At the European Central Bank meeting on 11 March 2021, the ECB decided to increase the pace of its weekly bond purchases in order to counter an unwarranted rise in European long-term yields that was sparked by US inflationary pressures.

As this decision came as a surprise to the analysts’ expectations, one could have expected a “straightforward” rally in European government bond markets on the back of the announcement.

Instead, the initial market reaction was very choppy which resulted in many traders on our floor losing their conviction and giving up on their long positions as the market didn’t react the way they expected.

In this article, we explore how our elite trader Demetris executed the announcement. We will see how he actively managed his positions in the initial choppy phase of the trade which allowed him to stay in the trade and run his long position for a big winner.

Watch The Live Trading Recording:

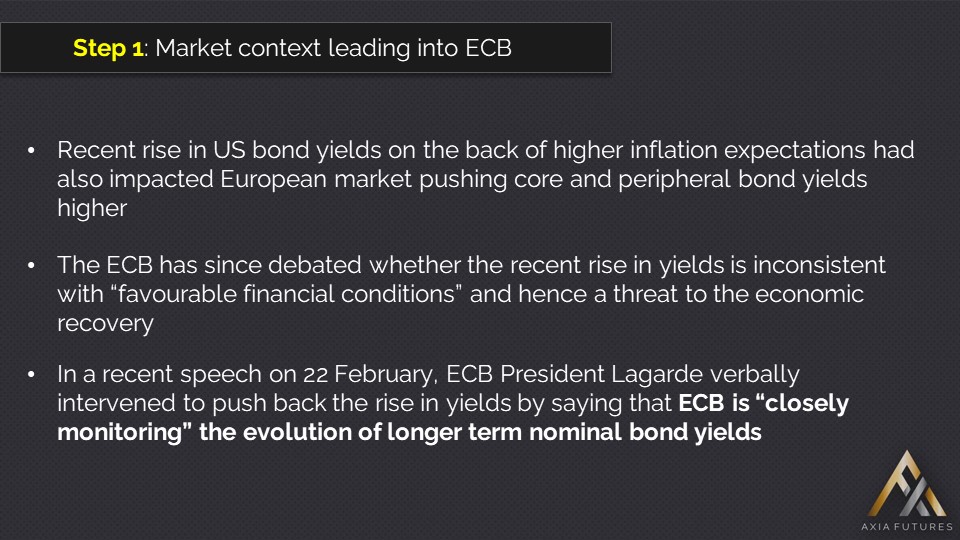

Market Context

After some verbal intervention from ECB officials where they expressed their concern about the recent rise in Eurozone yields, the market was waiting to see how the ECB would actually react and whether it would take action to counter the rise in yields.

Analysts were divided as to whether the ECB would just stick to verbal intervention or whether they would go a step further and actually communicate an increase in the pace of monthly bond-buying under the PEPP (Pandemic Emergency Purchase Programme).

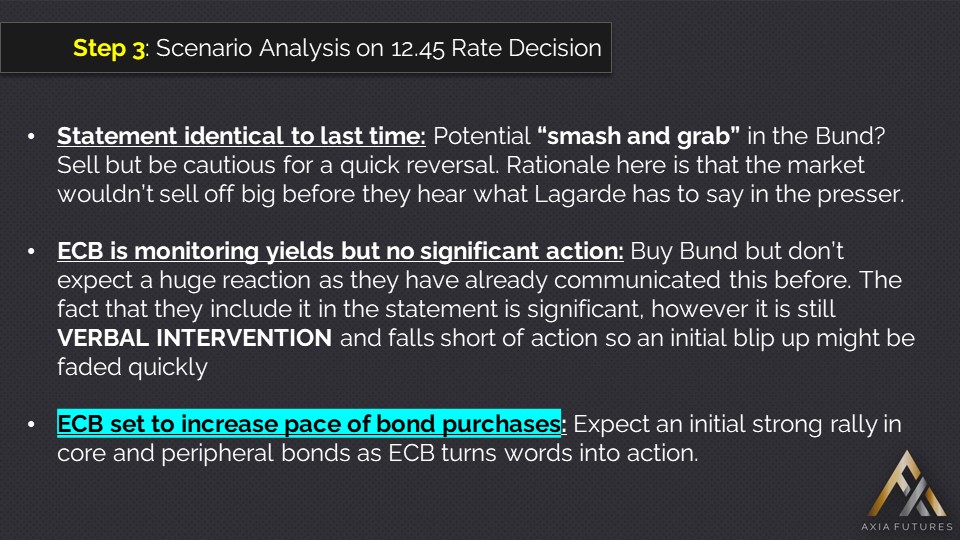

Scenario Analysis

In the Hawkish-Dovish spectrum, we have three distinct scenarios that Demetris was focusing on executing. A statement that was identical to last time would be considered as hawkish (as ECB wouldn’t be addressing the rise in yields) whereas an increase in the pace of bond purchases would be considered as the most dovish. The Bund (German 10-year bond) and Buxl (German 30-year bond) were the main markets the elite trader was planning to execute in.

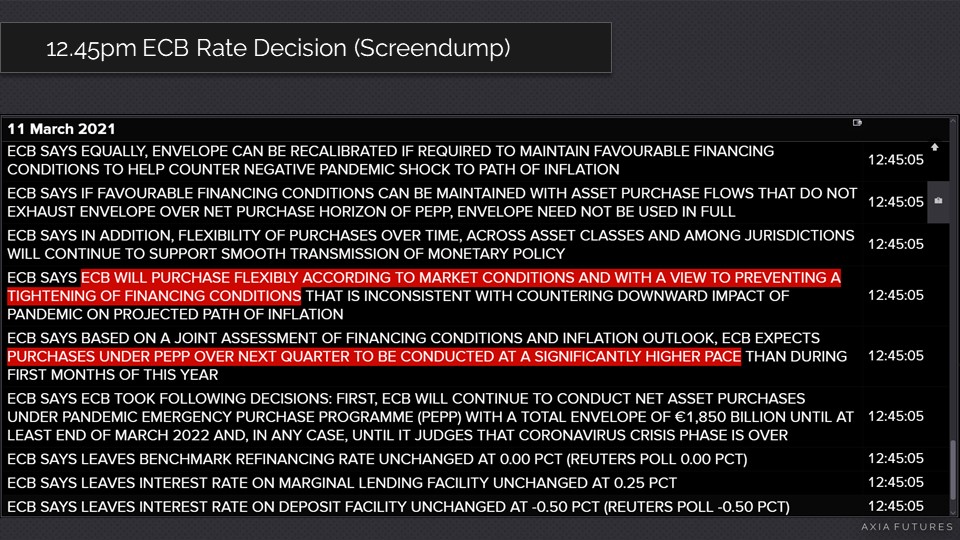

12.45 ECB Rate Decision

At 12.45 pm London time, the ECB released its Rate Decision and accompanying Statement. Scanning through, we can see that two significant lines were added in. The first one said that the ECB will be purchasing bonds flexibly with a view to preventing tightening of financing conditions, and most importantly a second line indicating that purchases under PEPP to be conducted at a significantly higher pace. As specified above this was one of the most dovish scenarios.

Execution of the Dovish play

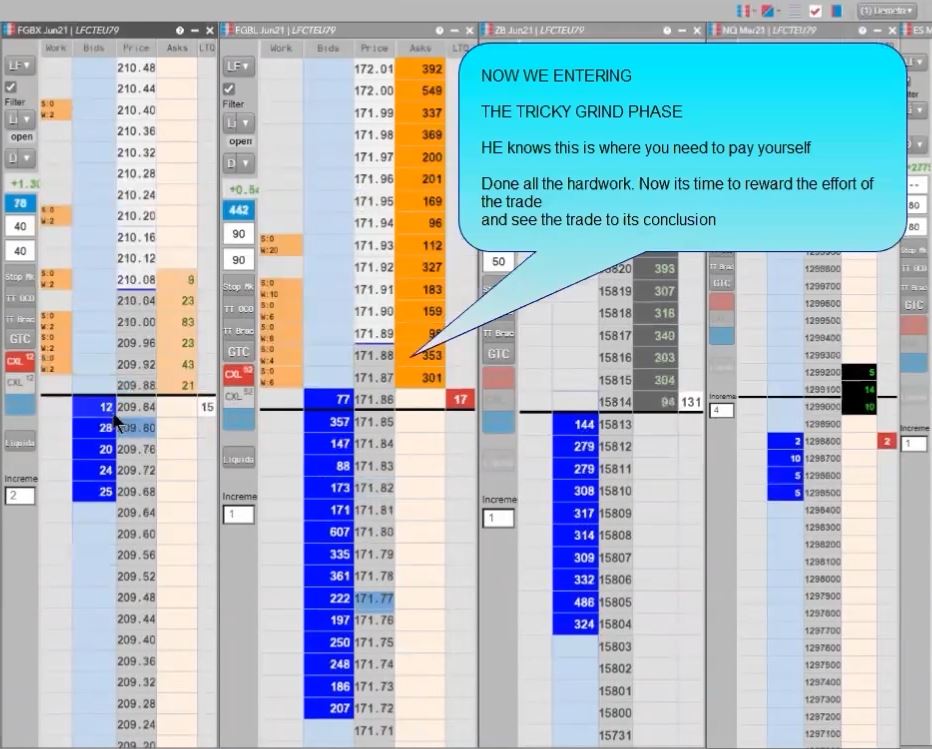

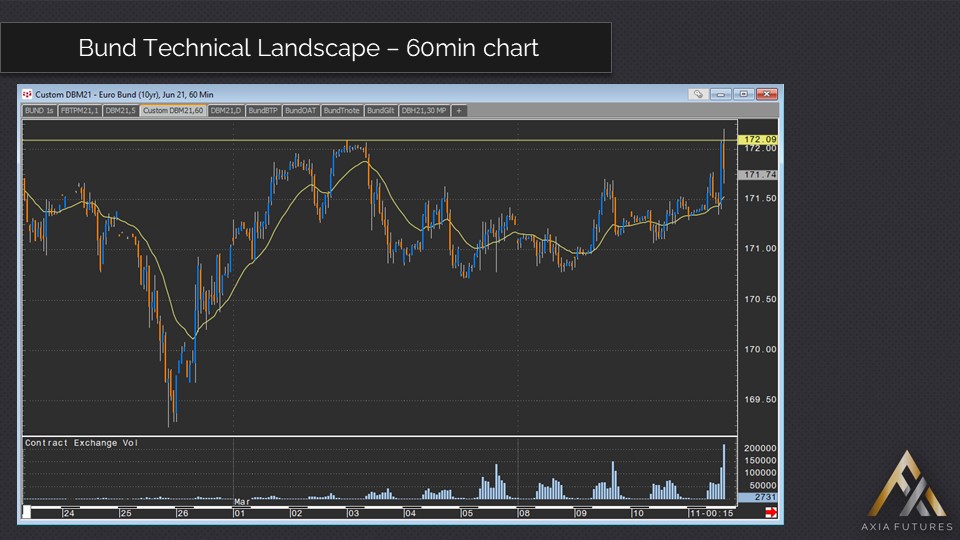

As soon as Demetris spotted the changes in the ECB statement he immediately started buying the Bund. Although in theory, the move-up should have been clean and fast as the statement deviated from analysts’ expectations, the initial reaction was surprisingly very choppy.

A quick 16-tick move in the Bund (from 171.54 to 171.70) was followed by a full retracement in the next few seconds. And this was followed by a few minutes of aggressive sideways price action with the bund oscillating in a range multiple times. This kind of price action is not what a day trader wants to see when he buys big size on a high conviction trade. He would expect to go onside straight away and then focus on running his winner. But on many occasions, the market will not react as people expect, and this makes traders lose their conviction and give up on the trade early on.

In the video above, we can see how our elite trader managed his trade in this initial phase of the event with the aim to maximise reward if the trade went his way, whilst keeping his risk in check if the trade never worked. This constant refinement of his position eventually allowed him to run big size (max 580 Bund and 80 Buxl) in the second more “grindy” phase of the trade, until the long position reached his technical target. Once the big daily technical level in the Bund was taken out, he significantly reduced his exposure and locked a P&L of over $220,000.

Key takeaways

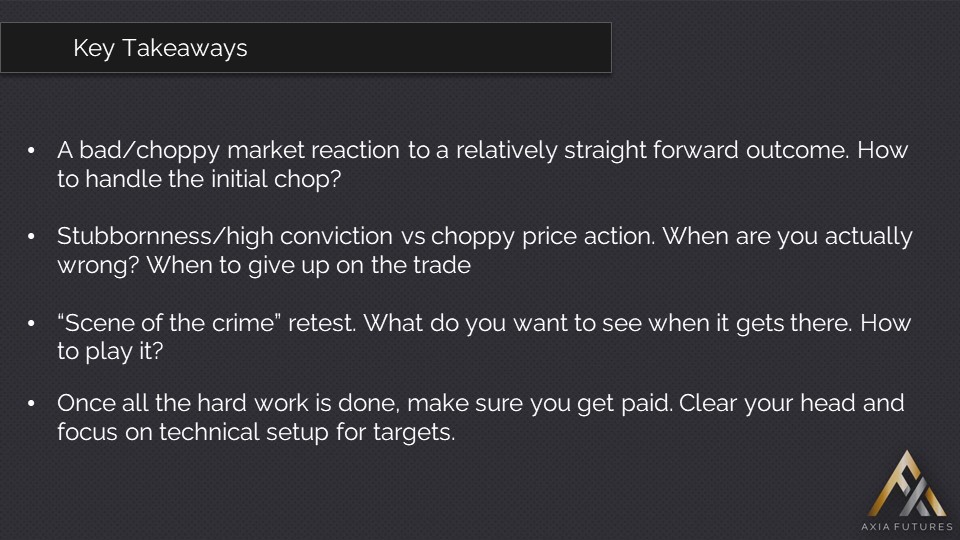

On high-risk events like the ECB or the FOMC Rate decisions, the first few minutes after the statements drop, markets are dominated by huge volatility and often wild swings as market participants try to analyse the statement and execute positions within seconds.

Sometimes the markets might start trending instantly on the back of an unexpected announcement, however, on many occasions, the market can move up and down violently for minutes before it settles into a trend.

What is hugely important here is that a trader does not give up on his conviction in the initial choppy phase of the trade. With active management of the position in the first minutes, one can allow himself to run the trade once the market escapes the sideways range and starts trending.

To see more examples of our elite trader execution on other big fundamental events, such as geopolitical events and central bank policy meetings, visit the AXIA Elite Trader playlist on our YouTube channel.

FREE Webinar Sign Up: https://www.elitetraderworkshop.com/

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Twitter: https://twitter.com/AxiaFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Instagram: https://www.instagram.com/axiafutures/

Facebook: https://www.facebook.com/AXIAFutures/

Medium: https://medium.com/@axiafutures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy