Market and volume profile charts are familiar to a larger group of traders compared to the footprint. Likewise, most charting software offers market and volume profile charts – yet Sierra Chart Market Profiles offer much greater flexibility, intuitive profile construction and quality of life features that are underutilised by its users.

Therefore, to continue our Sierra Chart tutorial series, in this post we are going to look at setting up numerous types of profile types, ranging from standard usage, useful addons, and various tricks that will weave your charts together to make its usage much more sleek.

Much of the guide is written linearly, a start to finish read through will leave you in good standing to build your own profile. However, it is worth skimming through to read relevant areas for yourself or using a search function for keywords.

The first part of this post will be an important reminder and refresh about understanding the tools that you are using.

The second part onwards discusses in detail many of the profile settings. For current Sierra Chart users who are already content with their market and volume profile charts, it would be worth reading part four. This section delves into combining your candlestick and footprint charts with profile overlays aimed at making it simpler to extract profile values efficiently.

Part One: Understanding The Tools

As discussed, in a previous post on footprint charts, it is critical as traders to understand how edge is extracted from the tools we use.

These various information gathering tools (like profiles or footprint) are often used backwards. This mistake is created when the tool itself is seen as the ‘edge’, which gives a scripted response or trade from the user.

Consider the novice attitude of wanting to print a profile to just find out value area highs and lows and then executing trades around these prices in a ‘vacuum’ with no consideration for any other factors. In a way, this automation of providing the user with market levels to trade around is an attempt to short circuit the deeper learning experience. Perhaps this is an attempt to outsource emotional and thought accountability to an outside ‘tool’ that can then be blamed or praised for trading results.

Not only should this issue take center stage to your trading as whole, but it is a vital consideration to understanding what you want out of your tools. What specific use is a volume profile providing you? Why are you highlighting ‘single prints’ on your profile, how does this fit into both your information gathering and your trading execution?

Simply, as you learn to build your own market and volume profiles, or any other tools first understand what you do not want from them, then further refine the features that you wish to keep. This should always keep you in good stead to make full and practical use of the tools and charts that you put in front of you.

Part Two: The ‘Standard’ Profile

NB: This guide will not reference each setting line by line. It will focus on the main and most important settings and will leave out self-explanatory settings which are not critical. If some settings are not addressed here then you can leave them as per the Sierra Chart default setting.

Sierra Chart refers to market profile as a ‘TPO Profile’. Likewise, this is what you must look for in the study menu under the ‘Analysis’ tab.

Before this guide delves into the settings proper of the TPO study. It is critical to understand the session time functionality in Sierra Chart. This is due to the time component that is the core of a market profile. (Time Price Opportunity).

As such, Sierra Chart uses your session times to highlight the initial balance, open and close prices and when to stop printing the chart all together.

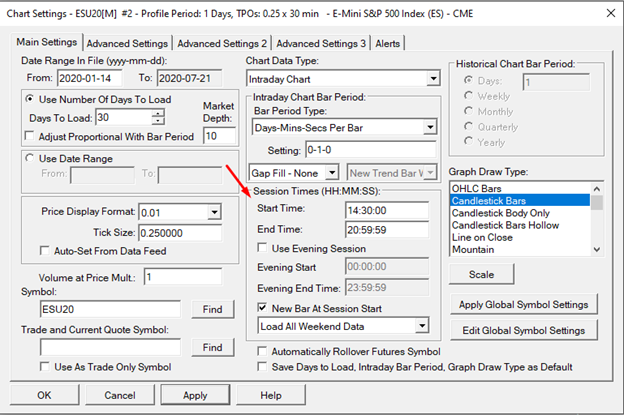

Consider these settings for the ES based on London time (GMT +0).

Sierra Chart separates data and other studies based on your ‘Session Time’ and your ‘Evening’ period.

Your ‘Session Time’ should fit in with the market’s cash open and close if a study is centered around this like the market profile. In this case we are printing the TPO’s only from the ES cash open (14:30 GMT) to close (21:00)

‘Use Evening Session’ is unticked. This means we are excluding the evening session or outer hours.

This will make the initial balance print from 14:30 to 15:30 if your settings deem it as one hour. Likewise, your open TPO letter will be the first price traded at 14:30.

