Macro Preparation For The Trading Week Ahead Introduction

In this blog post, we will focus on macro preparation for the trading week ahead. Trading around macro events can be scary and confusing at the beginning. It seems too complicated and complex to make sense of all the relationships and correlations that are unfolding quickly in the markets while the news is being released. But there is one huge benefit to becoming a trader, who has deepened the understanding of the macro events: additional level of an edge (on top of your price-ladder, market profile, and footprint tools) and the ability to obtain favorable access points quickly for vulnerable structures you want to attack. Let’s break down the process of preparation step by step and kick-start your macro event understanding.

Building Macro Themes

Why It Matters?

It is a good practice for every trader to not only do some deep reflections on the past week of trading but also to prepare for the week ahead. Apart from looking at the markets from the technical point of view, it is a good practice to keep deepening your macro themes understanding. Not only in a way what events are coming out (NFP, CPI, etc.), but also documenting larger themes that can potentially unfold. The best days usually come from outliers and those outliers can really elevate your trading and move you from being a 3lot trader to a 300lot trader. Events like this helped our Junior trader Harry make his 50k week and enabled him to step up his game.

How To Build A Macro Theme

There is no secret way. There is just deliberate practice. Coming every weekend and doing the work prepping for the week ahead. How? Start easy by reading the headlines from financial media sites like Financial Times, Bloomberg, Reuters. Understand at a high level what is going on, what are the financial media talking about and what can potentially develop into a bigger theme. Do not just read what is happening but build scenarios of how it can potentially evolve. That can give you a high-level perspective. Now let’s take a look at how to build a theme.

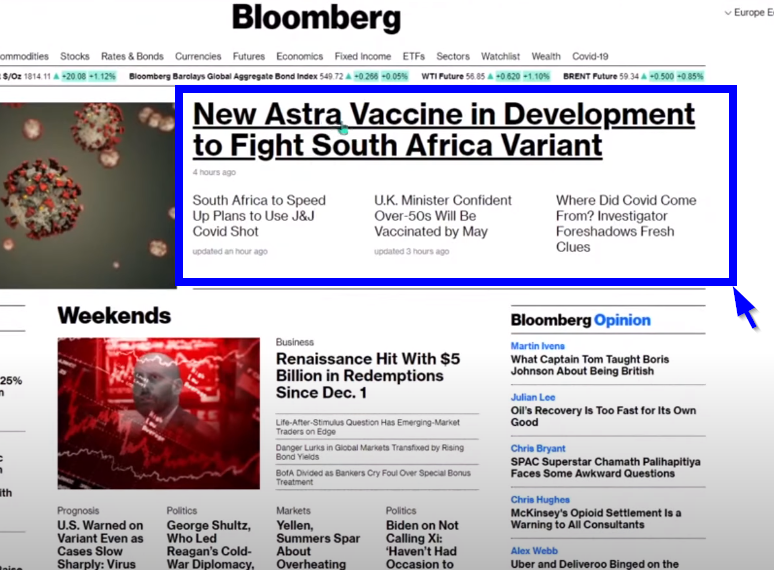

On the main page of Bloomberg, there is a headline title: “New Astra Vaccine in Development to Fight South Africa Variant“. This can start your thinking process. There is a new strain and pharma is trying to combat it. How effective will be even the current vaccine? What if news of the inability of the current vaccine to fight the new strain slowly spread? What is the tail risk there? What markets will be impacted the most? How can the news evolve and unfold? From here you start building your portfolio of possible themes.

