklist every trader should prepare for an event like this:

- Products you will hit ordered by the most rewarding

- Correlated products to lean on when this news will be released

- Trading environment aligned to products you gonna hit first (ladders centered and positioned at your main screen)

- The size that you will hit the market with and at what point you will scale out of the trade

- Exact wording you are expected to hear in order to hit the market. What would the headline has to say. What are the nuanced variations of the potential headline?

- If->Then wording analysis: if they say X, I’ll do Y for multiple scenarios

Why such extensive preparation? It is really about reducing your thinking time while hitting the market with your max size. Now let’s have a look a the execution of this trade in detail.

Trading Execution On The Back Of The Stimulus News

The Headline

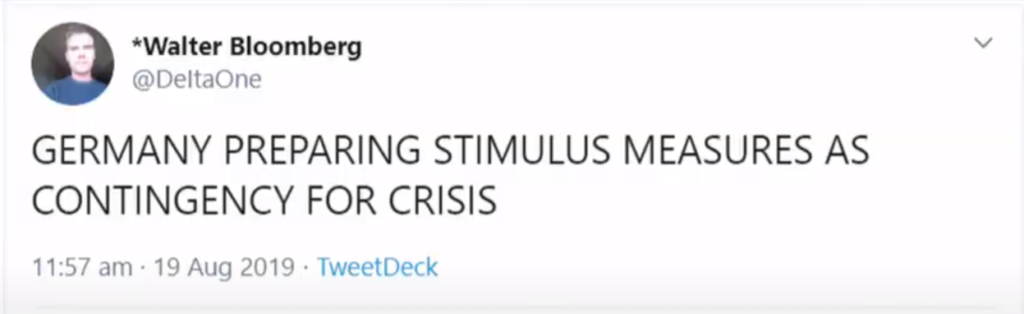

On 19 Aug 2019 at 11:57AM UK Time this headline has been released:

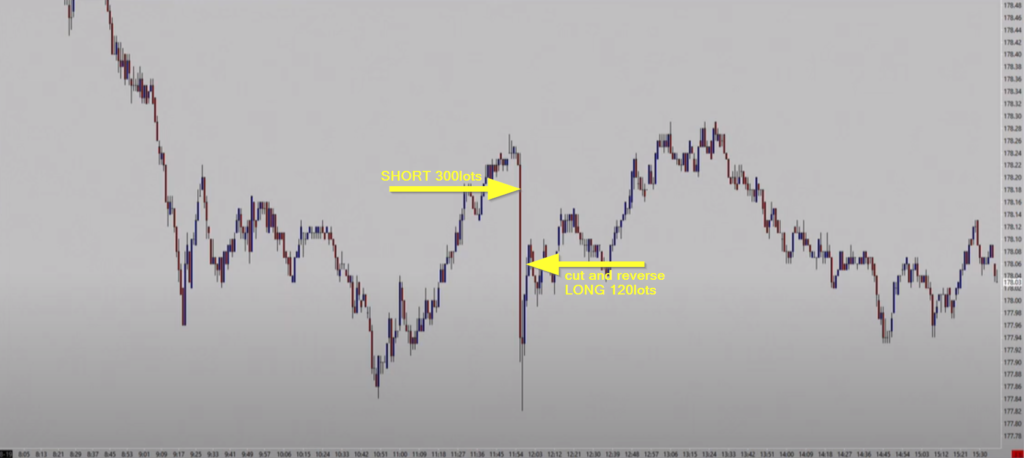

Now, this trader knows the size he wants to execute (300lots) and what product (Bund) while monitoring correlation with (Buxl and Euro) to manage the trade. As this news is being released a trader has executed 5clips of 60 lots in the market in less than 2seconds (watch the video for the action).

As the trade progresses trader monitors other markets like Euro but dominantly Buxl. Why Buxl? Because Buxl would be more affected than a shorter end so the reaction can give you clues while holding your Bund trade. While being in a trade, the trader realizes that one of the potential scenarios is that this news is just a “rehash” of the old news. Specifically, one word is a bit worrisome: “measures”. While monitoring the market, it is starting to be clear from the order-flow and other correlated markets that this is truly a rehash and the market starts to reverse. Not only this trader is to able exit with a nice profit on the first trade but by understanding it is a rehash he is able to cut and reverse (with half of the size) and take a long position on trade. By speaking to him, he has mentioned that after making good money on the first move, there is no way he would give it back on the reversal, therefore cuts his size half on the reversal trade.

It is these types of trades, made by fast money flows that can truly change a trajectory of a trader. That’s why the initial video is called from 3lots to 300lots in 18months. It takes a lot of deliberate practice and constantly being prepared for the market opportunity. Then, when the opportunity comes, squeeze as much as you can.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK