Volume Profile VPOC Reversal Strategy Introduction

In my previous article, we have introduced how Volume Profile VPOC Strategy can be approached in your intraday trading. We now know, that VPOC level, is just another level on a chart, but when combined with other trading clues, it can become a powerful reference point for your intraday trading. Sometimes I might sound like a broken record, but trading is all about picking those clues and building your trading narrative. These narratives then can form all kinds of strategies, such as the strategies used for trading volatile markets, open drive, or reversal type of strategies. In this article, we will focus on using VPOC to build a basic component of our Volume Profile VPOC Reversal Strategy.

Before we continue, check out this article or watch the video down below, describing key questions one has to ask when addressing how to trade around VPOC. This will help you understand the approach we have chosen to formulate our VPOC reversal strategy. Alternatively, you can learn more trading strategies in our market profile course.

Market Tools Used In VPOC Reversal Strategy

Good strategies are created, when multiple non-correlated market tools produce a confluence of signals. In times like this, we must max our size and trade the most out of our strategy. In terms of market tools, that will help us build our narrative and formulate our strategy, we will use these market tools.

- VPOC (Volume Point of Control) – is the price, where most of the volume traded over the day

- Prominent VPOC – a trading day that has clearly one significant VPOC

- Opening – are we opening out of balance (out of value area), or out of yesterday range? Is the market trying to continue in the direction it closed with yesterday? Open gives us a clue where the market accepts new prices. We will be watching this activity carefully in our strategy.

- Trend – what is the prevailing trend over the last few days. Are we trending higher or lower? Are we in range? Are we breaking out of a multiday balance (multiday range)? Although these clues are not the crucial cornerstone of our strategy, they are nice to have attributes we should observe.

- Extremes – how yesterday high and low has been formed? Did it stop because of a lack of momentum or was it strongly rejected and excess/tail created at an extreme?

- Momentum – when a new value is created, is it supported by momentum move and volume, or is it lacking volume and momentum? Lack of momentum and volume will indicate that new prices are not accepted

- Gap – are we opening with a gap? Why are we gapping? Is the gap result of new market information (news that hit the market) or just by price discovery acceptance? Is the new gap price accepted or rejected? Is there follow-through in the direction of the gap, or are we fading back, filling the gap?

You might be thinking, that there is a lot to cover and it might not make sense where I am heading right now, but please bear with me ;-). It will all start making sense when we lay the ground with market principles. By the way, there is a great video on market auction and absorption principles, that can put a few things into perspective, definitely nice to have to watch.

Market Trading Principles

Before we will apply market tools described above, let’s define market principles, that will help us in our Volume Profile VPOC Reversal Strategy. Why principles? In trading, we always try to abstract trading concepts into repeatable templates, we can apply over and over again. This abstraction enables our brain to quickly recognize the market condition and based on that chose appropriate strategy. That’s why we need Principles. They should ideally tell us a universal and timeless story about market dynamics and provide a repeatable template for our trading strategies.

Let’s have a look at what principles we have used as building stones for our Volume Profile VPOC Reversal Strategy.

Principle 1: Price Discovery

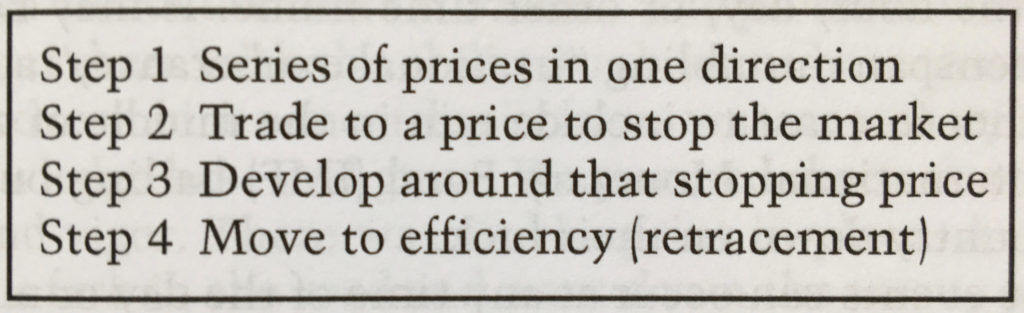

The purpose of trading is to facilitate trade between buyers and sellers. Based on market profile theory, the market is constantly in flux between two modes: excess and balance. Excess (trend) leads to balance (range), balance leads to excess. If we would break down these modes and used Steidlemayer concept of four market stages, the market is constantly unevenly rotating between these four stages, constantly searching for the fair price:

Principle 2: Fair Price

The price that is accepted the most by the amount of volume traded is considered fair price. The market has found interim equilibrium.

Principle 3: Return To New Equilibrium

Any price move out of balance, that is not accepted as fair price by market participants, continues the price discovery mode until a new equilibrium is found.

There is a great video about understanding market imbalances using a market profile, in case you would like to dive deeper into the subject.

Volume Profile VPOC Reversal Strategy Rules

Trading Rules

Now, if we combine those three principles together: Price discovery + Fair price + Return to a new equilibrium, we can deduct trading rules for our trading strategy.

Must Have (mh) Trading Rules

- a) The market is moving out of yesterday value producing either gap (at the opening) or directional movement

- b) The market cannot continue further (price is not accepted further) in the direction of the opening

- can be anywhere between the opening and end of the session, the longer the worse, because the market is clearly accepting new prices

Nice To Have (nth) Trading Rules

- a) Yesterday day type produced a Prominent VPOC (usually dominant in balanced type of days)

- b) Yesterday day produced an excess tail

- c) Trade is taken in the direction of the recent trend

- d) The balanced day was created after move out of balance

Application of Trading Rules

Hopefully, by now it will all start making sense :). Time to get a return on time invested in reading this article. Let’s put this all together. There is no better way, then an image that describes rules defined above.

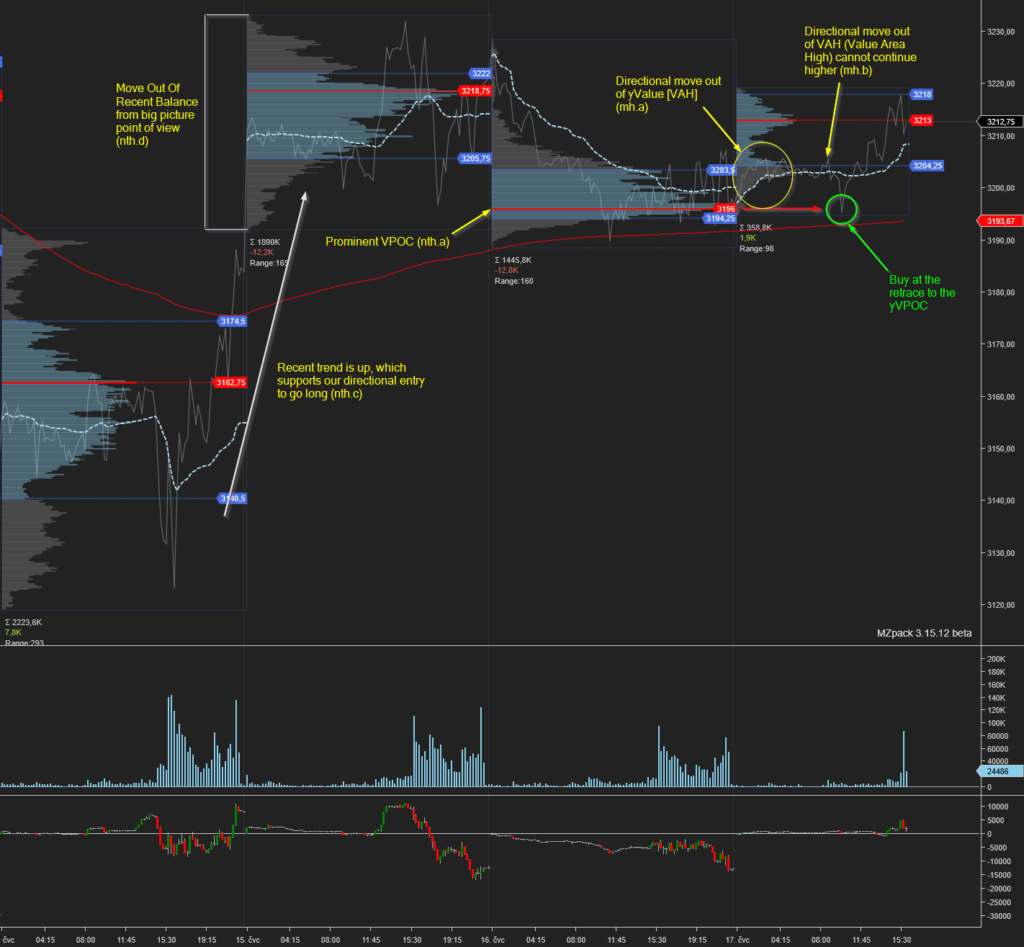

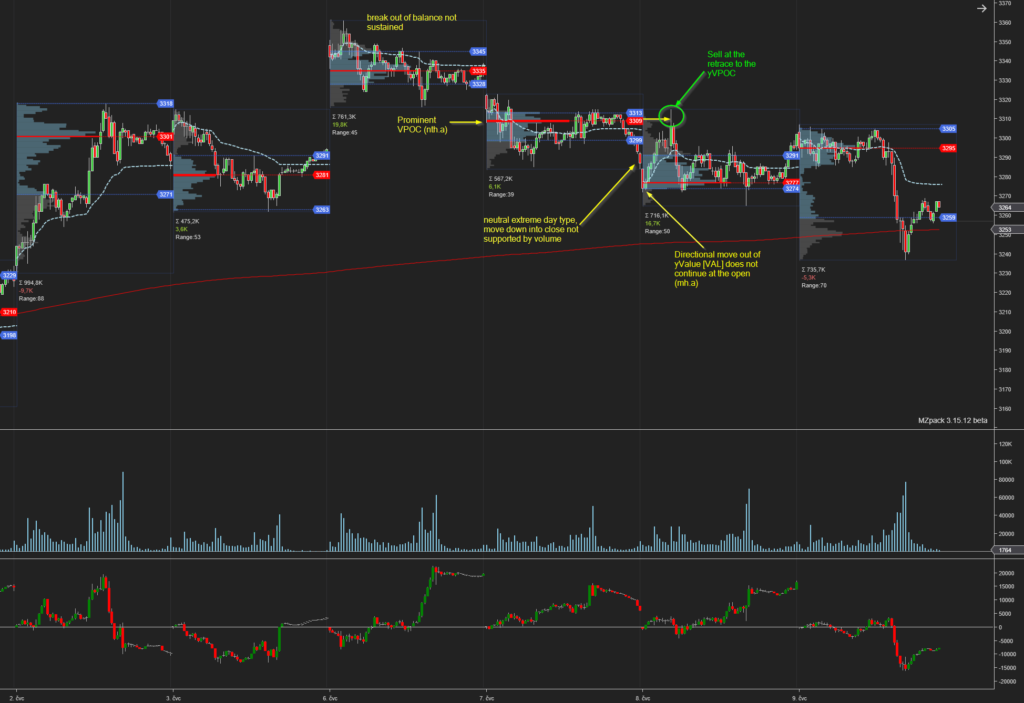

In the image above, you can see, that we have fulfilled all “must-have” (mh) rules and most “nice to have” rules (nth). To describe the story that the market is trying to tell us, we will use our principles and rules to check if conditions for our strategy has been met:

The market made a trend move (nth.c – check) and made a move out of recent balance (nth.d – check). Then balanced for two days, and in day two created a prominent VPOC (nth.a – check). Then on the day of our trade, we have created directional move out of yesterday’s value (mh.a – check). This move was not sustained and there was no follow through with momentum (mh.b – check). This lack of momentum created a move back towards our point of entry, our VPOC. VPOC then produced a great entry point for our trade and should be managed according to trade management strategy, something we will not cover in this article, but you can check one trade management strategy that you can potentially apply.