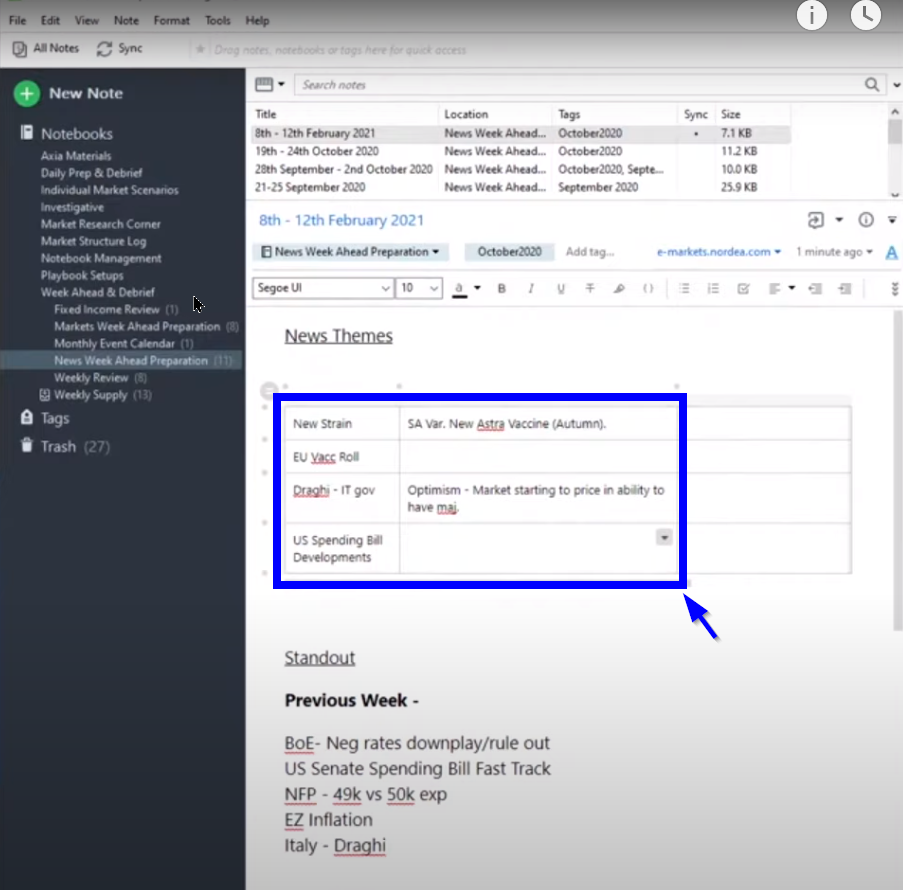

After skimming through the headlines and capturing the themes, you can start reading some of the bank research as well. One of the sites we regularly use is the research published by Danske Bank, specifically the Weekly Focus. By reading the weekly focus you can pick up on additional themes. In our particular case at the time of the recording, a US Spending Bill or Mario Draghi forming an Italian government was a macro theme in development.

Let’s now have a look at how we can define a potential scenario for Mario Draghi forming a government combining technicals and macro events.

Combining Macro Theme And Technical Structure

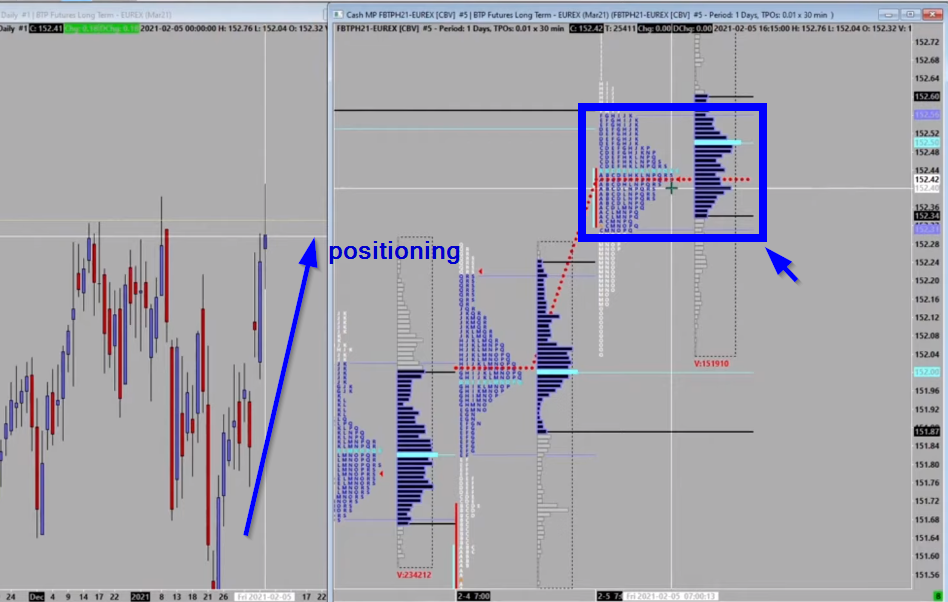

Now that we have identified our themes, we can focus on building our scenarios. We really want to build the “If->Then” scenarios specifically for those asymmetrical opportunities. What are the asymmetrical opportunities? These are situations when market positioning is skewed towards one side and potentially negative news might trigger a liquidation move. Let’s have a look at how our “Mario Draghi theme” forming a government can provide us with the asymmetrical opportunity.

Above we can see a chart of the Italian BTP (10yr bond that is being traded on the Eurex). We can see that positioning is built towards the upside therefore we must ask ourselves: “what negative news might trigger a potential liquidation move”?. We know that failure to form a government by Mario Draghi might be that tail risk event. The event that might cause the liquidation move. In our debrief we lean on this scenario of our theme and in the technical prep we define at what prices we are willing to hit the markets. What markets we will hit and with what size. Checkout how Axia Junior trader prepared for a similar type of event and made his best week so far by doing exactly what we have described above. Although in many situations the tail risk scenarios won’t materialize, we have done our best to capture them if they come.

It is events like these when opportunity meets preparation. When we can move our trading to the next level and execute a much bigger size with a high level of conviction.

If you liked this type of content, you might check these videos as well:

- AXIA Junior Funded Trader Remains Composed After Missing Vaccine comment Live Trading

- AXIA Elite Trader trades Gilts & GBP On Bank of England Rate Decision

- AXIA Elite Trader Attacks 4 Markets On July 19 FOMC Rate Decision And Presser

If you like our content and would like to improve your game, definitely check one of our courses that teach you all the techniques presented by AXIA traders from a market profile, footprint, or order-flow. If you are someone who likes to trade the news, we have a great central bank course. And if you are really serious about your future trading career, consider taking AXIA’s 6-Week Intensive High-Performance Trading Course.

Thanks for reading and until next time, trade well.

JK