However, it is still useful to have your evening session as a full 24 hours. Why? You can use shortcuts to quickly flip between seeing only your ‘session’ and the full 24hrs (Ctrl+G, or Chart > Use evening/full session). This gives you a quick view of the profile over a whole 24 hours and just a cash session.

Moving on, the settings menu for the ‘TPO Profile’ is shorter and more self-explanatory than the footprint (Number Bars) however, it still can be cumbersome for new users to quickly get acquainted with these settings.

A TPO chart and a volume profile are treated as two separate studies in Sierra Chart. If you already have created your market profile and would like to attach a volume profile, skip to part three as this will be addressed further down.

To start, remember that the most important settings with any ‘study’ in Sierra Chart is always closer to the top rather than further down the menu.

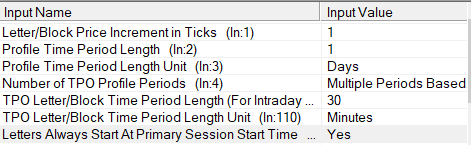

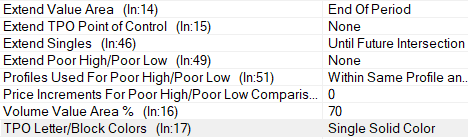

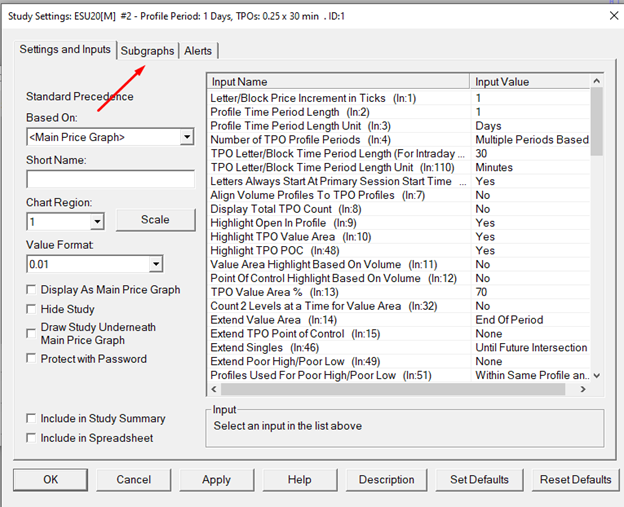

Following on from popular usage and in line with Dalton and Steidlmayer’s books on the profile, you will most likely want these settings as shown above.

Letter/Block Price Increment in Ticks – is a reference to the resolution that you want each TPO and volume to match per tick. The lowest and most accurate is ‘1’.

Tip: thin and wider range markets often are quite heavy on computer resources when you zoom out and moving quickly along the chart. Consider changing this setting to ‘2’ or ‘4’ if looking back through a lot of profile charts in a hurry.

Profile Time Period Length/Length Unit – Simply this is the period displayed per profile. ‘1’ Period length and ‘Day’ length unit is the whole session per profile. Additionally, this can be changed to ‘2’ days aggregated per profile. Moreover, ‘Days’ can be changed to ‘Weeks’ for a standard weekly profile, alongside other time options.

TPO Letter/Block Time Period Length & Unit – this is a reference to each TPO letter per time frame. ‘30’ would make each letter print for 30 minutes. This can also change to seconds or different period length for more niche profiles.

Letters Always Start at Primary Session Start Time – this changes the order of your TPO letters, which can also be customized as shown later in the guide. However, for new users it is easier to set this to ‘Yes’ when starting off.

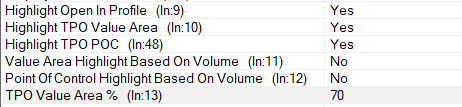

Highlight… – Self-explanatory, choose as needed. Choose ‘Yes’ if going for a standard profile.

Highlight…. Based on volume – Keep ‘No’ as a volume profile adjacent to your market profile will be better suited for this.

TPO Value Area % – What you deem the value area to be as a percentage.

Extend… – These are useful features to highlight important profile areas. ‘Until future intersection’ will leave these prices highlighted as a horizontal line forever until the market trades back to them. ‘End of Period’ will highlight the prices but are not extended horizontally after the session has ended.

Poor High/Low – These can also be highlighted, with ‘Price Increments’ as a threshold for Sierra to determine what should be highlighted. However, its recommended to not chart this. Much of what should be considered Poor High/Lows might change overtime depending on market and volatility. Moreover, if you are new to profile you want to train your eyes to spot these areas and consider them intuitively. Highlighting them risks creating blind spots.

Volume Value Area.. ignore as we will have a separate study.

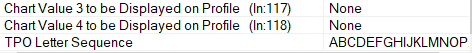

TPO Letter/Block colors…. Single Solid colour would be a ‘standard’ option. There is support for colouring each TPO differently. Useful for making Weekly coloured profiles where each day is coloured differently. This will be discussed later in the guide.

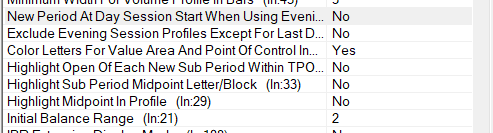

New Period … When using Evening Profiles – This will print a profile for the overnight or evening session then start a new once the ‘day session’ begins. For example, this setting with an ES chart will print a profile from 00:00 GMT to 14:29:59 and then create a new one from 14:30 until 21:00. Importantly, this is very dependent on correct session times. Refer to the start of the guide for more information. Likewise, this setting only works if ‘Use Evening Session’ in the chart settings is ticked.

Highlight… – Useful if needed for niche settings. Recommended to not have these activated as they will overlap the chart with too many different colours therefore obscuring the more important information.

Initial Balance Range – ‘2’ would print a 1-hour IB from your ‘Session Start Time’ in chart settings. The numbers refer to the amount of TPO prints you designated from ‘TPO Letter Period Length’. If 1 TPO letter is 30 min, and you want a 1-hour IB, then 2 would be the correct setting.

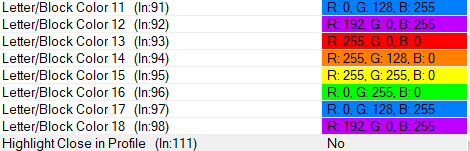

Letter/Block Color – These are the colours assigned to each consecutive TPO starting from the first print. These settings are only activated if ‘TPO Letter/Block colors’ are changed from a single colour to multiple.

TPO Letter Sequence – Right at the bottom of the menu, you can change the order in which TPO letters appear, this is also case sensitive so more letters can be used.

Colouring

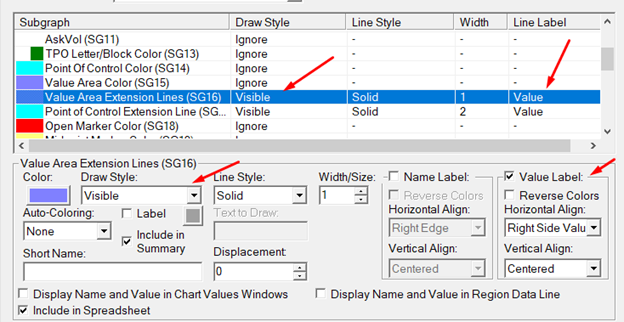

Lastly, the colour settings of the profile will be just as important. These can be found in the ‘Subgraphs’ tab as per any other Sierra Chart setting.

Most of this menu will be self-explanatory. However, the are two features to consider more closely.

Some colours or settings can be visible or ignored all together under the ‘Draw Style’ menu. For example, the ‘Point of Control Color’ is under ‘Ignore’ so not printed on the chart.

Compare this to the ‘Value Area Extension Lines’ which are visible as per the ‘draw style’. Moreover ‘Value Label’ is also ticked so the exact price of the value area highs and lows are highlighted on the y-axis (price) column.

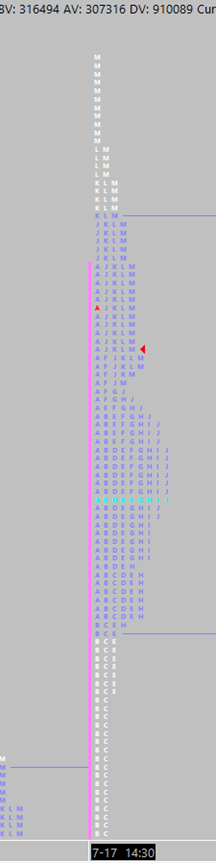

The result should a profile like this. We have a 1-hour IB printed in purple. Clear TPO value area and outside value areas. The Opening print as a red TPO. POC printed in blue. Lastly, the TPOs print A, B, C, D etc.

Sierra Chart Market Profile Manipulation

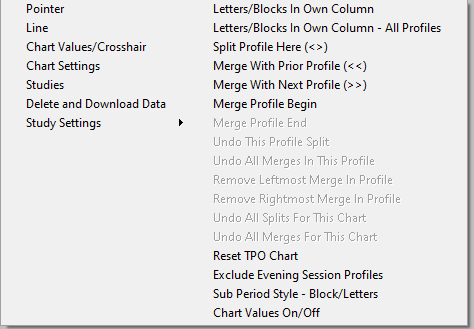

As mentioned previously, Sierra Chart has many quality of life features. Concerning the profiles, it is also easy to manipulate your charts directly through a menu without further tinkering the settings.

Firstly, however with your mouse over the profile you wish to manipulate.

Then, right-clicking on that profile should give you this menu:

Most of the options on the right-hand side are self-explanatory.

‘Letters in Own Column’, ‘Merge with Prior Profile’ and ‘Split..’ will be your most used.

If your chart becomes too disorganized, remember to use ‘Reset TPO chart’.

Part Three: Volume Profile

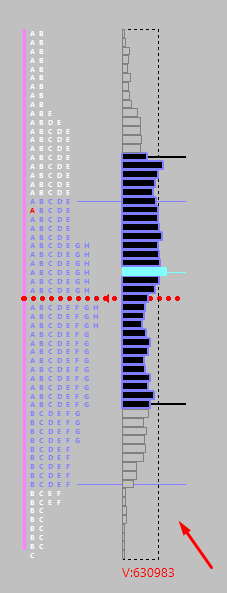

While optional for some, the volume profile adjacent to the market profile has become a staple if not the primary analysis tool for many traders. Sierra Chart can efficiently plot this next to your market profile chart like so:

Like the TPO chart. We have setup this volume profile to match the same prices as the TPO and to also highlight volume value areas, VPOC etc.

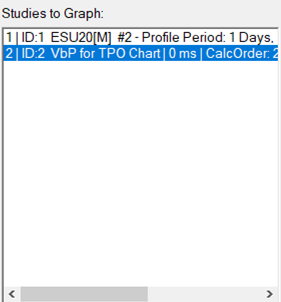

Importantly, the volume profile is treated as a separate tool to TPO in Sierra Chart.

To use it, First setup your TPO chart and have it ready within the settings. Then add the volume profile ‘VBP’ as Sierra Chart will auto configure this to be compatible with a TPO chart.

They should both appear in the ‘Studies to Graph’ window.

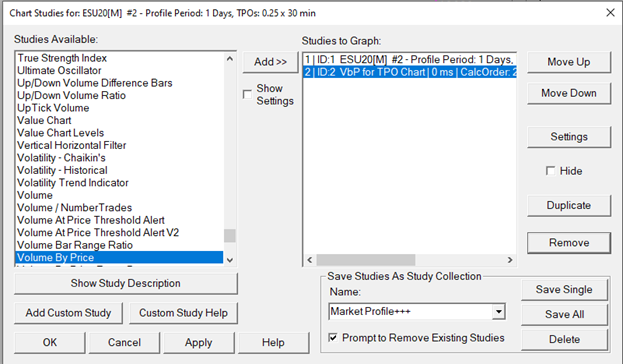

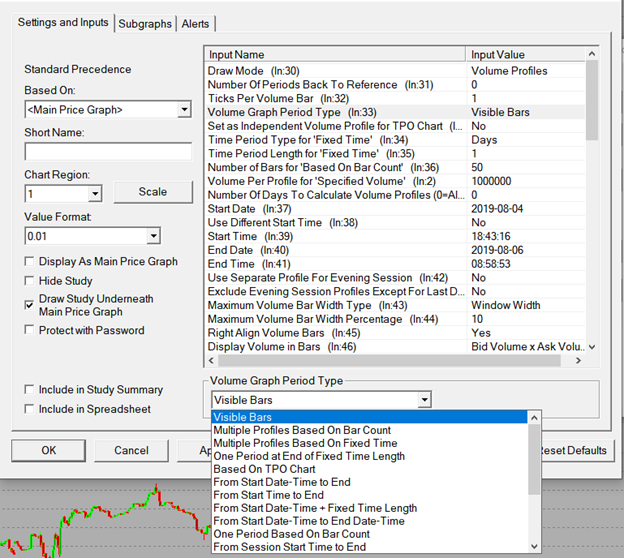

Once your TPO profile is prepared. You can look for the volume profile named as ‘Volume by Price’ in the settings window.

It is likely that the default Sierra Chart Volume by Price settings will already be suitable for immediate use. If not we can delve into the settings to make the necessary changes.

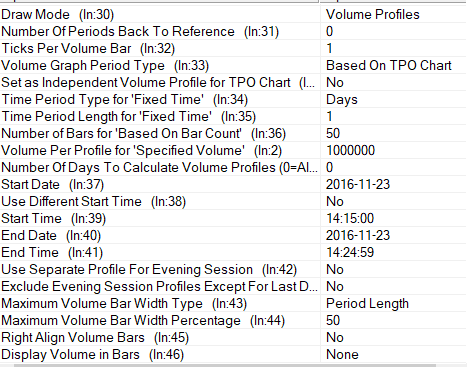

Draw Mode Leave ‘Volume Profile’ selected unless you want to chart more information like VWAP.

Ticks Per Volume Bar – Calculates the resolution of your data. ‘1’ is all the volume exactly aggregated per session at each price. ‘2’ would aggregate all the volume per two ticks etc. Leave this as ‘1’, if you need to change this due to performance issues, change the same settings in your TPO chart in stead

Set as Independent Volume Profile for TPO chart – This is the most important setting here. This should always be set to ‘No’ as it will exclude many settings, which are not needed, and save you time from changing them. This setting neatly organizes each volume profile per day as it is connected to the market profile for that session.

If the above is set as ‘No’ then the rest of the settings from ‘Time Period Type’ to ‘Maximum Volume Bar Width Type’ can be completely ignored as they will no longer affect the volume profile.

Right Align Volume Bars – Flips the direction the bars are facing

Display Volume in Bars – Can be used to numerically show total volume or delta etc.

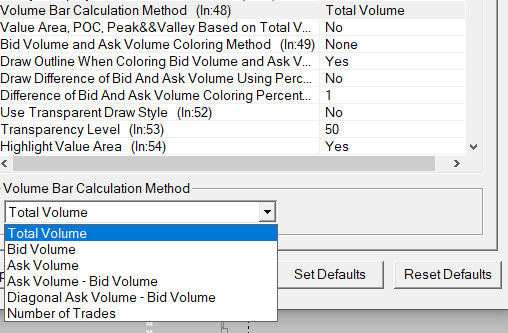

Volume Bar Calculation Method –

This can be kept as ‘Total Volume’ for standard volume profiles. However this can be changed to represent delta if needed.

Bid Volume and Ask Volume….

Useful like the other settings in this screenshot if you need delta to have its own colour change or representation.

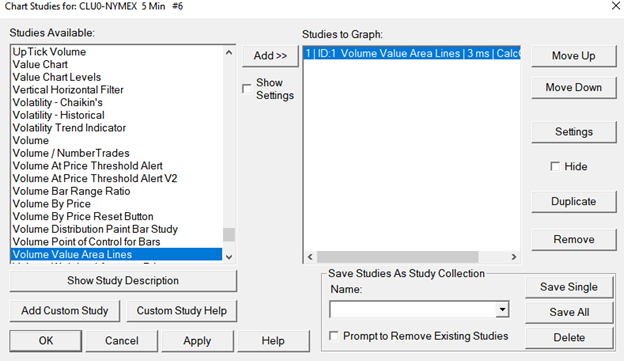

Highlight Value Area – Important to activate if volume area highs/lows are needed.

Extend Value Area – ‘Until Future Intersection’ will draw horizontal lines if that price is left untraded in the following sessions.

Value Area Percentage – as desired

Point of Control – activate as desired, using same logic for ‘extending until future intersection’ or not.

