We have now reached the biggest Central Bank decision day of the month – The Federal Reserve. Just like the ECB decision, I wrote about, earlier in the month, this will be a focal point of the week for all traders at Axia Futures formulating plans for how to trade the federal reserve decision. However just like the ECB there are limited expectations as to what the Fed could do; this will not diminish the level of preparation that will go into this decision though.

Central Bank Trading Strategies

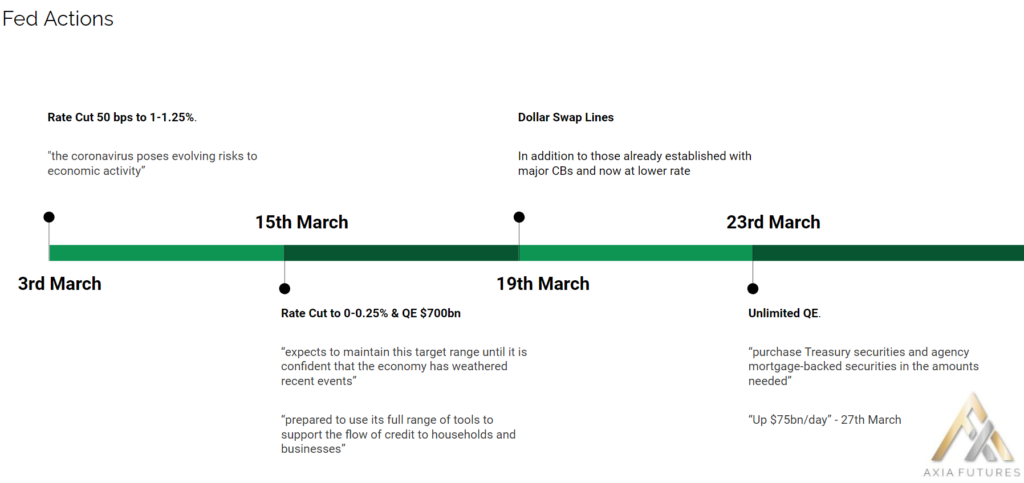

It is highly unlikely that many trading strategies will be formulated around a specific change in policy – The Fed, last month, formalised its asset purchases at a total of $120bn per month ($80bn of treasuries and $40bn of MBS) and held rates at 0-0.25% whilst indicating neither of these would be likely to change for some time: The Fed cuts its Dots indicating that not one member of the decision making FOMC (Federal Open Market Committee) saw a change in rates this year or next and only 2 saw an increase by end of 2022. The Fed has now settled into a new normal level of support for the economy after the unprecedented stimulus provided in March illustrated below.

Where Are The Trading Opportunities For This Central Bank Decision?

Most Trading Opportunities are going to fall into the interpretation category – a judgment of what The Fed is signalling through its use of language, or the answers that Chairman Powell gives in his Q&A session half an hour after the decision and statement is released. The main potential area of change is to The Fed’s forward guidance – how they describe their position when it comes to changing rates or QE. Understanding The Fed’s statements and learning how a Central Bank can signal a future decision is critical to this trading opportunity. So what is the current forward guidance?

- On Rates: “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.“

- On QE: “Federal Reserve will increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace”

Much talk is around the possibility of linking their guidance on rates to inflation (Core PCE YoY 1.1%) or unemployment (11.1%) or even both; by doing this a stronger signal is given that rates can be held at present levels. The interpretation comes in how they may phrase this new guidance and being able recognise it quickly from the statement – this is the role of ‘statement science,’ learning from past decisions – The Federal Reserve has used data based forward guidance when rates were last at these level post the financial crisis specifically in December 2012 when the suggested: “exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal. Linking any change in their policy directly to unemployment and inflation, the full statement can be found here. A similar use of language will enhance current guidance and come as a surprise to many who are still expecting nothing until at least September and thereby create a trading opportunity. Additional trading opportunities including structural plays which turned out to be the main trading opportunity over ECB are discussed in the Axia Futures Central Bank briefing in our live trading floor stream available to members.

Make sure you have a plan to trade any central bank event and if you want to learn more about how plans can be formulated, check out our Central Banks Trading Strategies Course. For more information on how to develop your trading career, check out our range of Trader Training courses and our flagship 8 Week Career Programme which can be attended live on our London Trading Floor or virtually from home as an online trading course.

Richard