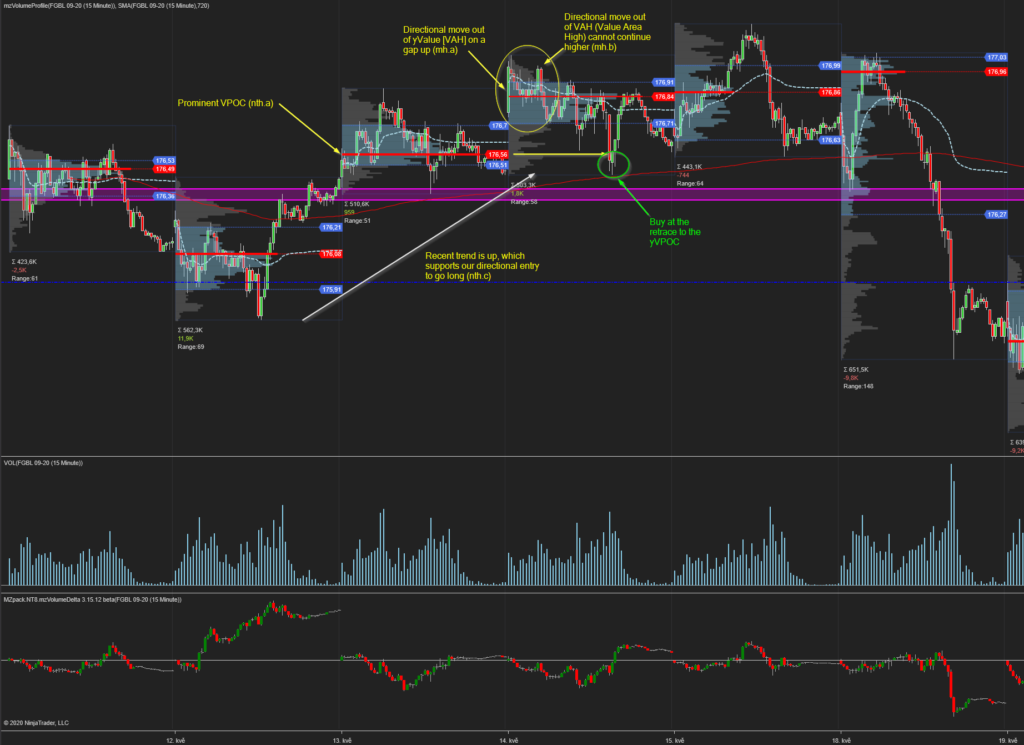

Now that you understand how to read the chart, apply rules and principles, check other variations of the same Volume Profile VPOC Reversal Strategy, and do the strategy rules checklist for yourself. Down below are other trades you can check for your inspiration (to get the full size, right-click on the image, and select open in a new tab).

Volume Profile VPOC Reversal Strategy Summary

We have used a top-down approach so that you not only can just copy-paste this strategy but also understand how and why this strategy works. I hope I was able to explain this reversal strategy as clearly as possible and you can now see what it means putting VPOC into perspective and turn it into a tradable idea and not just a reference price on a chart. Also, I would encourage you when building any trading strategy, always try to think in terms of principles and story behind your strategy. It will help you build trust in your strategy that would eventually lead to conviction and conviction to max size when everything clicks. It is in times like this when truly great trades are made.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that.

If you liked this type of content, you might check these as well:

- How To Trade A Price Action Reversal From A VPOC

- What Is Volume Point Of Control

- Power Of Initial Balance

Thanks for reading and until next time, trade well.

JK