When Change Presents A Reasonable Trading Opportunity Introduction

In this article, we will discuss time horizons when change presents a reasonable trading opportunity and how it differs between the timeframes. It is the significance of the clues that will lead to reasonable opportunity from both the short term and long term point of view. From positioning and structure to significant levels that were respected in the past. We will use these views to create a trading opportunity on one timeframe while maintaining a “no change” view on the other timeframe. Let’s get started.

This article is based on the context discussed in the video down below.

Spotting A Change

When evaluating trading opportunities, it is important to understand the broader picture and context in which we are trading. Given the market-generated information, we are constantly building a narrative for our next best trade and we should be asking questions for our short-term and long-term narrative: Has something changed? There are endless variables that can change but just some highlights from the video are:

- Trend

- Structure (using Market Profile)

- Context

- Important Levels

- Sequence

- Volume / Range (where it is rising/falling)

- Energy build-up/Positioning

It is the sequence we apply for short-term and long-term assessment that brings reasonable change. Understanding the sequencing, the source code of our strategy leads to trades that are worth taking a risk. Let’s have a look at the short-term and long-term views and how they form our view.

Short Term Vs Longer-Term Trading Lenses

In the images below, we will be doing an assessment of Spoo opportunities. We will look at certain clues that lead both to trading opportunities but also highlight a “no change” view from the bigger picture.

View #1

Down below we can see a chart of Spoo (E-MINI S&P500). Spoo over time has created a vulnerable low at 67 level while creating a very balanced, mature structure. With lower highs leading into the break, we have a vulnerable structure in the bullish context. This can give us a clue, that we should expect a liquidation type of move rather than a change in the bigger picture trend. This information can adjust our target expectations. Given the break of 67 level, this becomes our line in the sand. The break has occurred 2 hours prior to US cash open on higher than average volume. Once the US cash open failed to produce a bullish open drive, the market started to offer heavily. This was our trading opportunity with well-defined risk and expectations for the target.

View #2

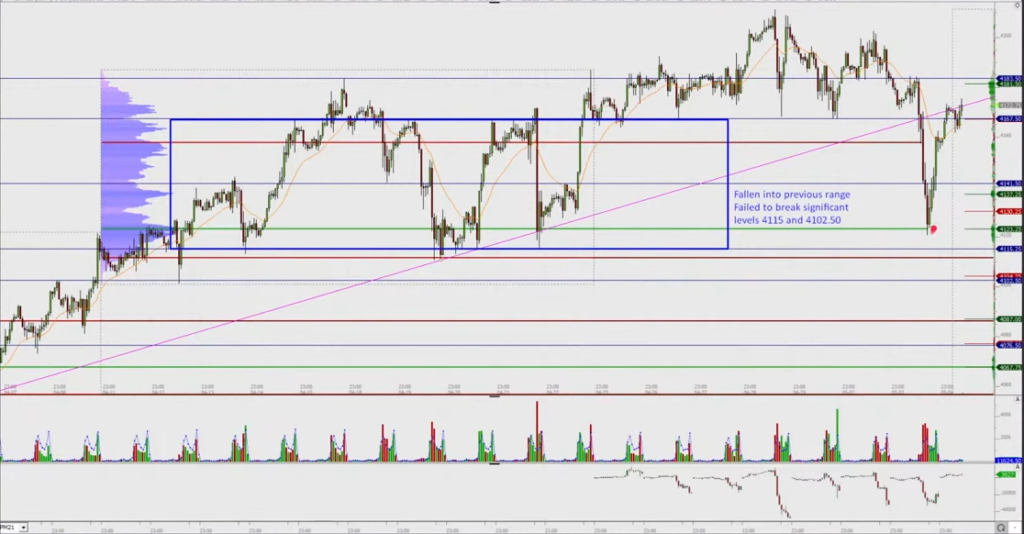

If we zoom out, given the trade we took, we can see that nothing has really changed. Yes, we have created a liquidation move that was short-lived. Even though we have seen an opportunity thanks to structure to go short, this liquidation move served as a good opportunity for buyers to buy into Spoo at more favorable prices once we traded back in the middle of the previously traded range.

View #3

Looking at the big picture, putting the trade into even broader context (see the red dot on the top right), nothing really happened. Yes, volume and range are slightly higher than average but we are far from important levels and change of trend. We should keep monitoring the points of significant change while keeping an eye on a short-term view for trading opportunities.

Key Takeaway

Has anything changed? That is the question to ask when evaluating trading opportunities. But not only that. It is an important question not just for identifying opportunities but also for setting the right expectations for your trades. Something to keep in mind in your future trades.

If you liked this article, you might check these videos as well:

- Trading S&P Long Liquidation Strategy

- The Short Squeeze & Long Liquidation Explained

- Liquidation vs Trend Day

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK