Trade Journaling On Steroids Introduction

How could this possibly go wrong? This is a question we ask much less frequently than we should before taking the trade. Trading is about understanding the variance of your trade setups. But variance manifests itself at many stages of the trade. We have a variance in the trading setup, access to the trade, trade development, exit, risk we take, etc. Understanding the permutations of your trade setup from bottom to top is the best way to get better in your own trading. Let’s discuss how we can take your current debriefing method and put it on steroids using the scenario-based approach. If you want to see good examples of basic journaling methods, read our Bund and Gold articles.

This article is based on the video down below.

Trade Journaling Basics

Let’s start with a simple truth. If you are not journaling at all, you are running your trading business at least suboptimally. Imagine a business that buys and sells stuff but has no idea what its accounts look like, what its margins look like, where the business can push new products and what product it should probably stop selling. It wouldn’t be a business for long. This applies to trading as well. So goal number one is.

Bookkeeping, Bookkeeping, Bookkeeping

Once you pass this checkpoint, it is all about the quality of your journaling, or the quality of debriefing after each trade. This is a minimum standard you should set for yourself if you are in the early stage of your career:

Now, let’s discuss how we can take your journaling from here to the next level.

Taking Your Journaling To The Next Level

Introduction

So how can you take your journaling to the next level? By adding a different view towards the trade you have taken. Simply put, by asking:

How can I get skrewed in this trade?

It is all about building different scenarios of how trade can develop. Understanding the different variations of the same trade is the bread and butter of a better understanding of the market. So if the trade goes wrong, you simply don’t put it into the category “trade went wrong” and walk away. On the contrary, now the trade should have much more of your attention.

Another way to think about the trade is in form of:

Expectation -> Reality -> Observation -> Improvement

What did you expect, what actually happened, what was the delta (difference) between these two and how can you improve your setup going forward? What have you observed that did not match the expectation vs reality framework? What can you learn from that observation?

Let’s have a look at one trading pattern, that developed differently and what can we learn from this pattern.

Journaling Different Trade Examples

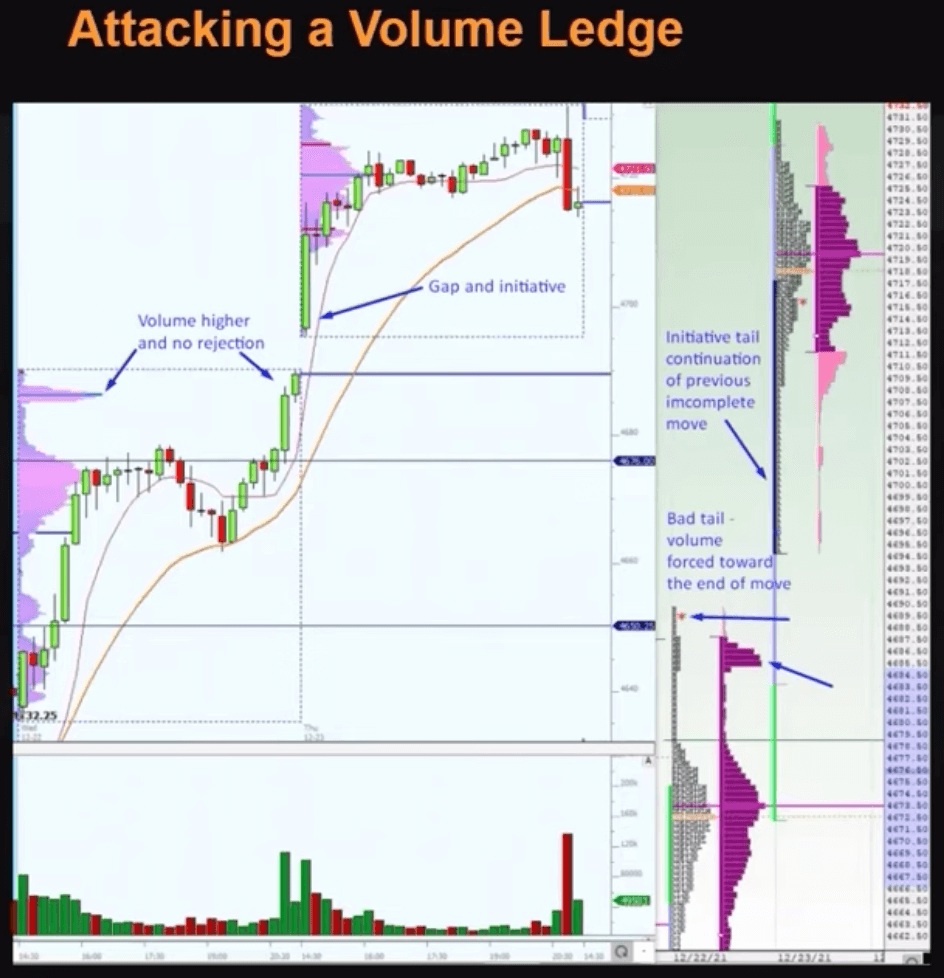

Down below we have three examples of the volume ledge break. In the first example, we can see a ledge break. Once broken, the market rallied strongly. The ledge highlighted by the red line got broken and the market run away.

Down below we have a similar variation of the same pattern. The volume ledge again got broken and the next day we opened with a gap up and market run away. Again, time to think, how could you play the similar pattern, but in a different setup.

