Routines That Improve Trading Consistency Introduction

One of the ways how a trader can improve the edge is to build routines that improve trading consistency. Simply turning at the right time and looking at charts is not enough. Especially if you are at the beginning of your trading journey. You need to build a replicable process that will over time ensure your consistency in analyzing the markets. This will bring more confidence to your trading, a higher degree of spotting the right opportunities that repeat over time, and fewer regrets of not missing opportunities so often due to repeatable process.

If you have not yet reached the level of consistency you wish for, continue to read since this can get your closer to your trading goals. Checkout the video below to get the maximum out of this article.

Why Are Trading Routines Important?

Apart from what was mentioned at the beginning of this article, the morning trading routine can also allow for:

- repeatable comparison of previous situations

- ensures full preparation with purpose – enables you to select correct strategies

- gives you a sense of calm and prevents you from rushing into things first thing in the morning when markets start to get active after the open

- maps your day in terms of timing and strategy

Questions are the answers. One thing to remember is that it always needs to serve the purpose of your specific needs. We can give you ideas on what questions to ask, but you need to think for yourself if these questions are helping your particular strategy. In this article, we will present sample questions presented in the video, and in the following article, we will have a look at questions I ask when doing my morning trading routine.

Top Down Approach

In order for us to build a robust morning trading routine, we want to look at markets from all possible angles. We will use a top-down approach going from two points of view (daily and market profile) to the lowest timeframe this trader uses for his execution. The Principle of “Top Down” approach is a good one to understand because it can help you build clues you need for executing your trading strategy. Also, this can be highly individual, since you might be executing your trades at different timeframes, but the top-down approach persists as a principle.

Daily – Context

Starting from Daily timeframe, we are trying to address these questions:

- Yesterday direction – Bullish / Bearish candle?

- Volume – Is Volume rising or falling?

- DSH/DSL (Daily Swing High/Low levels) – Are we hitting DSH/DSL and how it relates to Volume? Is Volume rising/falling while we are hitting it?

- Range – Are ranges rising or falling? Compare that to volume, DSH/DSL, and direction. Why? Maybe the market is trying to push one direction but the other side is happy to absorb the move. Or we are making new extremes, but volume is dropping. This gives us clues that we might be reaching a potential tipping point

- The current trend – what is the recent swing low to recent swing high direction?

- General direction – in general, is the market trending or balancing? Which direction?

Looking down at the chart below we can see, that the move on the very right has a current trend going up while the general direction is rangebound. As we are moving higher, the volume is dropping and we have just reached previous Daily Swing Low (DSL).

Market Profile – Structure & Context

Moving next to market profile, we want to get a sense of market structure and enrich our Daily context by asking:

- Day type – What was yesterday’s day type? This gives us clues about what kind of day we can possibly expect.

- Value Shift – was there a shift in value? This gives us a clue of how the market perceives the recent move. Was the move accepted by volume as well? If not, where was the market rejected?

- Extremes – how do extremes look like? Have we seen any major rejections and long tails created? Any poor lows/poor highs?

- L-I-S (Line In A Sand) – Where does direction change?

- In Control – Who is in control based on the information we have collected?

