How To Sustain Multiple Break Failures And Profit In The End – Introduction

In this post, we will look at how AXIA funded trader Harry sustained multiple break failures and profit in the end from the Gold trade. Read below for the top-down analysis using market profile and learn how Harry leveraged his price ladder skills to scale into the position even though the trade idea required several attempts. For a similar type of trade, read the Breakout Energy Change Trade.

This article is based on the trade described by Harry in the video down below.

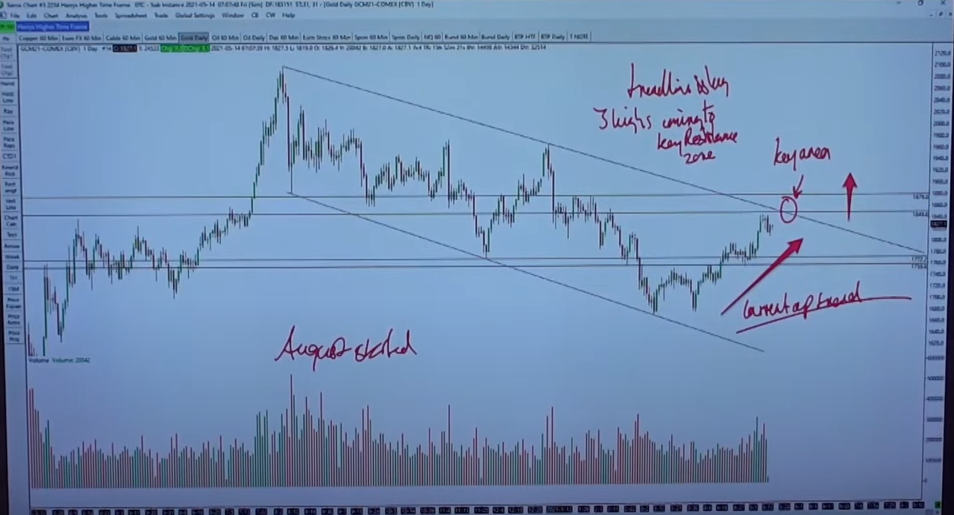

Technical Landscsape Of Gold Trade

We are looking at the Gold, trading in a bigger daily channel. As we are approaching the channel high, we are also approaching a location of poor daily highs, that should be auctioned and repaired. Given the rise of the expectation and recent steady daily drive in Gold, the expectation is to auction the poor high and continue higher. Harry is specifically looking for this area (read down below) to be auctioned before he will put on a trade:

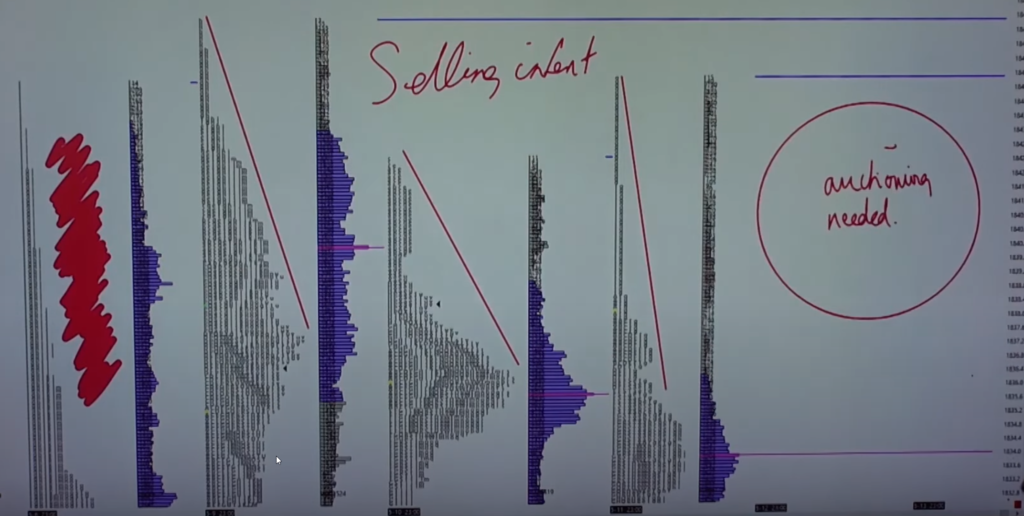

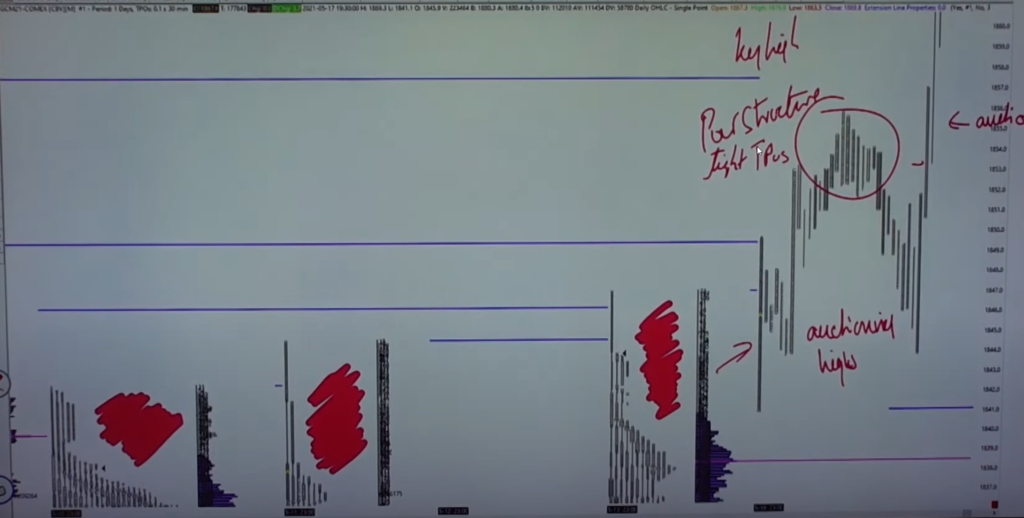

See where he mentioned, “auctioned needed”. The selling intent has capped the move higher, but the moment this zone gets auctioned, it can unlock further move up. On the image above, you can see the expectation and you can listen Harry explaining what he is looking for in the “auction needed” zone. He is anticipating the narrative that might unfold in a way that if we auction this area, this might bring fresh buyers to the play that can lift the market higher.

This is how eventually the area was auctioned and triggered the narrative Harry was anticipating. The game is on.

Using Price Ladder To Trade The Gold Breakout

Trading Execution

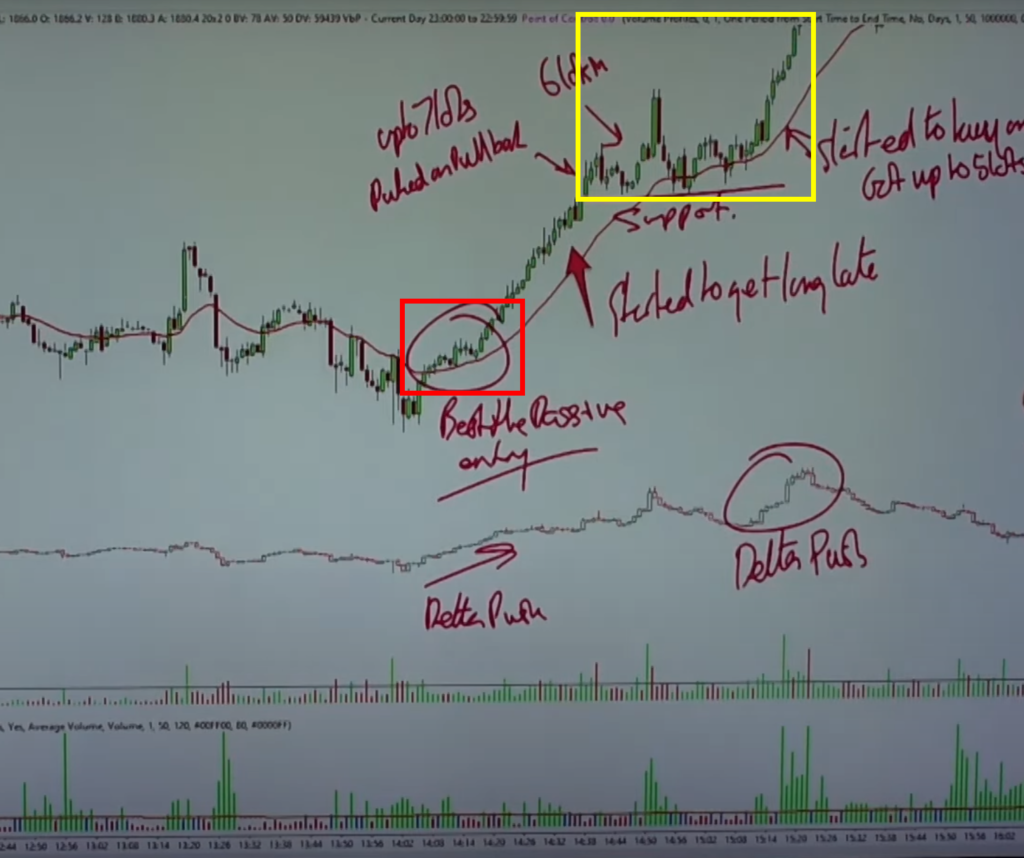

Zooming in on the actual trade, this is how the 1minute chart unfolded.

In the debrief, Harry has mentioned that before the Gold started to move higher (see red square on the image above), the sellers were struggling to move lower. Looking back, around the red square was the first best passive entry for a bigger trade long. Eventually, Harry has attempted to try to get on the move in the yellow square two times, before the trade finally paid off. It is all about utilizing the price ladder skills.

Price Ladder Commentary

You can watch the price ladder recording that starts from here to get the full understanding of what is Harry looking for and how he is managing all attempts for this break long in the Gold trade. Given the three attempts, there is several key takeaways that draw my attention:

- How Bid vs Offer is holding – is there someone who is willing to reload, hold the price. Many times you could spot, that bid is willing to hold better than the offer.

- What size trades up (into the offer) vs down (into the bid) – if 20lots trades higher, but only 2 or 3 lots trade lower, it tells you which side is putting initiative action into the motion

- Add size where initiative unfolds – when you see good buying initiative, that is the place to add size

- If a bigger offer goes, you can go with it – when on the offer the bigger size is eaten by buyers, you add into your trade

- When it does not go, cut it – the ability to cut immediately the size and scale down when what should happen did not is what enables Harry to eventually lose a bit on the first two attempts and get it all back and some on the third attempt

If I should draw a complete picture for this trade or a thing that stands up for me, it is the combination of anticipation of the auctioning (using market profile), big picture location on the chart (daily), and price ladder abilities to read the initiative of the buyers. What were your observations? Hope this was helpful.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- How To Manage & Exit A Failed Breakout Trade

- Sign Of A Breakout About To Fail – Price Ladder Trading

- Market Profile Trading: Better Breakouts with Context and Volume Profiling

Thanks for reading and until next time, trade well.

JK