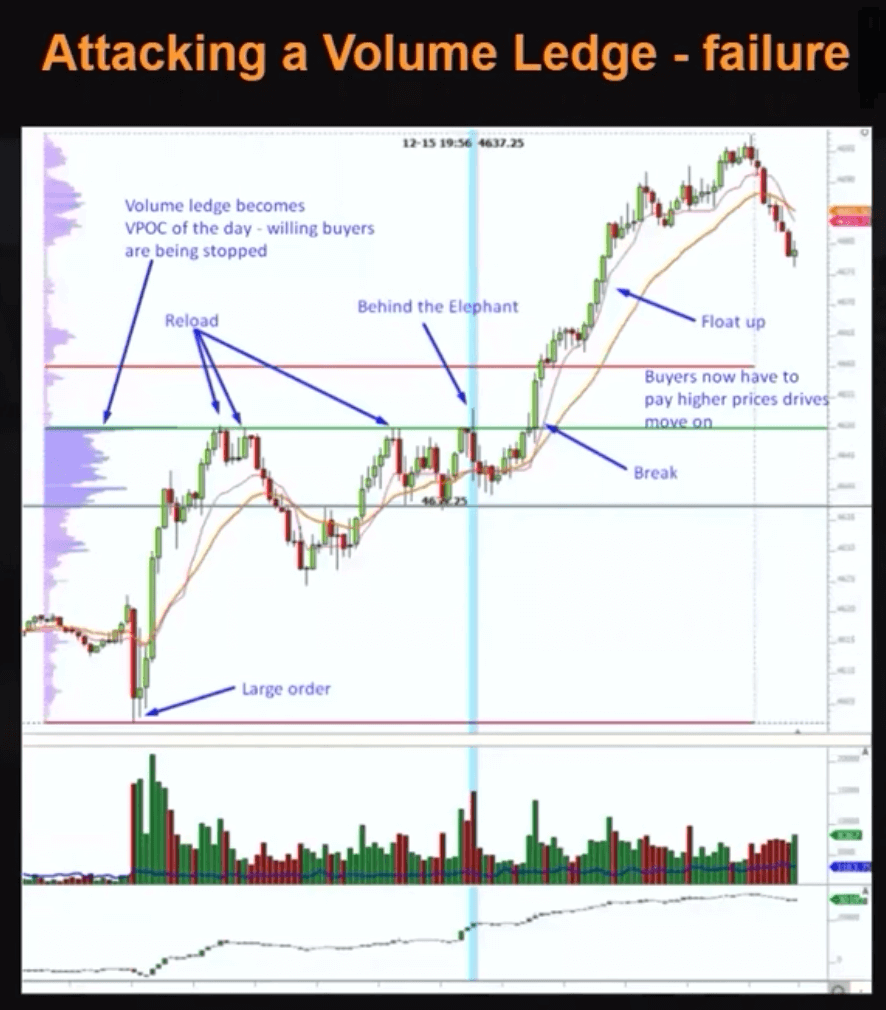

Now coming to the third variation we can see that the break was not so straightforward. Now we can zoom in on variation a) and variation b)

Within the first variation a), we have broken strongly by the Jump Trade pattern but immediately failed. You can watch the order-flow pattern directly from the replay here, at 15:07.

Within the second variation b), we have broken strongly again the Jump Trade pattern rejection high and accelerated again. You can watch the order-flow pattern directly from the replay here, at 19:18.

What do these three patterns have in common? They are similar in the way how you identify them but different in the way how you execute them. How different? That is homework for you. Apply the principles we have described and let us know what you have found out.

Key Journaling Takeaway

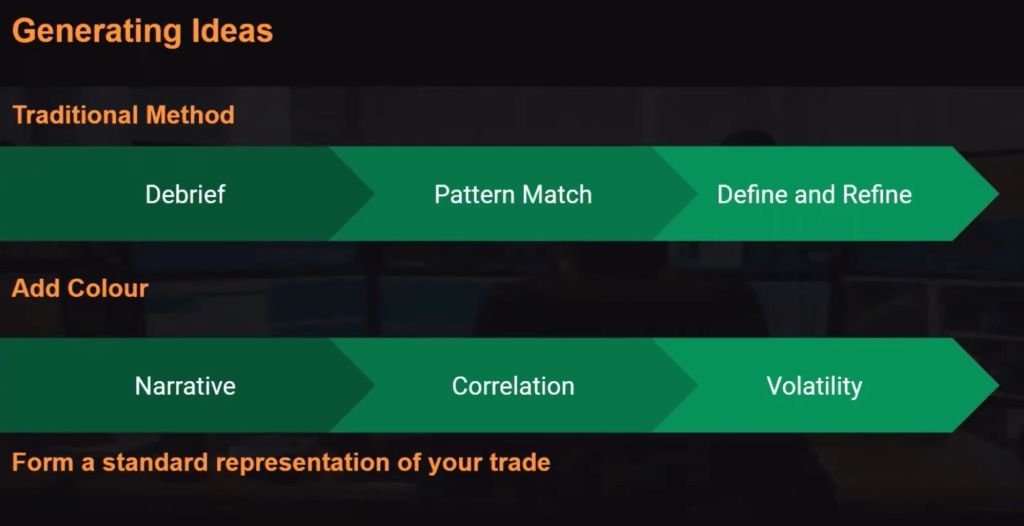

Debrief your trades. That is where you start, no question about that. Then on top of your trades, add narrative/correlation and volatility observations. Once you have the routine going build that permutation muscle by asking the Expectation vs Reality type of questions. It is in the detail, in the deep understanding of your setup that comes from the familiarity you have built over many many variations of the same pattern. That is how you improve.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK