How To Do Yearly Trading Review Like A Pro Introduction

Three reviews, three different approaches – that’s what is this “How To Do Yearly Trading Review Like A Pro” blog post all about. We will have a look at three prop traders looking at their year asking the right questions and figuring out what process they can improve going forward. In their review, they have used a broad range of methods from trade performance metrics, well-journaled market observations to behavior analysis of their own trading to set the appropriate process-oriented goals for 2022. Let’s have a look at their analysis in bigger detail.

Yearly Trade Reviews

Trader Harry

In this video, trader Harry breaks down his yearly P&L by:

- Product

- Trade type

- Time of the day

- Holding Time

- Months & Quarters

and compare all these trading metrics against each other. What is interesting is a relative comparison of different periods starting from April 2021 against each other. Also, an interesting composition of the yearly review is the win/loss ratio. Even though Harry had a 22% win ratio (see the blue portion of the pie chart below), his P&L was consistently positive throughout Q2, Q3, and Q4. By eliminating the so called “energy wasting trades”, this percentage should increase and this should have an impact on the overall P&L.

There is one highlight that stood out the most for me in Harry’s analysis and also this was big takeaway for him going into 2022. Going forward, it was the focus on increasing his size in A setups. Harry refers to this as trades where he should “5x his size”. Knowing which trades to press, can dramatically improve his performance in 2022.

Trader Isaac

A yearly performance review should be really about understanding things of the past you can improve going forward. You can either start working on eliminating your weaknesses or improving your strengths. In this yearly trading review, trader Isaac has focused on these 4 loops that previously held him back:

- Trading Markets Of Poor Participation

- Choosing Between Multiple Scenarios

- Days After A Big Winner

- Planning Being Too Narrow

He has broken down these four loops into problem diagrams (see the video down below) and has defined a circuit breaker for each of them. Highlighting key features of the problem and future development has enabled him a proper goal setting for the year ahead. Let’s have a look at what I mean by that.

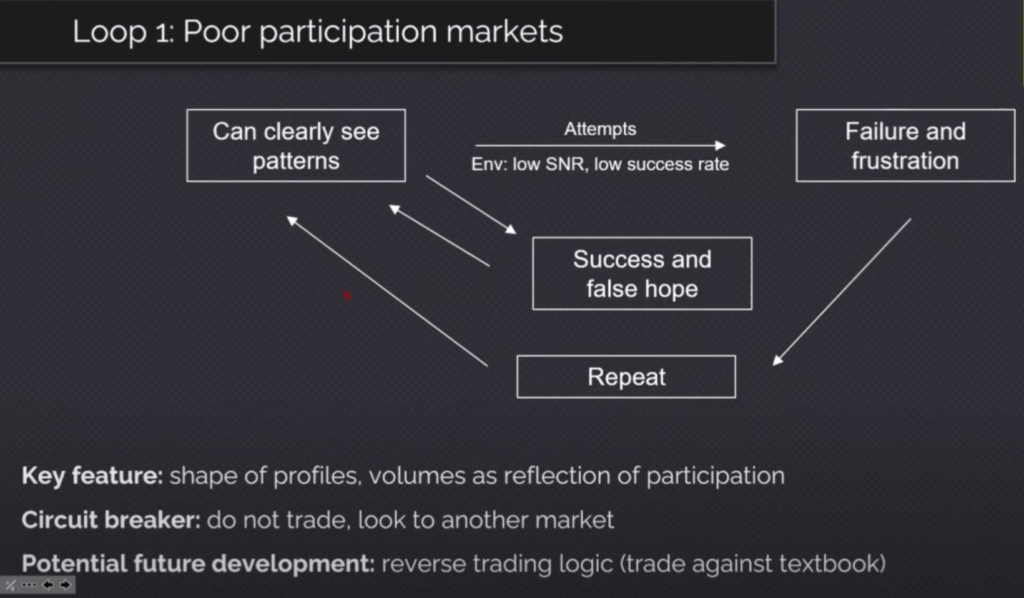

Here is one example out of four, that Isaac calls loops. These are behaviors that have certain cues, something that triggers his negative behavior. In the image below, you can see an example where a simple market pattern but without proper market participation triggers him to act. Failure and frustration leads him back to repeat the same poor behavior and occasional success gives him hope to try this strategy again. This creates the endless loop. In this particular case, he has identified a circuit breaker like this: avoid this trade because it is a trap trade with a low success rate. The pattern is not a trade. Avoid the false hope that it provides from time to time when the pattern succeeds and your dopamine center gets rewarded.

Also, have a look at how he tries to use the negative side of this behavior in his favor. In the potential future development, he looks to reverse the trading logic aka, trading against the textbook. In other words: do the opposite then what you doing and you might see dramatic improvement in your own trading.

Trader Tom

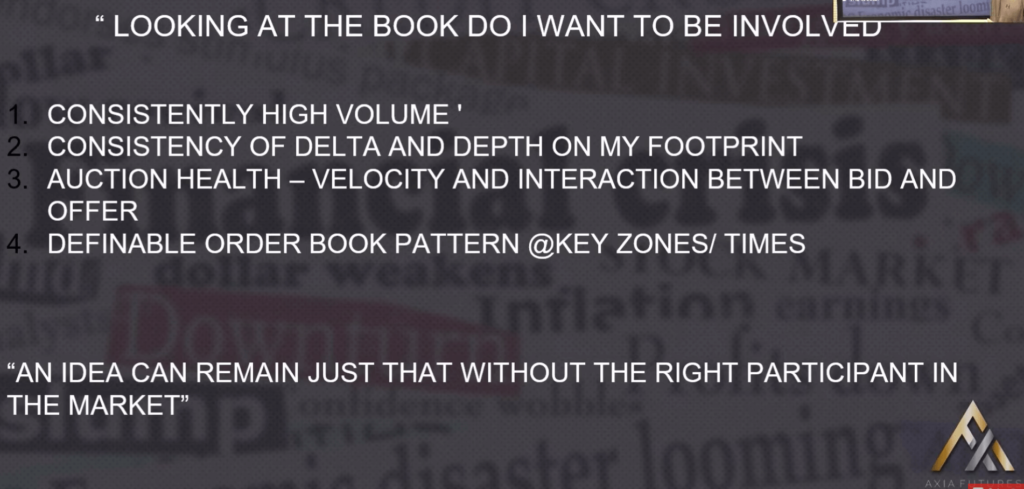

“An idea can remain just that without the right participants in the market”.

For this trader, the past year has been a journey to narrow down his trade selection techniques and a battle with his own psychology. The battle of patience, waiting for the right conditions to hit the market. Something what every trader has to face on a regular basis. From a key backbone process to focus on, to specific criteria that turn the idea into an actionable trade. Here is one key slide of the presentation that stood out to me. Why?

I like how it highlights in four steps what this trader wants to see for him to act. The more exact criteria that would narrow down his selection process and enable him to be more patient. The idea is nothing unless he can answer the question:

“Looking at the book do I want to be involved”?

Final thoughts

As you can see, each trader had a slightly different approach to the yearly trading review. It is all about one thing and one thing only: the method of a review must work best for you. From complex to most simplistic, it is all about looking honestly at your errors and limiting behaviours and eliminating them one by one through a diligent and disciplined process.

Here are some final quotes from trader Tom, that might resonate with you.

Thanks for reading and good luck in 2022.

Don’t forget to check out articles you might also like:

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.