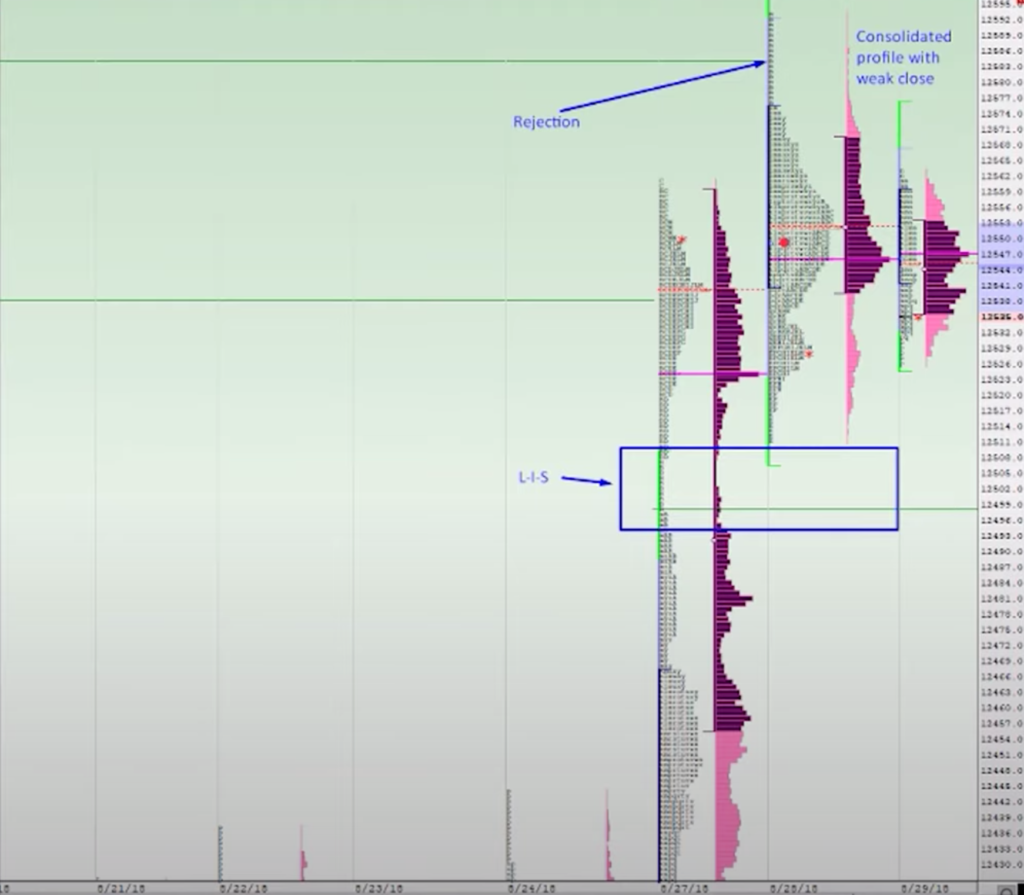

Now, let’s use the views in the questions above to form an opinion of the chart down below. After a trend day type, a L-I-S was created (low volume area) and value shifted higher. At this point, we believe the market might continue higher since based on what we have collected, buyers are in control. Great. Then the next day comes. We can treat this day as a balanced day with clear Tail at the highs. Now, this is tweaking our perception of the market a bit. Without this information, we would be much more bullish but now we can re-calibrate our view and wait for additional market generated information to form an objective opinion about where will the market head next.

Let’s move on to 60min and 5min timeframe to identify the access points.

60 Minutes – Tipping Points

This timeframe should offer more specific levels and plausible targets. Here are questions to address:

- Recent move – what have been the recent move?

- Levels – are there any significant levels within the scope of current range conditions?

- Market structure – does the current move have a good foundation?

- Is the market overstretched? – could this structure break?

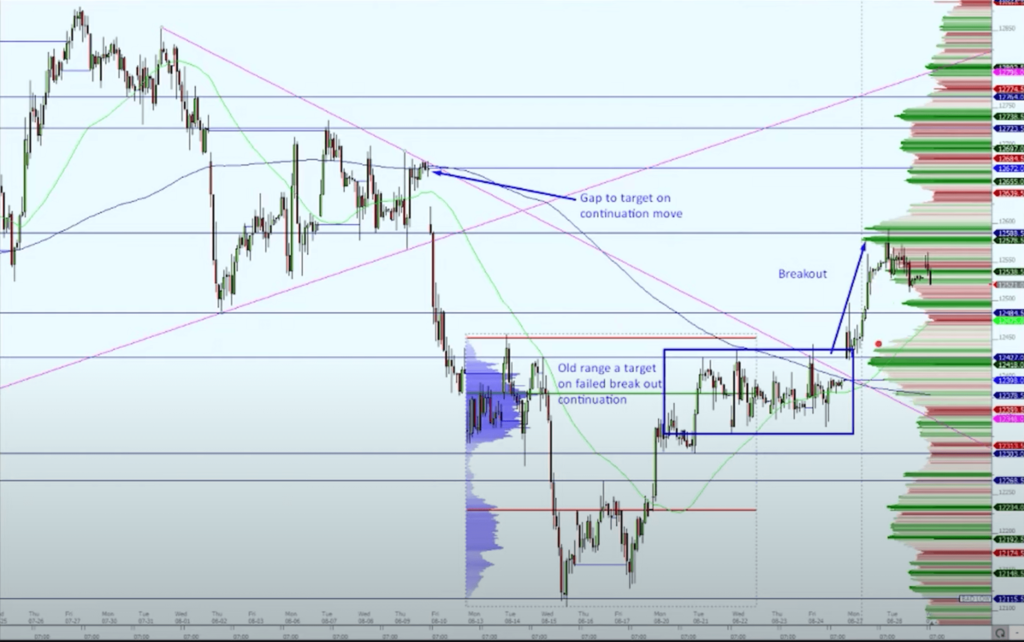

We can see where the clear levels are. One is at the edge of the last breakout of the previous range, the other is the gap above. We can see clearly the trend day we have identified in market profile and balance days that followed with rejection at the top after we broke out of the range. Now it is time to move to the lowest timeframe to identify potential entry points.

5 Minutes – Entry Points

It is show-time now. Time to identify execution opportunities, time to pin-point entry points.

- Entry – Where can be trade entered?

- Trade expectation – how is the trade likely to play out? Where are Acceleration points or sticky areas, reaction levels for scalps after we enter the trade? Never expect a straight-line move from your entry towards your target.

- Delta – What did delta do? How does volume react? Is the velocity (speed, auctioning health) accelerating?

Now that you have all the information you can define your entry point. Interested in going short? What is delta doing? What will be the next area market will likely move to once you enter a trade? What are the roadblocks you might encounter?

Connecting all questions together that are consistently asked leads to repeatable trading ideas. Let’s summarise it.

Summary

Morning trading routines help improve your trading consistency. It is important to remember to ask the right questions, that fit your type of style and strategies you deploy in the markets. Keep the Top-down principle in mind when designing your morning trading routine. This article and video have provided you with a starting point but now it is up to you to really ask yourself what those questions you gonna ask day in day out gonna be. Also, don’t be afraid to change them over time. We are constantly developing as traders and something that served us well 6 months ago, might not serve us anymore now. That’s why reviewing your routines is also crucially important so you don’t do the things just for the sake of doing them :).

If you enjoyed this article you may consider taking our market profile trading course or viewing more trader training programs on offer. To learn how to trade and explore other great trading strategies, check out our futures trading course that teaches you exactly that and more.

If you liked this type of content, you might check these videos as well:

- Trading Psychology: How To Develop the Skill of Consistency

- The 3 Step Journal Process Of An Order Flow Trader

- 10 Highly Effective Habits of Successful Traders

Thanks for reading and until next time, trade well.

JK