Trading Moderna Vaccine News Across Multiple Markets Introduction

In this post, we will look at Harry and his trading of Moderna vaccine news across multiple markets. Although Harry executed trades on one type of news (Moderna Vaccine News), there are really two types of execution that deserve their own separate attention. Based on that we will split the video into two posts (Part I. and Part II.). Let’s get started with the first reaction to the Moderna vaccine news that happened at 11:52:12 London time.

This post is based on the video below.

Market Prep Leading To Trading The Comment

Every execution that is happening on the back of news that are expected but you can’t be sure about the exact timing requires two important things:

- a very well prepared execution plan

- alertness and focus to hit the market the moment the news is released

What do we mean by this plan? This is how Harry structured his plan:

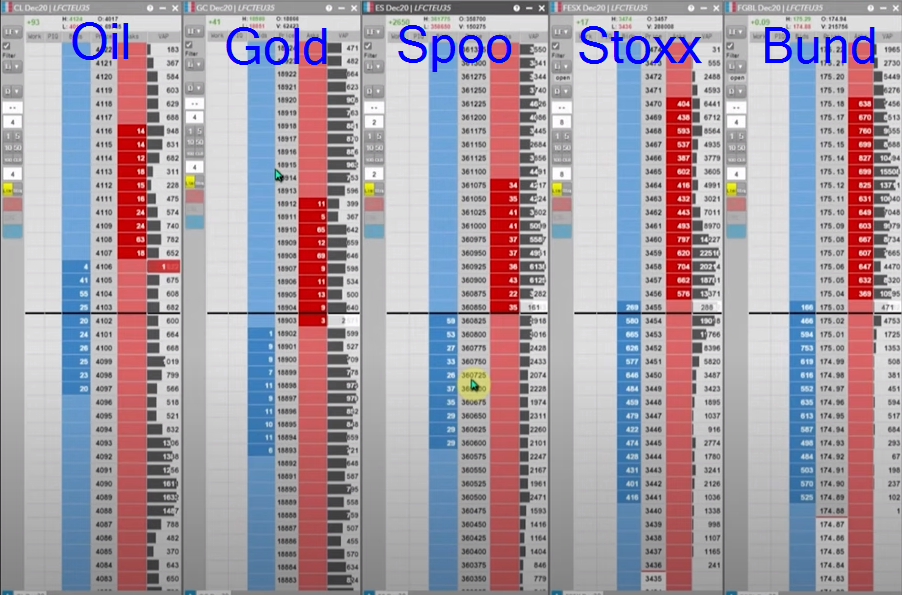

- Go through the markets you want o trade ie: SPOO (ES), STOXX (FESX), BUND (FGBL), GOLD (GC), OIL (CL)

- Ask yourself what markets will offer you the best risk-reward

- Understand the current market structure for each product you are planning to trade. Why? Because news can be a trigger leading momentum into a bigger picture technical landscape.

- Be aware of how the news can come out:

- Squawk

- Article (usually captured by Bloomberg/Reuters)

- Organize your workspace with your ladders to the event that is coming up or support the theme of the market you are following

- Set the correct clip size

- Which product is underperforming. In this case, Spoo and Stoxx’s relationship where Stoxx is underperforming over the last days and weeks can give you a better opportunity for market movement than Spoo.

- Define specifically what keywords you are looking for in the release. In this case, Harry trigger words were: “refrigerated temperatures”, “shelf life” and “% success“

- Adjust your expectations about the velocity of the move. In this case, Harry expected that the move won’t be any more such a market mover than the initial Pfizer vaccine news. Why? Read our article about “Diminishing value of news”

Last but not least, understand which product might be the best one to trade. Compound other reasons such as structure (technical landscape), other supporting news, potential RR, the velocity of the move. In this case, Harry liked the Gold not only for the structure but also because of recent disappointment regarding the stimulus.

Trading Execution

Big Picture Overview

Before we have a look at the actual execution on the back of the comment, let’s have a view of how the market reacted to the news. Down below you can see on a left screenshot of the comments that triggered the market movement. On the right, you can see the reaction of the market and the amount of ticks/handles it has moved after the comment was released.

You can notice that Bloomberg / Reuters headline consisted of the keywords Harry was looking for in his plan. An important aspect of the prep game.

Orderflow Execution

Leading into the execution, all things aligned, finally, the news was released. From this specific point, Harry starts to execute his trades.

Harry first hits Stoxx with a clip of 8, then Bund with a clip of 4, waits a bit for confirmation, and adds additional clips into the Stoxx and then Bund. Now having 16lots in Stoxx and 8lots in Bund he centers his focus on Gold to get him the trigger reaction he is waiting for. He starts with the first clip of 4lots in Gold while observing how other markets are behaving. As long as he is onsite, he is aware he has a good position to hold and other participants to join. He is also aware that these products (Stoxx, Bund) might take a little longer to develop the move he is expecting. Soon he sends three clips of 4lots into a Gold getting his size to 16lots. In seconds after he does, Gold is near the low and the market starts to go really aggressively in his favor. He is paying most attention to Gold and starts to scale out a bit on that first impulsive move down. In Bund, he is 5ticks onsite, in Stoxx still around breakeven. Soon after he scales out fully from his Gold trade, Bund and Stoxx finally pick up momentum putting him well onsite. But then the market dynamic changes and starts to squeeze making the position bit more uncomfortable and for many frustrating. What to do in such a situation? Cover or hold? What can one lean on in such conditions? You have multiple options. Something we will break down in our next post, Part II.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

Thanks for reading and until next time, trade well.

JK