The understanding of false breakout can help you access opportunities that you would otherwise miss. In this post, we will have a look at the example of that in DAX futures, particularly how this false breakout created a double top and presented sell structure.

Market Context for False Breakout Sell

The false break came on above 13332 levels, once we failed to get up above there – this was then the opportunity started to present itself. You could be already looking for a false break before we reach daily highs the second time, but ultimately this market could have consolidated, it could have drifted slowly higher, or do anything else. Only after the double top formed you’re getting a little bit of a clue and potentially a trade opportunity. Your focus should intensify once the price gets back down to 13299-90 range – this effectively was your sell zone if you are playing this double top as a false breakout. Also when we traded the second time around 13332 (the highs) you’re shown that we’ve put in the open drive down, failed auction to the downside, and then rally with single prints, possibly a P-shape, or even trend like day. All these things could prevent you from getting short earlier. It’s only when the price gets back trough 13290 – into the single prints you can then look for that drop and liquidation of long positioning. Initially down towards 13267 when we could find the target at Initial Balance high.

Whilst we can look back at this and say you should short 13300 and take it all the way down to 12962 on the initial move it seems much more probable scenario to be looking for a break of 13290 with the target at Initial Balance high. We then get a bounce and once you were into initial balance again you could notice very similar order flow dynamics as on the 13305-00 levels with pressure building harder and harder to the downside around 13265. That memory of order flow could give you a clue that there’s potential for a much bigger move.

The first trade in this was more short term and the second trade was only on after the market gets to Initial Balance high for the second time, and presents the same price action that could give you the clue that this had a bigger move in it.

We’re facing a scenario:

Sell based on price action above the key level, taking profit on target, then allowing the price to show us what’s next, and observing if the same pressure builds once again around Initial Balance High.

After seeing the same repeating price action pattern as on the upper levels you could start believing in a larger move. So the clues were all there but only when you got through the 13265 that much larger move was confirmed.

- 2 Trades Using Market Profile Ledges

- Volume Profile VPOC Reversal Strategy

- 2 Market Profile Day Types – Liquidation vs Trend

Watch The Pressure Selling Coming After False Breakout

Unpacking The Order Flow Patterns That Followed

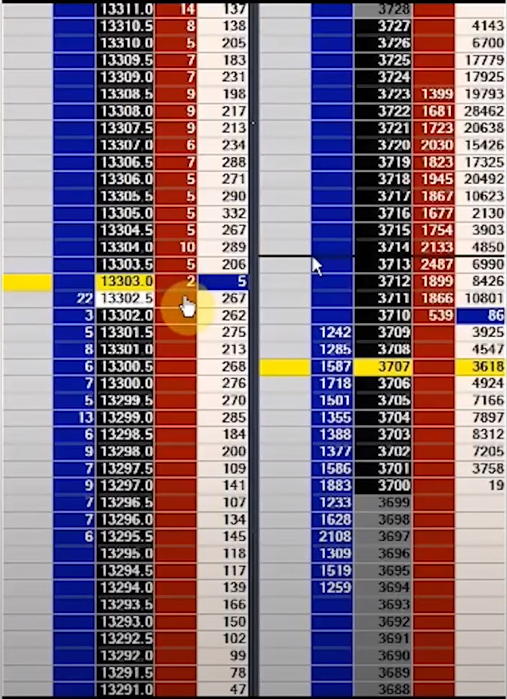

We already had one snap off the lows (first snap and bounce on the picture above) and that happened very fast. Bounce back was limited and then after breaking the low of that snap we start getting this pressure building with a heavy, steady type dropping. Price doesn’t show a great deal of bounce but equally not lots of fast pushes down, and this is what we mean by that pressure. The move wasn’t a surge to the downside, you couldn’t feel the move is hugely aggressive, but it never felt it had any easing off. Watching that purely out of chart perspective could even make you think that’s a nice place to buy betting the next rally higher, but when you look at the ladder it never actually shows any willingness to move up.

The beginning of a drop around 13300 is where you could be expecting some kind of buyers to step in, but you’re not getting it, and order flow does not change.

Larger order appears, but only for a brief moment at 13302.5, suggesting that someone tries to spoof their way into a short position before the move goes. This is a potential chance to get short just above the level. At this point, we still haven’t broken it, but correlating markets could give us more conviction, specifically Eurostoxx being already weak by trading back below yesterday high at 3715. DAX after steadily dropping below 13299 really struggles to get another rotation higher and then snaps down towards 13290 after which, again, we see almost no pullback. Any pick up in pace towards level where the snap occured could be a warning sign, but instead, we see the market actually slow down with no one trying to buy – this should keep you in. Then another snap occurs down to 13280 – this is where people start to panic and that accelerates that move down giving you even more reasons to use Initial Balance high as your target which eventually gets hit.

Learn How To Trade False Breakout Order Flow

What really played a role in this trade was recognizing where the selling was coming in and noticing the clues in the activity – that selling although not aggressive at first was a consistent and steady move that could accelerate below key market level.

If you want to develop your skills of trading price ladder and see more examples of how to read Depth of Market to build your edge make sure to join our newsletter and check out our Price Ladder and Order Flow Strategies Course.

To learn how to build your own market approach and inventory of day trading patterns, check out our Trader Training courses. Our flagship 8 Week Career Programme can be attended live on our London Trading Floor or virtually from home as an online trading course. These are the most comprehensive training programmes in the proprietary futures trading industry and are based upon years of successful in-house skills development.