Elite Traders Trading Execution Playlist Introduction

In this blog post, we will revisit the Axia Futures YouTube video archive and watch the Elite Trader’s price ladder execution playlist. We will specifically focus on the execution of the Elite Traders using the price ladder by providing you with the specific time, where the price ladder execution begins. Each video will be accompanied by a theme and a learning question dedicated to improving your trade management skills so you can make the most out of the order flow mastery of these traders. On the importance of high-quality questions, we have also written an article (Trading Techniques To Become More Profitable Trader) you might find helpful.

Let’s get started.

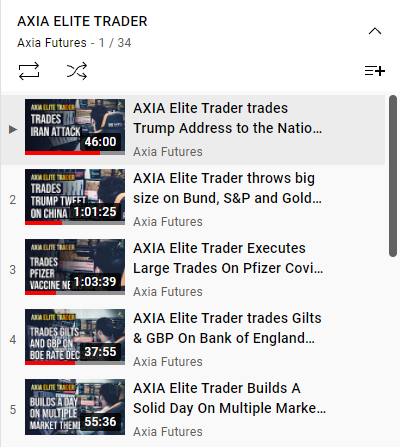

Axia Futures Elite Traders Playlist

In case you have not been aware, there is a whole list of high-quality content of Elite Traders videos that we have shared with the trading community.

Click on the image above or this link to find the full list.

Axia Futures Elite Traders Price Ladder Execution

Elite Trader Trades Trump Address To The Nation After Iran Attack

Price Ladder execution starts: 20:48

Theme: With the beginning of 2020 there was a dramatic escalation in tensions between the US and Iran after Trump ordered an airstrike on Jan 3rd that killed top Iranian military commander Soleimani. After this, Iran pledged to take “severe revenge” and markets started getting nervous about the prospect of a military conflict between the two nations. Oil and Gold surged on geopolitical risks after the US strike while equities and risk-assets sold off. The markets were nervously awaiting Iran’s response although there was hope for a diplomatic solution and an avoidance of Iran’s retaliation.

Question: How would you describe the trader’s scaling strategy when the market was not moving in favor of this trader?

Elite Trader Pushing Performance Boundaries on US-China Trade Commentary

Price Ladder execution starts: 21:38

Theme: On Monday morning, while attending the G7 summit, Trump commented that China called the US and is willing to restart negotiations with the aim of achieving a trade deal. This was a surprisingly positive development that should cause risk assets to rally and safe-haven assets to sell off.

As soon as those headlines hit the wires, our Elite Trader positioned himself aggressively in S&P, Gold, Yen, and Bund. Knowing how those markets were caught off guard by these comments, he expected an aggressive unwinding of the overnight moves as traders would rush to square their positions.

Question: Given the risk-on environment, what was the order/priority of the products this Elite Trader hit in order to achieve maximum return? And why?

Elite Trader Trades Gilts & GBP On Bank of England Rate Decision

Price Ladder execution start: 15:04

Theme: As the BOE Rate Decision was released at midday UK time, the BOE said that it will “engage with regulators on how to implement negative rates”. This statement was taken by the market as a signal that the BOE is moving closer to cutting rates below zero for the first time in its history.

Although initially, markets were a bit slow to react, as the comment got wider attention, Short Sterling (UK short-end bonds) futures started catching a bid, indicating market participants started bringing forward their expectations for negative rates. Gilts (long-end bonds) followed STIRS higher while GBP started selling off.

As the comments drop, our trader starts executing by feeding a few clips in the Gilts, while also selling the Cable (GBP). As the volume in these markets picks up and as the velocity and order flow dynamics shift and become more aggressive, he adds to his positions. He buys over 300 Gilts, sells 180 Cable, and buys 360 lots in the Short Sterling. Although after a first move up in Gilts the market stalls for some time, he decides to stick with his trades and hold the majority of his size for a second leg-up. By holding on to his positions he manages to double his P&L for the day.

Question: There was a moment when the Gilt market started to stall and possibly put the trader’s position in danger. The trader held that position thanks to the correlation with another market. What was the correlated market that gave him the conviction to hold?

Thanks for reading.

Don’t forget to check out articles you might also like:

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK