Trading Gold Breakout Using Market Profile And Price Ladder Introduction

In this blog post, we will be looking at Junior Axia Trader trading Gold breakout using market profile and price ladder. In the video down below, Harry explains his order-flow tactics. He explains how he got into the trade, how he held the trade through the initial squeeze, and eventually added and managed the position. We will look at the context of the trade and zoom in on the 1sec chart to explain what is not so obvious from the price ladder. If you like this type of content, check our previous article: “How To Sustain Multiple Break Failures And Profit In The End” which uses similar tools such as market profile and price ladder. Let’s get into it.

Gold Breakout Analysis

Market Profile Context Of Gold Breakout

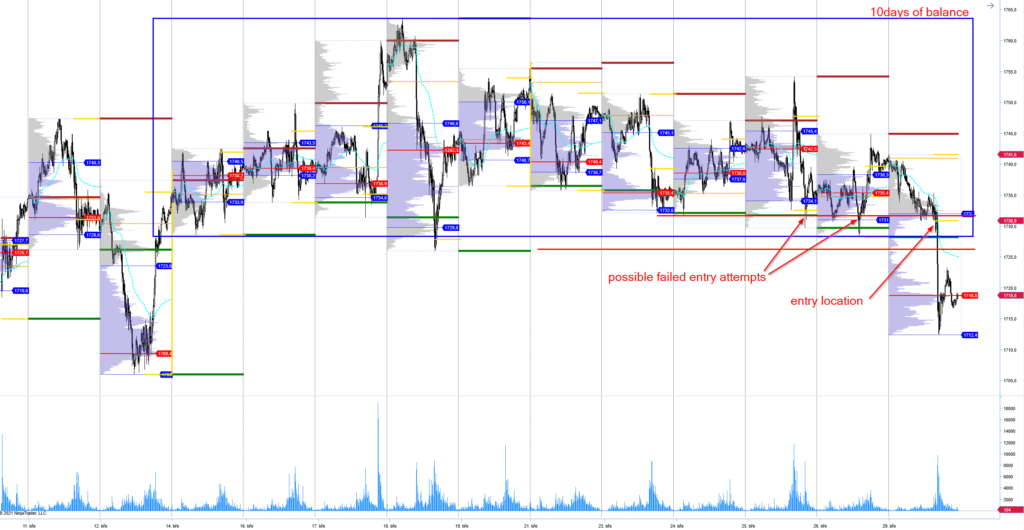

Before diving into the trade, let’s have a look at the structure. We are looking at the trade that has been forming over the last 10 days inside a larger balance area. The idea behind the trade is the energy release of this trade the moment the low gets broken. The tricky part is the timing. Not all breakouts lead to winners, but given the structure, we must be willing to try multiple times because the reward should be much greater.

Micro View At The Gold Breakout

If we zoom in on the chart below, we are looking at the 1second chart. In this chart, it is clear where the break itself was tricky. If you watched the video, you might have noticed that Harry got squeezed a bit at first. He got squeezed but stayed in the trade. Specifically, he has mentioned, that he has observed many Gold breakouts and found out that they often share similar characteristics. Like a difficult start. Let’s break the stages of trading the Gold down below.

There were three stages worth mentioning that can be sometimes very typical for a Gold breakout and each trader must be aware of how to handle those stages.

- Initial Breakout Choppy Stage – usually accompanied by higher volume and heavy hitters (the red numbers highlight heavy hitters that are clipping 50lots or more). This is the most choppy stage of the whole Gold breakout cycle. The stage when we must expect to have clearly defined risk and have the gut to hold even when a position goes against us until the risk-defined level. Usually, you can get scared by multiple touches of your risk level before the market starts to go lower again. This is the part when it is easy to get scared and cover fast. In this case, the market touched our risk level 3x before rolling lower again.

- It’s Going Stage – if you sustained the hard stage, stage 1, you have no reason to cover it. The market is now in the price discovery stage. Stops are getting triggered. People who are late to the party jump in and buyers passively accept the new prices. Unless there is a reason2cover (news, massive volume reversing sharply the price action), you must hold onto a trade.

- Capitulation Stage – no matter which target you have in mind, if you go for multiweek balance breakout, I have observed it is better not to have any target in mind and simply follow the volumes for final puke. Ideally, you want the move to end with the highest volume on the day and then observe for one last probe below. If we quickly come back, we most likely have the low of the move. If we come back mildly, there is a chance for the additional leg. Many times in the past, my targets were too conservative and I missed an additional 50-100ticks move given the context and magnitude of the move just because I had a target. Something to consider.

Now after watching the video and reading the post, ask yourself these questions:

- How well do I understand each stage of my setups?

- What is my self-talk accompanied with each stage?

- What is the one thing for each stage I can improve that would make me a more consistently profitable trader?

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Do you like what you have been reading? If you would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading again and until next time, trade well.

JK