Introduction to Candlestick Charts:

In this blog, you will learn to trade the most common and significant Reversal Candlesticks Patterns that I see almost everyday and that you will come across in trading. Candlestick charts are a great tool to make trading decisions based on regularly occurring Candlestick Patterns and help forecast the direction of the market’s price.

Before going into the details of the Candlesticks charts, I would like to express that Candlestick charts cannot be taken on their own, it is one of the great trading tool that helps to read market movements but you always have to read Candlestick charts in context and combine it with other tools like the price ladder and with an order flow strategy to make the best trading decision.

I often hear traders expressed their discontent because the market did not react as they would have expected and I always ask them the following questions:

- Did you check your time frame?

- Did you wait for the close of the pattern?

- Have you checked the bigger picture?

- What phase of the overall trend was your specific candlestick pattern? Was it in a market trend or inside a range?

Basically, did you ask yourself the right questions before interpreting a candlestick pattern for what it is? Did you put the Candlestick pattern in context?

Why should I learn to trade Candlestick charts and why should I use them?

I will not go through all the history of Candlestick charts but straight to the main points.

- Majority of Traders use them:

Candlestick charts are one of the most used charts by Futures Day Traders so it makes sense for you to learn how to read them. By choosing the representation of the market that is the most commonly used, you will have the same view as the majority of market’s participants which is already a first benefit of this tool.

- A representation of the price action visually quick and easy to read

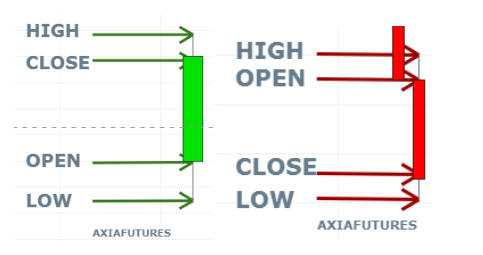

Traders use Candlestick charts because a Candlestick is formed with 4 criteria: Open, Close,high and low throughout a period of time a trader specifies. Without going into details at this stage that you will find below in the article, already you can see it becomes very easy to spot a high price, low price and be visually quickly aware when the market is going up (easy to spot a green candlestick body) or down (with a red candlestick body).

On the image below you can see the structure of an upside candlestick in green and a downside candlestick in red.

Now that you know how to read a candlestick, I will share with you the 3 most common Reversal Patterns that you will come across that will help you make a trading decision.

2 factors can influence the significance of a pattern, its shape (I will be developing below) and the timeframe.

What timeframe should I use?

You will often hear people asking this question, and it is not possible to answer with a straight recommendation. The question is not if one is better than another one, it all depends on your strategy, are you a scalper or a swing trader? My view on that question is : more the time frame of the candlestick is big, more the significance of the candlestick is important, so if you are looking for a reversal pattern after a trend of couple of weeks, you will be better to choose a 2 Hours or 4 Hours candlestick chart.

There is another aspect of the Candlesticks that is not so often put forward, which I think is key, is the close of the candle. It sounds obvious to think that a candlestick should have a significance only when it is close, but in your trading career, you will face the FOMO (Fear Of Missing Out) and this feeling can apply to every day trader. You will find yourself trading on the back of a hypothetical Candlestick shape that may never have formed.

So make sure you wait for the close of the candlestick before you validate your pattern.

The Most Common and Significant Reversal Candlestick Patterns to Know

I think the most important is first, to be able to recognise Candlestick patterns and then, to know their significance on the future of the market’s price. To be as closed as the reality of a day trader experience and be immediately useful for you, I will summarize which Candlestick pattern you will most likely see and which ones will affect the most the market price action.

This is why I have regrouped the Candlestick patterns per theme, by doing so, I will not make any difference between a hammer and Dragonfly Doji, a shooting star and an inverted hammer, because when you are a day trader, the most important is to understand the significance of the candlestick as quickly as possible more than the exact shape of it.

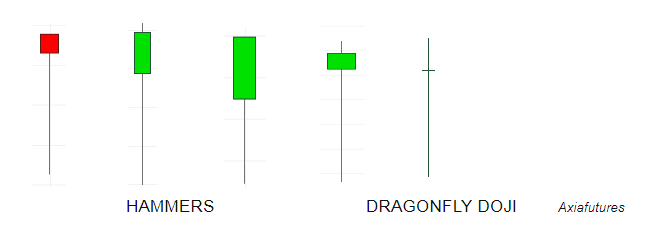

1- REVERSAL CANDLESTICK PATTERNS : THE HAMMER/DRAGONFLY DOJI

They are well known Candlesticks shapes for day traders. They are also simple and easy Candlesticks shapes to spot live.

What is the shape?

The Hammer/DragonFly Doji are candles with a long wick and usually a small body that closes at the top or around the top of the Candle. The only difference between a Hammer and Dragonfly Doji is the price of the close (Dragonfly doji closing price is exactly the same as the opening price). Deliberately, I have chosen different Hammers shapes on the picture and regroupe Hammer and Dragonfly doji because it doesn’t really matter if the close of the candle is not perfectly the same as the opening one. For me the interpretation is the same, when you are a day trader, the most important is to be able to quickly visualize the shape. Important precision, the longer the wick of the candle is, the greater the candle’s significance is.

WARNING : Make sure you wait for the close of the candle before any validation.

When should I use this shape of pattern?

The hammer let you know when the market is ready to take a pause on its downside trend and usually calls the start of a retracement in the bearish trend. This is a very helpful candlestick when either you want to take profit from a short position or it is mostly used to pick a bottom in a bearish market. In my opinion, the best is to trade the Hammer only when the market has a bearish trend. Again, the context is important, you might see a hammer in the middle of a range or in a consolidation area but it will not have the same effects and same expectations as a Hammer on a bearish trend.

Translation from a market participant’s perspective :

You have to think about short Traders who didn’t take profit (because the trend is bearish) or short traders who sold the lows and are frustrated and are becoming nervous. All of them will want to buy back if the market does not come back down. This is why, when the wick of the candle is long, that means the bounce occurs quickly and lower prices never get retested, so most Traders with a short position did not have time to take profit (and see their profit reducing), and those who sold the lows are offside quickly. In consequence, you usually see the start of a retracement/taking profit movement.

Put into context, the candle before the hammer and the candle after the Hammer is as significant as the hammer by itself and you can relate to Price Action Strategy for more details.

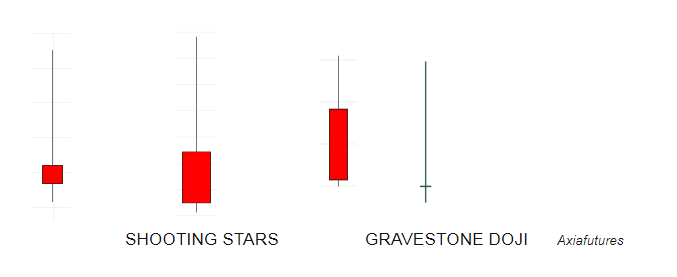

2- REVERSAL CANDLESTICK PATTERNS : THE SHOOTING STAR/ GRAVESTONE DOJI

They are well known Candlestick shapes for day traders. They are also simple and easy shapes of candle to spot live that you will come across often and it will help you in your trading decisions.

What is the shape?

Like the Hammer and the DragonFly Doji, I have regrouped the Shooting Star and the Gravestone Doji together because what you want to know is the meaning of those shapes, no matter if the close is not to the tick exactly the same as the open.

The Shooting star is a candle with a long wick and usually a small body that closes at the bottom or around the bottom of the Candle. The only difference between a Shooting Star and Gravestone Doji is the price of the close (Gravestone Doji closing price is exactly the same as the opening price). I have deliberately chosen different Shooting Stars shapes on the picture because for me the interpretation is the same. Important precision, the longer the wick of the candle is, the greater the candle’s significance is.

WARNING : Make sure you wait for the close of the candle before any validation.

When should I use this shape of pattern?

This Candlestick pattern is basically the opposite of the Hammer (that signals a pause in down trend), this time, the Shooting Star signals a pause in an up trend and could signal the start of a retracement. This is a very helpful candlestick when either you want to take profit from a long position or it is mostly used to pick a top of a market move. In my opinion, the best is to trade the Shooting star only when the market has a bullish trend. Again, the context is important, you might see a Shooting Star in the middle of a range or in a consolidation area but it will not have the same effects and same expectations as a Shooting Star on a bullish trend.