If the Setting ‘Set as Independent Volume Profile for TPO chart’ was selected as ‘No’ then all the following settings left in the menu can be ignored. It is worth doing this to save time. Likely if the rest of the settings are needed – then the volume profile fits a more niche role likely to be used for an advanced user.

Part Four: Sierra Chart Market Profiles And ‘Other’ Charts

As mentioned previously, it is noticeable that even competent Sierra Chart users may underutilize the full tools of available. In this case, we can combine our candlestick or footprint charts with a volume profile or perhaps automate the display of key profile reference points.

A general rule is that any point of reference you can find on a profile or volume chart you could transplant onto any other non-profile chart.

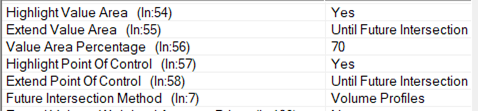

In this example we will aim to add a volume profile to both a candlestick and footprint. Concerning this footprint example, we can see on the right handside a volume profile is printed with a VPOC and the value area highs and lows are drawn automatically on the chart. This is especially useful for a footprint chart to not get lost easily from where we are trading if the market becomes very volatile and directional. At the very least will help save and effort when the market and your ladders require your immediate attention.

Furthermore, consider this example where we have transplanted the volume value area and VPOC onto a simple 5min candlestick chart:

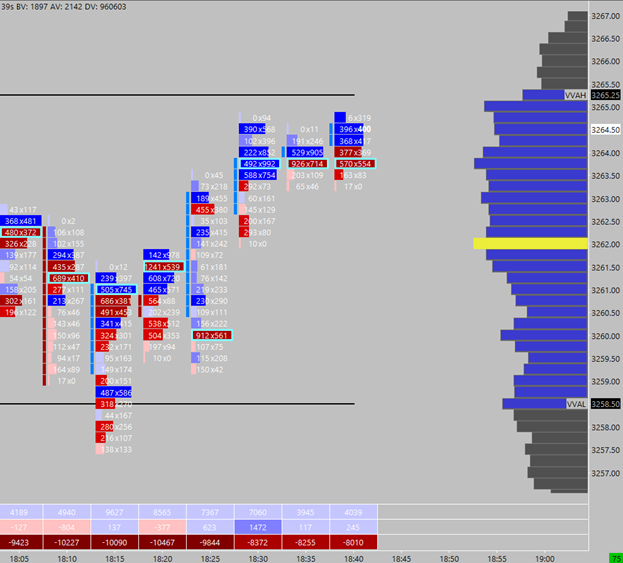

Using that logic, you can find the relevant points of reference in the ‘Studies Available’ column. We wanted to add Volume Value area lines and found the study named as ‘Volume Value Area Lines’:

Lastly, consider this flexibility in charting in resolving a specific problem. Many times when a market would blip due to news you would be interested in seeing the most recent and fresh volume profile to spot specific ledges or areas to get involved. However, if the market trades back within previous prices it is likely that your current volume profile will overlap with the freshest volume traded.

As such in this example chart, the VBP (Volume by Price) study tracks the ‘Visible Bars’ in a short time frame chart. In doing so, one can quickly scroll the chart to display only the bars since the news headlines hit the wires, thereby providing a clean and quick reference to the structure that has now been separated from the aggregated volume of the whole day.

This is another good example where knowing the things you do not want from the chart, and applying your tools very specifically to your own edge should quickly provide answers on how intuitively prepare your volume and profile charts.

Good trading to you all,

Bogdan

Learn To Trade With The Profile & Other Advanced Tools

If you enjoyed this article, you might want to consider taking our market profile trading course or viewing out our full range of Trader Training courses. Our flagship 8 Week Career Programme can be attended live on our London Trading Floor or virtually from home as an online trading course. We offer the most comprehensive training programmes in the proprietary futures trading industry which are based upon years of successful in-house skills development.

Axia Futures

4 Endsleigh Street London GB WC1H 0DS

+44 20 3880 8500

https://axiafutures.com/

Social Media:

Facebook: https://www.facebook.com/AXIAFutures/

YouTube: https://www.youtube.com/AxiaFutures

LinkedIn: https://www.linkedin.com/company/Axia-Futures/

Contacts:

Demetris Mavrommatis – Co-Founder, Head of Trading

Alex Haywood – Co-Founder Head of Strategy