Large Orders Reversal Trade Introduction

Managing your trade entry based on a good understanding of the price ladder order-flow can give you an extra edge in timing your trades, like in the trade below which produced a large orders reversal trade type. Price ladder order-flow provided us with two main clues, read below what those clues were and how that trade evolved during the trading session. If you are interested in more price ladder tactics see one of our other blog posts where we deep dive into the detail of managing large positions through the price ladder.

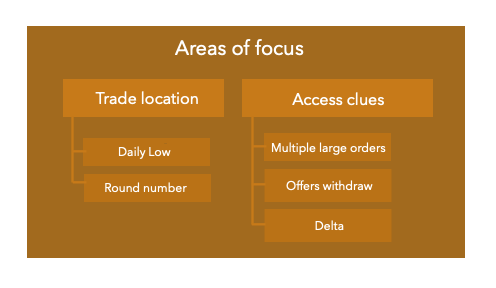

Areas Of Focus In Large Orders Reversal Trade

We will break the video into two parts. The part that is covered in the video, trade location and access clues, and part that is not covered in the video, the expectation of the move. Let’s have a look at the first part.

Key areas of focus for the trade explained in this article are trade location and access clues. From the trade location perspective, we are entering the trade at the daily low that is in confluence with a round number, and with the idea based on profile, that the market will continue higher if there is enough evidence, that this zone will hold. Usually, as traders, we would like to seek as many meaningful and non-correlated confluences of signals because they can give us extra conviction on a trade.

Now, that we have a trade location prepared, we are looking for a price ladder order-flow signal for us to get in, to access the trade. Let’s have a look at the trade context and what is price ladder telling us.

Access Clues In Reversal Trade

Now, that we understand trade location, we are changing our focus towards the price ladder order-flow and any change that comes at the area of 00 (round number) – 97 (yesterday low). What you can see in the video recording of the Bund trade is that at this location large orders are stepping in.First 800lot traded, then 1200lot, and then 1000 lot traded in the area mentioned above. This is the first signal, that there is a higher degree of interest. That is our first clue from the “access clues”. Then you can see, that offers got withdrawn as the price starts to move higher. As the price moves higher from 98, the offers that looked heavy (in hundreds of lots) got actually traded only a couple of lots. Many times, this can be a trap by sellers and algo’s to move prices bit higher only to attack with the size one more time down. What you can’t see in the video is the last push lower, the final stop run, before taking off to the upside. Adding to that your Volume Delta reading can give you a great timing opportunity for your trade.

Management Expectations In Reversal Trade

Many times in our trading, we expect that once we enter our trade, the trade will resolve itself in a straight line. This is actually poison for our decision-making setting completely wrong expectations and putting pressure on our emotional center and our decision-making process. Trade management is one of the most undervalued parts of trading mainly because it is not that much about the management itself, but in a first-place about the correct expectations, we have for our trade. Our trade management plan. There is a great article dealing with exactly these expectations on our blog.

So once we have entered this trade, how can we actually manage it? I like the saying that “questions are the answers”. So before you even enter into a trade, you need to set correct expectations for the trade and also identify the biases and emotional baggage you carry on into this trade. Here are key questions to ask:

- Where are the areas the trade will likely to stall and why?

- What are your expectations of how fast we can get to these areas?

- Once we reach the stalling area, what is your expected/adequate price and times response?

- What are my reason2exit and reason2hold criteria? In another version, when you pyramid into a trade, what are your reason2scale-in and reason2scale-out criteria?

- What is the baggage/bias I carry on from previous trade/previous trading day? Are you nicely up on a day, you might get more protective. Is this the last trade of the day, you likely will have less patience because you don’t want to end the day red if this trade does not work, etc.

Let’s apply some of these questions for three stalling areas in our Bund trade (marked with blue line).

Answering our questions, it is clear, that the first obvious reaction will come at the first blue line, where support was broken and morning impulsive move came from. Since we are trading with our first move into this level, we also need to be aware that yesterday this was a zone, where the market ranged for a couple of hours. So we need to set the correct expectations. Once we reach the first blue line, we expect that the move will most likely try to push back towards that range low from yesterday or last HVN (high volume node). We are not setting wrong expectations, that the move will immediately run towards the second blue line. What we can also expect with this first move is, that it might return to the first blue line quickly because the impulsive moves are usually resolved at the same speed as they are created.

Ok, now we are above our first move@reaction run, we have passed move@reaciton 1 with correct expectation. Now, ask yourself again. Our next blue line is at the top of the previous range. Again, we need to expect that there will be some stalling in this zone since we are entering range again, even though in this case this was range created overnight. Once resolved, our next expectation is for the third blue zone. In this case, the move through down was created in more of a one-directional/one-sided type of trade. The expectation can be in this case, that we might move through this zone in a similar, one-directional/one-sided fashion and reach our third target.

Creating correct expectations can dramatically improve your trade management so it is important that you ask the right questions before you enter your trade. Because after you enter your trade, you must simply trust your process then you trust yourself, especially if you are at the beginning of your trading career.

Large Orders Reversal Trade Summary

Watching the price ladder order-flow action can truly improve your risk-reward (RR) if you can spot the areas, where large orders are entering the market. Understanding how we got to the price you are interested in and how we trade straight after the large-orders appeared, together with reading the bids/offers size and their behavior can give you an opportunity to time your trade more precisely and improve your overall RR performance.

In case you are interested in finding out more about trader training to learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more. Or if you want to really maximize your ladder execution, check out our price ladder trading course.

If you liked this type of content, you might check these videos as well:

- What Markets Do You Select When Trading – Price Ladder Trading

- Key Observations To Stay In A Trade – Price Ladder Trading

- 3 Reasons To Get Into A Trade – Price Ladder Trading

Thanks for reading and until next time, trade well.

JK