Translation from a market participant’s perspective :

You have to think that long Traders that didn’t take profit (because the trend is bullish) or long traders that bought the highs are vulnerable and becoming nervous, all of them will want to sell if the market does not come back up. This is why, when the wick of the candle is long, that means the sell off occurs quickly and higher prices never get retested, so most Traders with a long position did not have time to take profit (and see their profit reducing), and those who bought the highs are offside quickly. In consequence, you usually see the start of a retracement/taking profit movement.

Put into context, the candle before the shooting star and the candle after the shooting star is as significant as the shooting star by itself and you can relate to Price Action Strategy for more details

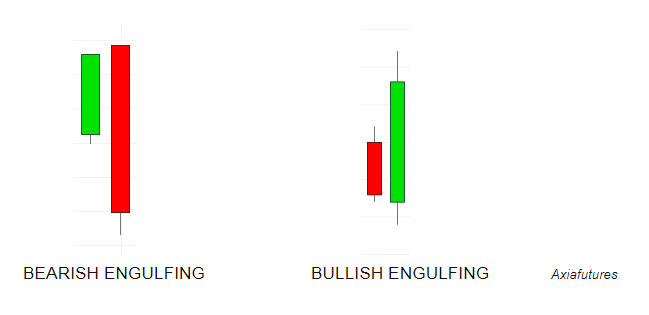

3- REVERSAL CANDLESTICK PATTERNS : ENGULFING PATTERNS

Important aspect of this Candlestick Pattern, you can not take the Engulfing Pattern on its own, the Engulfing Pattern is only viable based on the previous candlestick.

Like the previous Candlestick shapes, Engulfing Patterns are well known for intraday traders. They are also simple and easy shapes of candle to spot live that you will come across often and it will help you in your trading decisions.

What is the shape?

You will come across Bullish and Bearish Engulfing patterns, instinctively it very easy to understand that the Bullish Engulfing will have a body with a closing price higher than the opening price (usually a green body), and a Bearish Engulfing will have closing price lower than the opening price (usually a red body).

The body has to be large and it has to be bigger than the previous candlestick.

When should I use this shape of pattern?

You should mostly use this candle when you expect the market to reverse its current trend.

When you see those Candlestick patterns (either Bullish or Bearish), if you have already a position within the trend, it should signal an opportunity to take profit and if you are looking to trade a retracement or a start of reversal move, that should signal a possible entry price.

Translation from a market participant’s perspective :

When you have Bullish Engulfing, you have to read it as the buyers have definitely stepped in. Buyers have been able to stop the bearish trend. Also, most buyers are on-side and are not vulnerable at the close of candle, contrario to the shorts which have not taken profit yet and will most likely want to exit in the next candles to come, pushing the price higher.

The opposite interpretation is true for the Bearish Engulfing. Shorts have stepped in and stopped the bullish trend, more shorts are onside at the close of the candle than long are onside so the long traders will feel vulnerable and most likely want to exit in the next candles, pushing the price lower.

Conclusion

You now know how to recognize and trade the most common Reversal Candlestick patterns that you will come across over your day trading career.

They are a significant help in your understanding of the markets and will have definitely a big role in your trading decision.

Do not forget, like I explained in this article, the context of the candle is essential (the big picture and the price action: Trend, range, consolidation, liquidation, flag, triangle, wedge…), tacking the candle only by itself does not make sense and can actually disrupt your reading of the markets.

In any time-frame you are using for your candlestick charts, make sure you wait for the close of the candle before any validation of them.

Always keep your curiosity wide opened, have a look at your charts, see how markets have built those Reversal Candlestick Patterns and what was the market reaction after those candles, more you get used to recognize them, more you will have trust in them and more you will be able to rely and use them in your trading decisions.

Great Trading

EJ

Learn To Trade Candle Patterns & More

To learn to trade with real price action and develop your career as an elite trader then check out our range of Trader Training courses. Our flagship 8 Week Career Programme can be attended live on our London Trading Floor or virutally from home as an online trading couse. These are the most comprehensive training programmes in the proprietary futures trading industry and are based upon years of successful in-house skills development.