VWAP Trend Trading Strategies Introduction

In this blog post, we will be breaking down the VWAP trend trading strategies. At first, we will be looking at using a VWAP as a trend-type strategy, holding the VWAP in a directional way on the pullbacks back to the VWAP. In the second part of this post we will use footprint charts and some additional clues that can be used when waiting for the VWAP signal. If you like these types of price action articles, don’t forget to check our previous blog post Trend Scalping Strategy To Trade S&P500.

This blog post is based on the content below and additional trade examples.

Why Use VWAP Strategy

VWAP stands for Volume Weighted Average Price. It is what it says on the cover: an average price weighted by volume. In general, the VWAP strategy is relatively simple. The VWAP is trying to indicate where in the given day is value. As a rule of thumb, if you are buying below VWAP, it is perceived as a good value to buy. On the opposite side, if you are selling above VWAP, it is a good value to sell.

Let’s have a look at a first strategy.

VWAP Buying And Selling Strategies

VWAP Buying Strategy

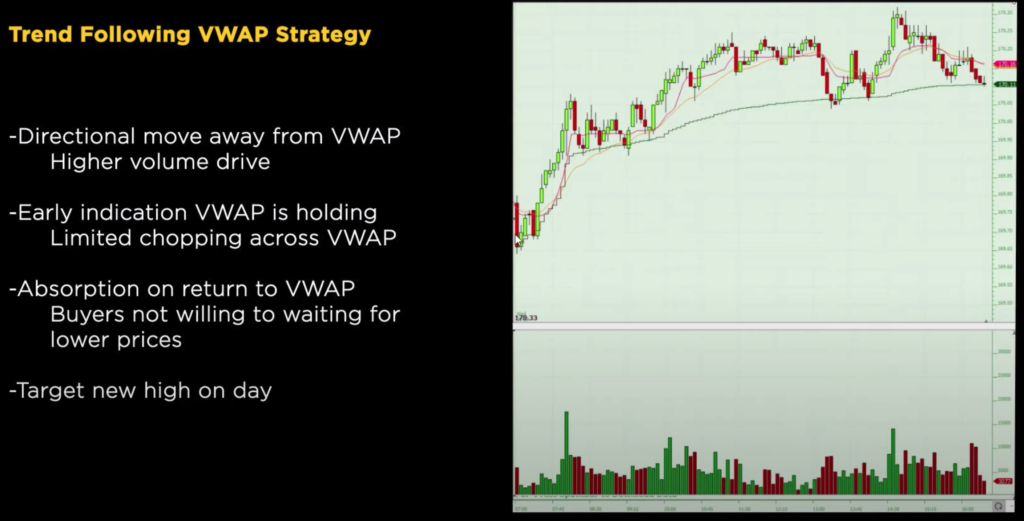

In this example, we are looking at the trade in the Bund. The idea for this trade is to expect a directional move. A move that gets further away from VWAP and returns back to VWAP. We are also looking for signs that on this day, VWAP is respected. As the market gets away from the VWAP, on the return, we are expecting the VWAP to hold. A signal for that to be true is the ability of the market to absorb at the VWAP price. The moment, you start to see reloading and good degree of absorption, your trade is on.

You are entering long as the market confirms that the price holds. Look at the price ladder, use footprint and define criteria what it means that market holds, what does it mean when market confirms the absorption you have been waiting for. Sign up for our free course, where we teach you how pro’s are doing it: https://go.elitetraderworkshop.com/Free

Additionally, as you develop this strategy you expand on clues that increase your conviction. One of the clues you can expand your conviction is a gap up day. As long as the market gaps up, trends and is unable to fill the gap, this is a sign that buyers are in control. A different clue that increases a conviction is a characteristic of a trend day. Look for single prints that are left behind. If single prints are presented, you have an additional sign that you might be experiencing a trend day and buying at the VWAP is a reosanable strategy.

Last but not least, understand which products under which conditions have a more tendency to respect VWAP. There can be periods of time where Spoo (S&P500) can respect it very nicely, but Bund is terrible at respecting VWAP and vice versa. Again, search for clues that make your trade a really high probability trade. Don’t just sell or buy any touch of the VWAP.

VWAP Selling Strategy

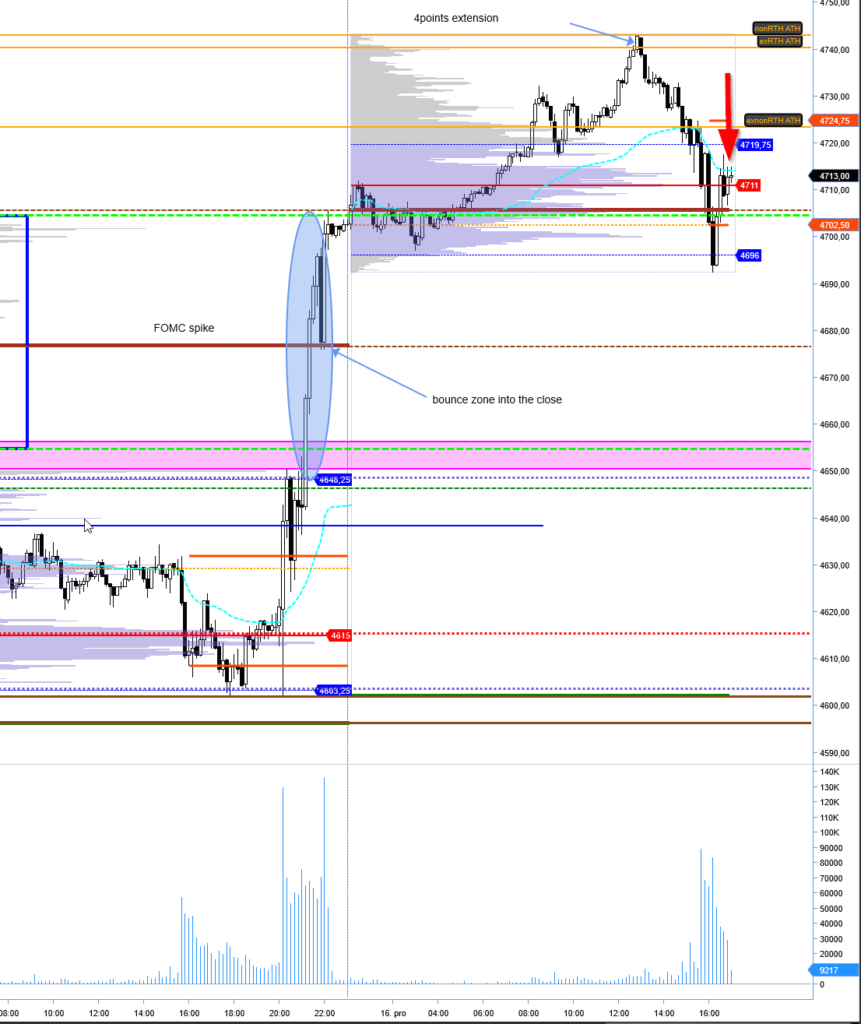

Now looking at the chart below, we are looking at the chart of Spoo. Spoo had an overnight session (nonRTH) bullish but after the cash open the dynamics has changed. All short-term traders that were long and had stops at the overnight low are out and market rallies back to VWAP. Moment of truth. Understand the context. If we found sellers at the VWAP, this might be a day when we at least revisit the overnight lows that we have flushed already and either make a new leg lower or create HL and revisit VWAP again. Let’s have a look at the clues we can use, to safely place a bet on revisiting the lows after the VWAP was touched.

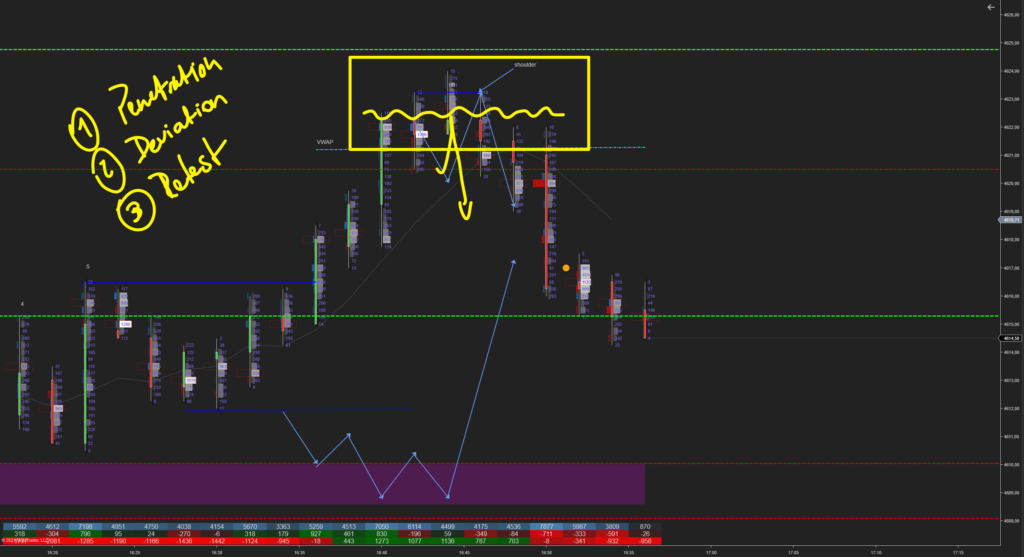

Down below you can see a 1sec chart of Spoo. The red and green circles are something I call Heavy Hitters. Larger participants that truly move the market. There is a set of clues that I want to see for me to get short the VWAP:

- Penetration – I want to see the market get to the VWAP and actually break it a little further. Why? I believe that the main purpose of the market is to seek liquidity. If only average liquidity is found at the VWAP, it can try to push further. So clue number one: break the VWAP to seek liquidity

- Deviation/Extension – once we are in the liquidity zone above VWAP, heavy hitters might try to push harder one more time to possibly trigger the next leg’s directional move. We want to see higher volume and ideally bigger players to get active.

- Retest – if the market is unable to push higher with the deviating probe, we use the location where the final deviation move initiated as a place to get short on a retest, with a stop above that deviation high (see the red arrow below). We target either low of the day or look for signs of absorption closer to the lows for HL(higher low) type of day to exit the trade.

Here is another day, a different example of Spoo VWAP reversal. Penetration -> Deviation -> Retest, this time from the footprint perspective.

Hopefully, now you understand, that there is more to it than just buying or selling at the VWAP. You can also see that there are multiple ways how you can do business around VWAP. Most importantly, you need to make them your own so you fully understand the trade you are taking and why you are taking it. It is all about listening to the market what works the best.

Thanks for reading.

Don’t forget to check out articles you might also like:

- How To Trade A Grinding Trend Day – Trade Strategies | Axia Futures

- Counter Trend Scalp Trade With Tight Stop | Axia Futures

- How To Use Single Prints To Trade A Trend | Axia Futures

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Trade well.

JK