3 Day Trading Tips For Breakout Strategies Introduction

In this blog post, we will discuss three day-trading tips for breakout strategies. Trading breakouts is not as easy as it sounds. Usually, it seems good on paper at first but when you start to go down the rabbit hole, you find out that there are many nuances that make it hard. And it makes sense, it must be hard because breakouts are relatively easy to spot, therefore your breakout trade can be just a great liquidity opportunity for someone on the other side. Having said that, there are three clues that can make your breakout strategy more robust. Let’s explore what those clues are.

3 Tips For Day Trading Breakout

Ripe For Breakout

A general rule of thumb is that the longer the range is being built, the more energy (movement) is gonna be released once broken. The problem with range breakouts is the timing. If you would be selling too early, you would get destroyed by many unsuccessful attempts. Of course from hindsight, it is always easy to pick one particular point when breakout worked and neglect all the previous ones, but if you were actually trading this setup, it is a different story. But this is just one part of the equation. Let’s call it: Time + Compression= higher potential for energy release and success of a breakout.

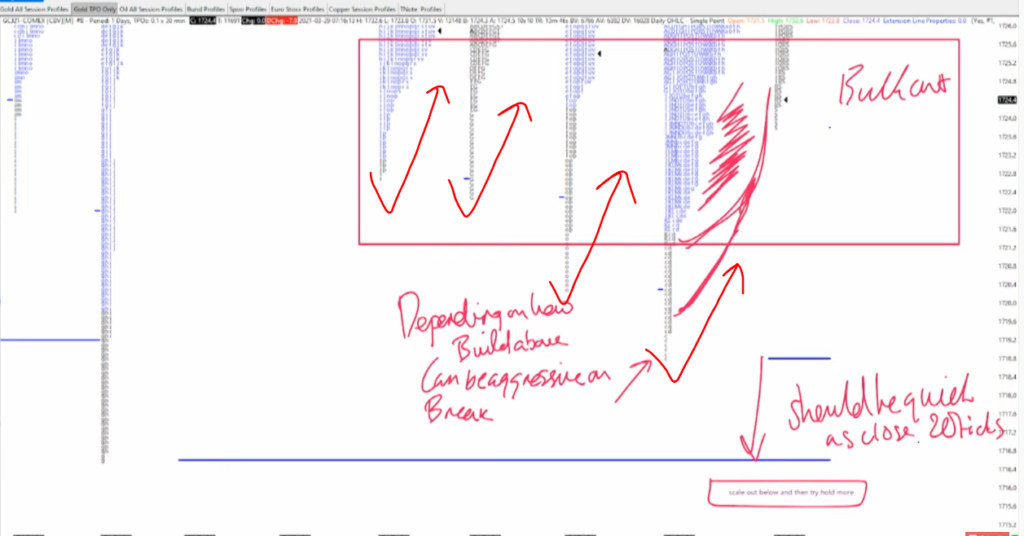

Here is an example: As we are nearing the proper maturity of the multiweek structure, the market keeps reacting with buying tails (see red arrows). This is not a structure we want to see for the breakout. We want to see positioning being built near the tails. We need to “bulk it out”. This is the second part of the “ripe for opportunity” equation. The Character Change.

As one of the Axia Elite traders has once stated:

So remember, Time + Compression + Character Change = increases the odds of your breakout working. Read more about this in “Trading The Multiweek Range Gold Breakout” blog post.

Calm Before The Storm

If we were to analyze many different breakouts, we would focus on highlighting two important aspects:

- The best breakouts come when markets consolidate ahead of the break

- When we see a lack of initiative at the low prices, it is a signal that break won’t have follow-through until it does

What do we mean by the second point? Point number two is about seeing the initiative with the break. We want to see the change at the location, that lacked initiative in prior instances that failed to break.

We want to see that those responsive actors who previously defended the position are gone. This usually creates the last accumulation leg that tends to be very tight. A common mistake we all make is that we are not willing to wait for this tight accumulation and we jump early into trades.

Remember that the calm before the storm signals a change from previous instances. Use it to your advantage. Seek full example in “Two Breakout Strategies For Futures Markets“.

Rotation Retests

Every time we enter a trade, we are agreeing that we will participate in a rotational market. Most of the time market does not go in a straight line from access to the exit. Although we would love to believe that, that is not a reality of trading. So we need to be realistic about what the market will really do. One thing we can bet on is that market will be rotational. The market will present us with rotational retests.

It is our job before we enter a trade to visualize what those rotation retests will look like. What we want to see and what we don’t want to see. Here is an excerpt from one of the trades trader Harry took:

If we zoom in on the chart below, we are looking at the 1second chart. In this chart, it is clear where the break itself was tricky. If you watched the video, you might have noticed that Harry got squeezed a bit at first. He got squeezed but stayed in the trade. Specifically, he has mentioned, that he has observed many Gold breakouts and found out that they often share similar characteristics. Like a difficult start. Let’s break the stages of trading the Gold down below.

There were three stages worth mentioning that can be sometimes very typical for a Gold breakout and each trader must be aware of how to handle those stages. You can read about those stages in “Trading Gold Breakout Using Market Profile And Price Ladder“.

Going back to our original idea about rotation retests. Ask yourself: what are reasonable rotations that the market will follow based on your deeper understanding of how the market trades when it gets into your specific situation and setup? How many retests of these rotations are within the norm of your understanding of the market?

If you want to learn how we perfect our breakout strategies don’t forget to check the free webinar we are running at: https://www.elitetraderworkshop.com.

If you liked this type of content, you might check these videos as well:

- What Markets Do You Select When Trading – Price Ladder Trading

- Key Observations To Stay In A Trade – Price Ladder Trading

- 3 Reasons To Get Into A Trade – Price Ladder Trading

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK